The aggregate supply curve illustrates the total quantity of goods and services that producers in an economy are willing to supply at different price levels. It plays a crucial role in understanding inflation, economic growth, and the impact of fiscal and monetary policies. Explore the rest of the article to learn how shifts in the aggregate supply curve affect your economic environment.

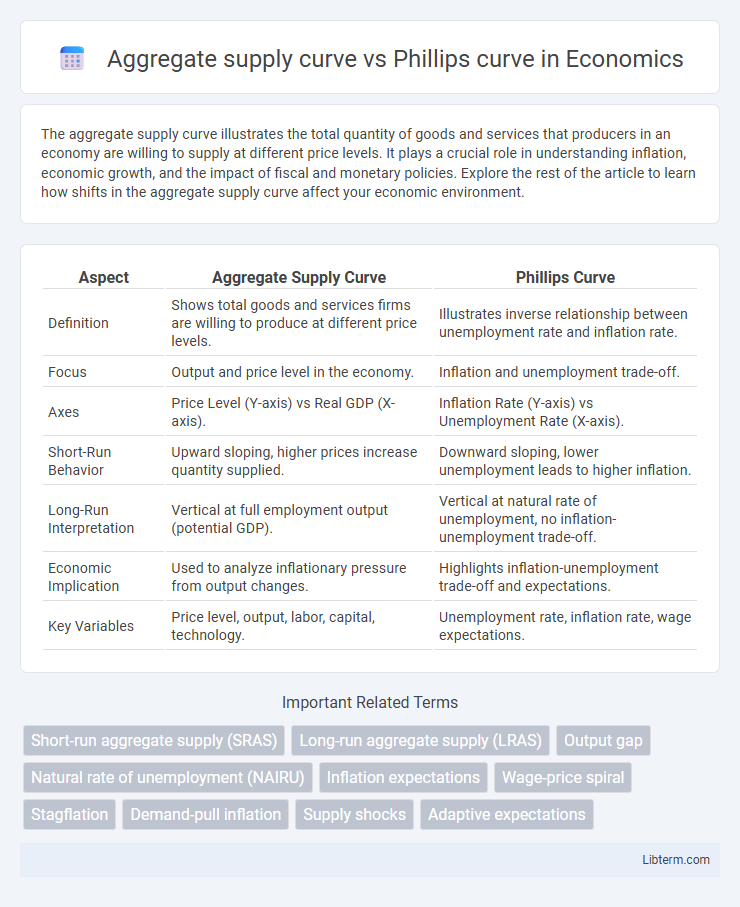

Table of Comparison

| Aspect | Aggregate Supply Curve | Phillips Curve |

|---|---|---|

| Definition | Shows total goods and services firms are willing to produce at different price levels. | Illustrates inverse relationship between unemployment rate and inflation rate. |

| Focus | Output and price level in the economy. | Inflation and unemployment trade-off. |

| Axes | Price Level (Y-axis) vs Real GDP (X-axis). | Inflation Rate (Y-axis) vs Unemployment Rate (X-axis). |

| Short-Run Behavior | Upward sloping, higher prices increase quantity supplied. | Downward sloping, lower unemployment leads to higher inflation. |

| Long-Run Interpretation | Vertical at full employment output (potential GDP). | Vertical at natural rate of unemployment, no inflation-unemployment trade-off. |

| Economic Implication | Used to analyze inflationary pressure from output changes. | Highlights inflation-unemployment trade-off and expectations. |

| Key Variables | Price level, output, labor, capital, technology. | Unemployment rate, inflation rate, wage expectations. |

Introduction to Aggregate Supply Curve and Phillips Curve

The Aggregate Supply Curve illustrates the total quantity of goods and services that producers in an economy are willing to supply at different price levels, highlighting the relationship between inflation and output. The Phillips Curve demonstrates the inverse correlation between unemployment rates and inflation, suggesting that lower unemployment comes with higher inflation. Understanding these curves is essential for analyzing how economic policies impact inflation, employment, and overall economic performance.

Defining the Aggregate Supply Curve

The Aggregate Supply Curve represents the total quantity of goods and services that firms in an economy are willing to produce at different price levels, reflecting the relationship between price levels and output in the short run and long run. In the short run, the curve is typically upward sloping due to wage and price rigidities, while in the long run it is vertical, indicating output is determined by factors like capital, labor, and technology rather than price level. Understanding the aggregate supply curve is essential for analyzing inflation, economic growth, and policy impacts in macroeconomic models.

