Constant discounting applies a fixed rate to future values, simplifying financial decision-making and economic modeling. This approach assumes a steady preference for present benefits over future gains, making it essential in evaluating investments and policies. Explore the full article to understand how constant discounting impacts your financial strategies and long-term planning.

Table of Comparison

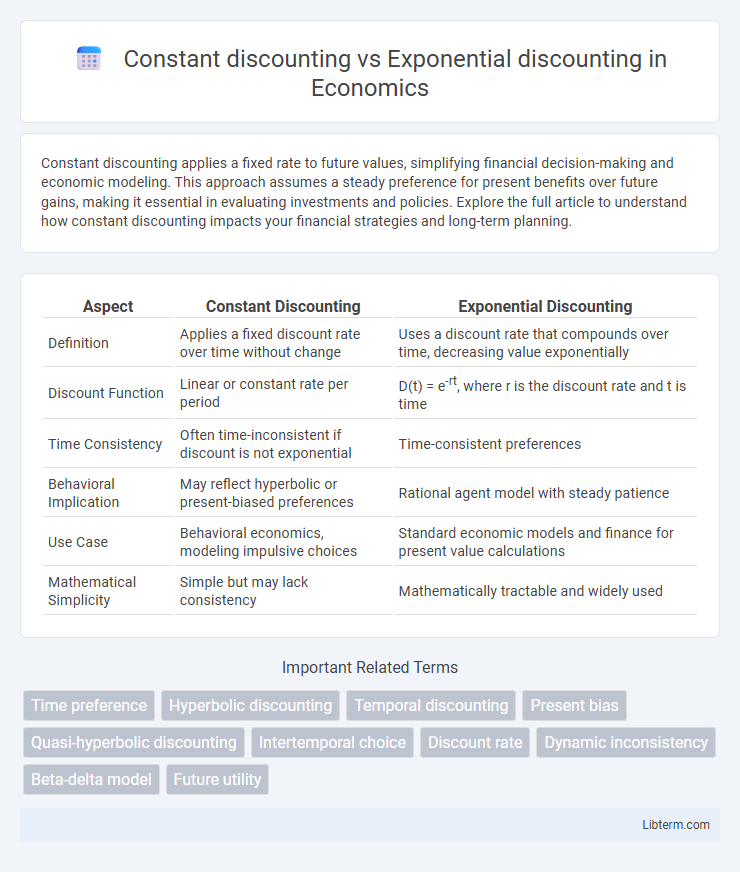

| Aspect | Constant Discounting | Exponential Discounting |

|---|---|---|

| Definition | Applies a fixed discount rate over time without change | Uses a discount rate that compounds over time, decreasing value exponentially |

| Discount Function | Linear or constant rate per period | D(t) = e-rt, where r is the discount rate and t is time |

| Time Consistency | Often time-inconsistent if discount is not exponential | Time-consistent preferences |

| Behavioral Implication | May reflect hyperbolic or present-biased preferences | Rational agent model with steady patience |

| Use Case | Behavioral economics, modeling impulsive choices | Standard economic models and finance for present value calculations |

| Mathematical Simplicity | Simple but may lack consistency | Mathematically tractable and widely used |

Introduction to Discounting Methods

Constant discounting applies a fixed reduction rate to future values regardless of time, maintaining a steady emphasis on future rewards or costs. Exponential discounting reduces future values by a consistent proportion per time period, reflecting time preference in economic and financial models. These discounting methods are fundamental in evaluating present values of future cash flows, investments, and intertemporal choices.

Defining Constant Discounting

Constant discounting refers to applying a fixed rate of discount over time, where future values are reduced by the same proportion at each time period, maintaining a steady decay in value. This method contrasts with exponential discounting, which decreases value multiplicatively over time, leading to a dynamically changing discount rate. Understanding constant discounting is crucial in finance and economics for modeling consistent time preferences and evaluating long-term investments.

Understanding Exponential Discounting

Exponential discounting models future value by applying a consistent discount rate over time, reflecting time-consistent preferences in decision-making processes. This mathematical approach uses the formula V = V0 * e^(-rt), where V is the present value, V0 the future value, r the discount rate, and t the time delay, ensuring a steady rate of decline in perceived value. Understanding exponential discounting is essential for economic theory, behavioral finance, and intertemporal choice models, as it contrasts with hyperbolic or constant discounting, which capture time-inconsistent preferences.

Mathematical Formulations

Constant discounting employs a fixed discount rate applied uniformly across all future time periods, mathematically represented as D(t) = 1 / (1 + r)^t, where r is the discount rate and t is time. Exponential discounting uses a continuous compounding model defined by D(t) = e^(-rt), with r as the constant discount factor, reflecting time-consistent preferences. These formulations highlight how constant discounting assumes discrete intervals while exponential discounting captures continuous time preferences in intertemporal decision models.

Assumptions Behind Each Model

Constant discounting assumes a steady rate of time preference, implying individuals value future rewards proportionally less at a uniform rate regardless of delay length. Exponential discounting relies on the assumption that preferences remain consistent over time, leading to time-consistent decision-making where the discount factor decreases exponentially with delay. Both models presuppose rational behavior, but exponential discounting uniquely enforces dynamic consistency, contrasting with constant discounting's tendency toward time-inconsistent preferences.

Applications in Economics and Psychology

Constant discounting and exponential discounting are key concepts in decision-making models within economics and psychology, influencing how future rewards are valued. Exponential discounting, characterized by a consistent discount rate over time, is commonly applied in economic models to explain rational choice and optimal intertemporal consumption. In contrast, constant discounting often appears in psychological studies to describe time-inconsistent preferences, where individuals disproportionately favor immediate rewards, impacting behaviors like saving, addiction, and procrastination.

Comparison of Behavioral Implications

Constant discounting implies a fixed rate at which future rewards are devalued, promoting consistent decision-making over time, whereas exponential discounting involves a diminishing rate that can cause preference reversals and impulsive behavior. Behavioral studies show that constant discounting aligns more closely with observed human patience and future-oriented choices, while exponential discounting often models myopic tendencies and hyperbolic discounting patterns. Understanding these differences is crucial in fields like behavioral economics and psychology for predicting time-inconsistent preferences.

Real-world Examples of Discounting

Exponential discounting is commonly observed in financial markets where investors apply a constant discount rate to future cash flows, such as in bond pricing and project valuation. Constant discounting aligns with behavioral economics, demonstrated by consumers who prefer immediate rewards over delayed benefits, evident in retail promotions or subscription models offering upfront discounts. Real-world decisions often reflect a blend of both, as seen in retirement savings where individuals increasingly discount future benefits at varying rates over time.

Advantages and Limitations

Constant discounting offers simplicity and ease of calculation by applying a fixed discount rate over time, which makes it easier to model consistent preferences in economic decisions. However, it may overlook time-inconsistent behavior, leading to less accurate representations of real-world decision-making. Exponential discounting captures decreasing valuation of future rewards accurately and supports time-consistent choices but can be difficult to calibrate and may underestimate immediate preferences in behavioral economics contexts.

Choosing the Right Discounting Approach

Choosing the right discounting approach depends on the decision context and time preferences, with constant discounting offering a fixed rate that simplifies long-term financial forecasts. Exponential discounting, characterized by a decreasing discount factor over time, aligns more closely with observed human behavior and time-inconsistent preferences in economics and psychology. Understanding these distinctions is crucial for accurate modeling in fields like behavioral economics, environmental policy, and investment planning.

Constant discounting Infographic

libterm.com

libterm.com