The loan-to-deposit ratio measures a bank's liquidity by comparing its total loans to its total deposits, indicating how well the institution manages its funds. A higher ratio suggests more aggressive lending, which can impact financial stability, while a lower ratio shows conservative lending practices. Explore the full article to understand how this ratio affects banking decisions and your financial security.

Table of Comparison

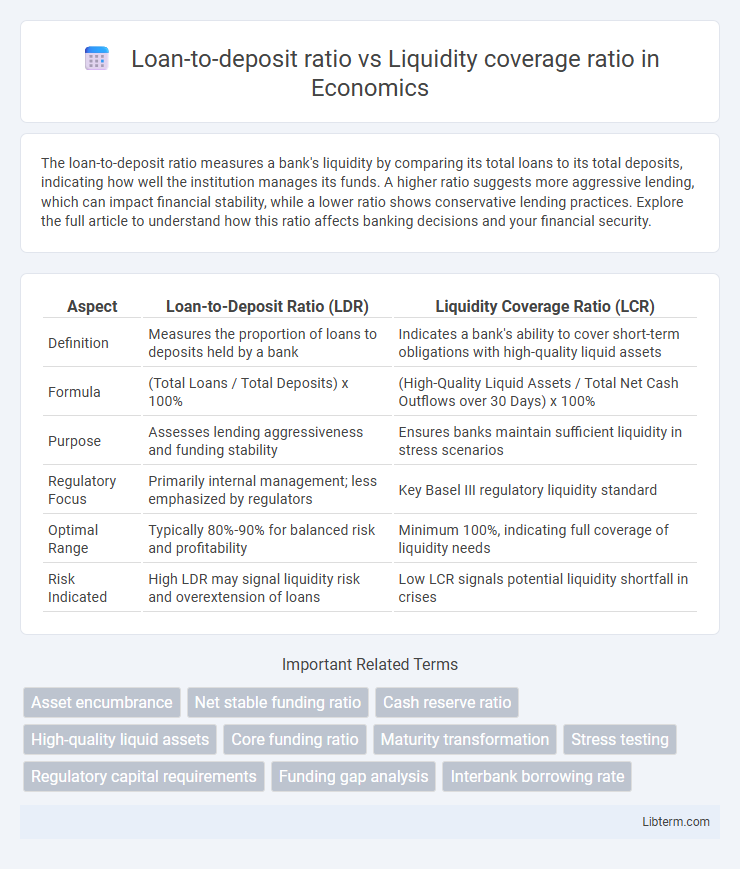

| Aspect | Loan-to-Deposit Ratio (LDR) | Liquidity Coverage Ratio (LCR) |

|---|---|---|

| Definition | Measures the proportion of loans to deposits held by a bank | Indicates a bank's ability to cover short-term obligations with high-quality liquid assets |

| Formula | (Total Loans / Total Deposits) x 100% | (High-Quality Liquid Assets / Total Net Cash Outflows over 30 Days) x 100% |

| Purpose | Assesses lending aggressiveness and funding stability | Ensures banks maintain sufficient liquidity in stress scenarios |

| Regulatory Focus | Primarily internal management; less emphasized by regulators | Key Basel III regulatory liquidity standard |

| Optimal Range | Typically 80%-90% for balanced risk and profitability | Minimum 100%, indicating full coverage of liquidity needs |

| Risk Indicated | High LDR may signal liquidity risk and overextension of loans | Low LCR signals potential liquidity shortfall in crises |

Introduction to Loan-to-Deposit Ratio (LDR) and Liquidity Coverage Ratio (LCR)

The Loan-to-Deposit Ratio (LDR) measures a bank's liquidity by comparing its total loans to its total deposits, indicating how efficiently it utilizes deposits to fund loans. The Liquidity Coverage Ratio (LCR) requires banks to hold high-quality liquid assets that cover net cash outflows over a 30-day stress period, ensuring short-term resilience. Both ratios serve as critical metrics for assessing a bank's liquidity position and risk management practices.

Key Definitions: LDR vs LCR

Loan-to-deposit ratio (LDR) measures a bank's liquidity by comparing its total loans to its total deposits, indicating how much of the deposits are utilized for lending. Liquidity coverage ratio (LCR) assesses a bank's ability to withstand short-term liquidity disruptions by requiring sufficient high-quality liquid assets (HQLA) to cover net cash outflows over a 30-day stress period. While LDR focuses on loan utilization relative to deposits, LCR emphasizes the bank's capacity to maintain adequate liquid assets for short-term financial stability.