Understanding the Phillips Curve

The Phillips Curve illustrates an inverse relationship between inflation and unemployment, suggesting that lower unemployment rates lead to higher inflation levels. In contrast, the Aggregate Supply curve represents the total quantity of goods and services firms are willing to produce at varying price levels, reflecting production capacity and cost conditions. Understanding the Phillips Curve helps policymakers balance inflation control and employment goals by analyzing wage-pressure dynamics in the economy.

Key Assumptions Behind Each Curve

The Aggregate Supply (AS) curve assumes a positive relationship between price levels and output, rooted in sticky wages or prices and the idea that firms respond to higher demand by increasing production. In contrast, the Phillips curve rests on the inverse short-term trade-off between unemployment and inflation, assuming adaptive expectations and a stable relationship during periods of non-accelerating inflation. Key assumptions differ as the AS curve emphasizes supply-side constraints and price rigidity, while the Phillips curve centers on labor market dynamics and inflation expectations.

Aggregate Supply Curve: Short-Run vs Long-Run Variations

The aggregate supply curve in the short run is upward sloping, reflecting price and wage rigidities that cause output to increase as prices rise. In contrast, the long-run aggregate supply curve is vertical, indicating that output is determined by factors such as technology and resources, independent of the price level. Short-run fluctuations in aggregate supply influence inflation and output, while the long-run curve represents the economy's potential output at full employment.

Phillips Curve: Short-Run vs Long-Run Perspectives

The Phillips Curve illustrates the inverse relationship between inflation and unemployment in the short run, depicting that lower unemployment rates often coincide with higher inflation due to wage and price adjustments. In the long run, the Phillips Curve becomes vertical at the natural rate of unemployment, indicating that inflation expectations adjust, and there is no trade-off between inflation and unemployment. This distinction highlights the short-run policy trade-offs versus the long-run neutrality of inflation in affecting unemployment levels.

Relationship Between Aggregate Supply and Phillips Curves

The Aggregate Supply (AS) curve illustrates the relationship between the overall price level and the total output firms are willing to produce, while the Phillips curve depicts the inverse relationship between inflation and unemployment. Short-run fluctuations in aggregate supply can shift the Phillips curve by altering inflation expectations and wage-setting behavior, linking supply-side factors to labor market dynamics. Understanding the interaction between these curves is crucial for policymakers aiming to balance inflation control with employment objectives.

Policy Implications: Inflation, Unemployment, and Output

The Aggregate Supply curve highlights the relationship between price levels and output, guiding policymakers to adjust fiscal and monetary policies to stabilize inflation without compromising production. The Phillips curve illustrates the inverse trade-off between inflation and unemployment, suggesting that policies targeting lower unemployment may risk higher inflation in the short run. Understanding both curves enables balanced policy decisions to optimize output while managing inflationary pressures and unemployment rates effectively.

Real-World Applications and Empirical Evidence

The aggregate supply curve illustrates the relationship between price levels and output in the economy, often used to analyze inflation and economic growth dynamics, particularly during supply shocks or changes in production capacity. Empirical evidence shows that shifts in aggregate supply, such as oil price shocks, directly affect inflation and real GDP, confirming its predictive value in macroeconomic policy. The Phillips curve, depicting an inverse relationship between unemployment and inflation, has experienced mixed empirical support; while it explains short-term trade-offs in labor markets, its breakdown during periods of stagflation and the advent of expectations-augmented models highlight limitations in predicting long-term inflation-unemployment dynamics.

Conclusion: Comparing the Aggregate Supply Curve and Phillips Curve

The Aggregate Supply Curve illustrates the relationship between price levels and output in the short and long run, emphasizing how changes in aggregate demand impact production. The Phillips Curve depicts the inverse relationship between inflation and unemployment, highlighting short-term trade-offs and expectations-driven shifts. Comparing both curves reveals that while the AS curve focuses on real output and price levels, the Phillips Curve centers on inflation-unemployment dynamics, underscoring different aspects of macroeconomic equilibrium and policy implications.

Aggregate supply curve Infographic

libterm.com

libterm.com