The AD-AS model illustrates the relationship between aggregate demand and aggregate supply in an economy, highlighting how price levels and output fluctuate. Shifts in aggregate demand or aggregate supply can indicate economic expansion, contraction, inflation, or recession. Explore the rest of the article to understand how your economy is influenced by these critical forces.

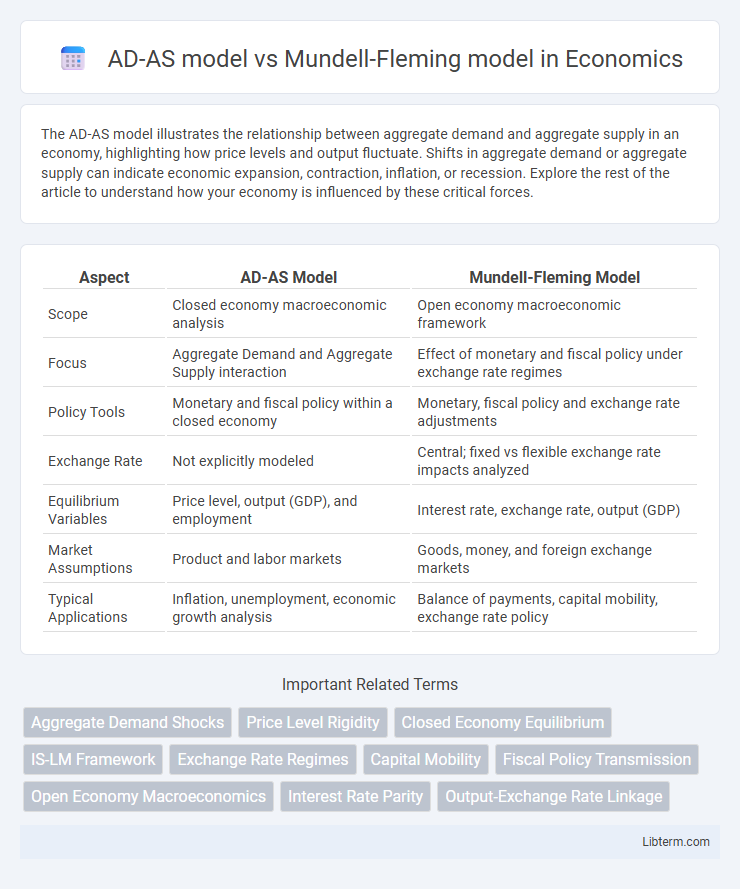

Table of Comparison

| Aspect | AD-AS Model | Mundell-Fleming Model |

|---|---|---|

| Scope | Closed economy macroeconomic analysis | Open economy macroeconomic framework |

| Focus | Aggregate Demand and Aggregate Supply interaction | Effect of monetary and fiscal policy under exchange rate regimes |

| Policy Tools | Monetary and fiscal policy within a closed economy | Monetary, fiscal policy and exchange rate adjustments |

| Exchange Rate | Not explicitly modeled | Central; fixed vs flexible exchange rate impacts analyzed |

| Equilibrium Variables | Price level, output (GDP), and employment | Interest rate, exchange rate, output (GDP) |

| Market Assumptions | Product and labor markets | Goods, money, and foreign exchange markets |

| Typical Applications | Inflation, unemployment, economic growth analysis | Balance of payments, capital mobility, exchange rate policy |

Introduction to Macroeconomic Models

The AD-AS model illustrates the interaction between aggregate demand and aggregate supply to determine overall price levels and output in a closed economy. The Mundell-Fleming model extends this analysis to an open economy, incorporating exchange rates and capital mobility effects on fiscal and monetary policies. Both models provide foundational frameworks for understanding macroeconomic fluctuations, but the Mundell-Fleming model emphasizes external sector dynamics often absent in the AD-AS framework.

Overview of the AD-AS Model

The Aggregate Demand-Aggregate Supply (AD-AS) model illustrates the relationship between overall price levels and output in the short run, highlighting how shifts in aggregate demand or supply affect economic equilibrium. It emphasizes internal macroeconomic factors such as consumption, investment, government spending, and price flexibility, making it essential for analyzing inflationary pressures and unemployment within a closed economy. Unlike the Mundell-Fleming model, which focuses on open economies and exchange rates, the AD-AS model primarily addresses domestic economic fluctuations and policy impacts.