Fundamental Differences Between LDR and LCR

Loan-to-deposit ratio (LDR) measures the proportion of a bank's loans to its deposits, indicating credit risk and asset utilization efficiency, while liquidity coverage ratio (LCR) assesses a bank's ability to withstand short-term liquidity stress by holding high-quality liquid assets covering net cash outflows over 30 days. LDR primarily evaluates lending practices and funding stability, reflecting potential liquidity risk from over-reliance on borrowing, whereas LCR focuses on regulatory liquidity standards aimed at maintaining sufficient liquid resources in crisis scenarios. Both ratios serve distinct roles in financial risk management, with LDR highlighting credit exposure and banking liquidity balance, while LCR ensures adherence to Basel III liquidity requirements.

The Role of LDR in Banking Operations

The loan-to-deposit ratio (LDR) measures a bank's liquidity by comparing its total loans to total deposits, indicating how efficiently a bank uses its deposits to fund loans. A balanced LDR is crucial in banking operations to ensure sufficient liquidity while maximizing profitability, as high LDR may signal potential liquidity risk but also higher income generation. Unlike the liquidity coverage ratio (LCR), which focuses on short-term liquidity buffers to meet stress scenarios, LDR provides insight into the core lending strategy and funding stability of a bank.

Understanding the Importance of LCR for Regulatory Compliance

The Liquidity Coverage Ratio (LCR) ensures banks maintain an adequate level of high-quality liquid assets to withstand 30-day stressed funding scenarios, directly impacting regulatory compliance under Basel III standards. Unlike the Loan-to-Deposit Ratio (LDR), which measures a bank's lending efficiency relative to its deposit base, the LCR focuses specifically on liquidity risk management and short-term resilience. Regulators prioritize the LCR to prevent liquidity shortfalls, making it a critical metric for maintaining financial stability and meeting international banking regulations.

Calculation Methods: LDR versus LCR

The Loan-to-Deposit Ratio (LDR) is calculated by dividing a bank's total loans by its total deposits, reflecting the proportion of deposits used for lending. In contrast, the Liquidity Coverage Ratio (LCR) is computed by dividing a bank's high-quality liquid assets (HQLA) by total net cash outflows over a 30-day stress period, ensuring short-term liquidity adequacy. LDR focuses on balance sheet composition, while LCR emphasizes liquidity management under stress scenarios.

Impact of LDR and LCR on Bank Liquidity Management

Loan-to-deposit ratio (LDR) directly influences bank liquidity by measuring the proportion of loans financed by deposits, where a high LDR may indicate potential liquidity risk due to limited liquid assets. Liquidity coverage ratio (LCR) ensures banks maintain an adequate buffer of high-quality liquid assets to withstand short-term cash outflows, promoting stability during financial stress. Balancing LDR and LCR is crucial for effective liquidity management, as LDR affects the bank's asset-liability structure, while LCR enforces regulatory liquidity requirements to prevent insolvency.

Risks Associated with High or Low LDR and LCR Levels

A high Loan-to-Deposit Ratio (LDR) indicates that a bank is aggressively lending, potentially increasing credit risk and liquidity strain, while a low LDR may suggest underutilization of deposits and reduced profitability. The Liquidity Coverage Ratio (LCR) measures a bank's ability to withstand short-term liquidity disruptions; a low LCR exposes the institution to liquidity risk, while an excessively high LCR could limit earnings by holding excessive liquid assets. Maintaining balanced LDR and LCR levels is critical to manage credit risk, liquidity risk, and overall financial stability in banking operations.

Regulatory Standards Governing LDR and LCR

Regulatory standards governing the Loan-to-Deposit Ratio (LDR) set limits to ensure banks maintain sufficient deposits to cover loan issuance, typically ranging between 80% to 90% to manage credit risk and promote financial stability. The Liquidity Coverage Ratio (LCR), mandated by Basel III regulations, requires banks to hold high-quality liquid assets sufficient to cover net cash outflows over a 30-day stress period, often set at a minimum of 100%. Both ratios serve as critical regulatory tools to enhance banks' risk management: LDR focuses on credit and funding risk by controlling loan growth relative to deposits, while LCR emphasizes short-term liquidity resilience to withstand financial stress.

Conclusion: Integrating LDR and LCR for Optimal Bank Performance

Integrating the Loan-to-Deposit Ratio (LDR) and Liquidity Coverage Ratio (LCR) provides a balanced approach to bank performance by ensuring both asset utilization and liquidity resilience. A well-managed LDR optimizes lending capacity without overextending depositor funds, while a robust LCR guarantees sufficient high-quality liquid assets to withstand short-term stress. Synergizing these metrics enhances financial stability, regulatory compliance, and sustainable growth in banking operations.

Loan-to-deposit ratio Infographic

libterm.com

libterm.com