Overview of the Mundell-Fleming Model

The Mundell-Fleming model extends the IS-LM framework to an open economy, analyzing the interaction between exchange rates, interest rates, and output under different exchange rate regimes. It emphasizes the role of capital mobility and distinguishes between fixed and flexible exchange rate systems, demonstrating how monetary and fiscal policies impact the economy differently compared to the closed-economy AD-AS model. This model is particularly crucial for understanding macroeconomic policy effectiveness in small open economies subject to international capital flows.

Key Assumptions of AD-AS vs Mundell-Fleming

The AD-AS model assumes a closed economy with a fixed price level in the short run and flexible prices in the long run, emphasizing aggregate demand and supply to determine output and price levels. The Mundell-Fleming model operates under an open economy framework, incorporating perfect capital mobility with fixed or flexible exchange rates to analyze the interaction between interest rates, exchange rates, and output. Key assumptions of the Mundell-Fleming model include price rigidity in the short run and the influence of international capital flows on monetary and fiscal policy effectiveness.

Open Economy vs Closed Economy Perspectives

The AD-AS model primarily addresses macroeconomic equilibrium within a closed economy, emphasizing aggregate demand and aggregate supply interactions to determine output and price levels. In contrast, the Mundell-Fleming model extends these concepts to an open economy framework, incorporating exchange rates, capital mobility, and trade balance effects on fiscal and monetary policy effectiveness. The Mundell-Fleming model highlights the challenges policymakers face in managing economic variables under fixed versus flexible exchange rate regimes in a globally interconnected market.

Policy Implications: Fiscal Policy Comparison

The AD-AS model suggests fiscal policy primarily affects aggregate demand, shifting output and price levels in closed economies with limited external trade impact. The Mundell-Fleming model highlights that fiscal policy effectiveness varies with exchange rate regimes, being potent in fixed exchange rate systems but less so under flexible exchange rates due to capital mobility. Policymakers must consider open economy factors in the Mundell-Fleming framework, as international capital flows and exchange rate adjustments can offset fiscal measures, unlike the more straightforward fiscal multipliers in the AD-AS context.

Policy Implications: Monetary Policy Comparison

The AD-AS model emphasizes monetary policy's effect on domestic output and price levels through shifts in aggregate demand, assuming a closed economy where interest rate changes mainly influence consumption and investment. In contrast, the Mundell-Fleming model highlights monetary policy's varying effectiveness depending on exchange rate regimes and capital mobility, showing that under fixed exchange rates, monetary policy is largely ineffective, while under flexible exchange rates, it can influence output by affecting exchange rates and net exports. Policymakers must consider these differing impacts when designing monetary interventions in open economies versus closed or less open economies.

Exchange Rate Regimes in Both Models

The AD-AS model primarily operates under a closed economy framework, where exchange rate regimes are often fixed or irrelevant due to a lack of international capital flows. In contrast, the Mundell-Fleming model explicitly incorporates open economy dynamics, distinguishing between fixed and floating exchange rate regimes and demonstrating their impact on monetary and fiscal policy effectiveness. Floating exchange rates in the Mundell-Fleming model allow autonomous monetary policy, whereas fixed regimes constrain it to maintain currency parity.

Applications and Limitations of Each Model

The AD-AS model primarily analyzes short-run economic fluctuations in a closed economy by illustrating relationships between aggregate demand, aggregate supply, and price levels, making it useful for understanding inflation and output changes but limited in addressing open economy dynamics. The Mundell-Fleming model extends analysis to an open economy setting, incorporating exchange rates and capital mobility to evaluate the effectiveness of monetary and fiscal policies under different exchange rate regimes, yet it assumes perfect capital mobility and may oversimplify real-world complexities. Both models provide valuable frameworks for policy analysis, but the AD-AS model is constrained in addressing international capital flows, while the Mundell-Fleming model's assumptions limit its applicability in economies with capital controls or imperfect financial markets.

Summary: Choosing Between AD-AS and Mundell-Fleming

The AD-AS model provides a framework for analyzing aggregate demand and supply effects on price levels and output in a closed economy, emphasizing domestic factors and short-run adjustments. The Mundell-Fleming model extends this analysis to an open economy setting, incorporating international capital flows, exchange rates, and monetary and fiscal policy effectiveness under different exchange rate regimes. Choosing between the AD-AS and Mundell-Fleming models depends on whether the focus is on closed economy dynamics or international macroeconomic interactions, with the Mundell-Fleming model being essential for policy analysis in open economies with flexible or fixed exchange rates.

AD-AS model Infographic

libterm.com

libterm.com