Monopoly is a classic board game that challenges players to strategically buy, trade, and develop properties to bankrupt opponents. Mastering the art of negotiation and understanding property values are key to dominating the game. Discover expert tips and strategies to boost your chances of winning in the full article.

Table of Comparison

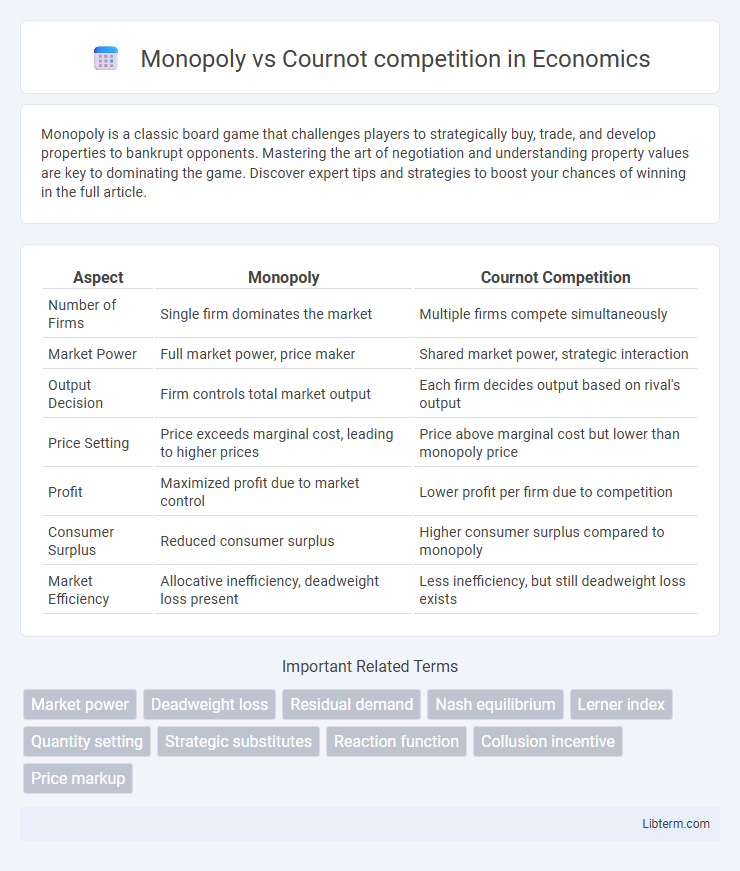

| Aspect | Monopoly | Cournot Competition |

|---|---|---|

| Number of Firms | Single firm dominates the market | Multiple firms compete simultaneously |

| Market Power | Full market power, price maker | Shared market power, strategic interaction |

| Output Decision | Firm controls total market output | Each firm decides output based on rival's output |

| Price Setting | Price exceeds marginal cost, leading to higher prices | Price above marginal cost but lower than monopoly price |

| Profit | Maximized profit due to market control | Lower profit per firm due to competition |

| Consumer Surplus | Reduced consumer surplus | Higher consumer surplus compared to monopoly |

| Market Efficiency | Allocative inefficiency, deadweight loss present | Less inefficiency, but still deadweight loss exists |

Introduction to Monopoly and Cournot Competition

Monopoly describes a market structure where a single firm dominates, facing no direct competitors and controlling the entire market supply, which allows it to set prices above marginal cost. Cournot competition involves multiple firms simultaneously choosing output quantities, with each firm's optimal production decision depending on the quantities produced by rivals, resulting in a strategic interdependence. Unlike monopoly pricing, Cournot equilibrium leads to a market output and price level between monopoly and perfect competition outcomes.

Defining Monopoly: Key Characteristics

Monopoly is characterized by a single firm that dominates the entire market, facing no direct competitors and holding significant control over price and output decisions. The firm maximizes profits by setting a price above marginal cost, resulting in restricted output compared to perfectly competitive markets. Monopoly power leads to inefficiencies such as higher prices and reduced consumer surplus, distinguishing it sharply from Cournot competition where multiple firms strategically choose quantities.

Understanding Cournot Competition: Basic Framework

Cournot competition models firms competing on output quantities where each firm chooses its production level assuming the rival's output is fixed, leading to a strategic interdependence captured by reaction functions. Unlike Monopoly, where a single firm maximizes profit by controlling total market output and price, Cournot equilibrium results in less market power due to simultaneous quantity setting by multiple firms. The Nash equilibrium in Cournot competition is characterized by firms producing quantities where no player can increase profit by unilaterally changing its output, balancing market supply and demand.

Market Power in Monopoly vs. Cournot Models

Monopoly markets exhibit significant market power due to a single firm's ability to set prices and output without competition, leading to higher prices and lower quantities than competitive markets. In Cournot competition, firms choose quantities simultaneously, resulting in shared market power and intermediate prices between monopoly and perfect competition levels. The strategic interdependence among Cournot firms limits individual pricing power, reflecting a balance of market control rather than the full dominance observed in monopolies.

Output and Pricing Strategies Compared

Monopoly firms produce a lower output and set higher prices compared to Cournot competitors, who strategically choose quantities to maximize profit given their rivals' outputs, resulting in higher total market output and lower prices. In Cournot competition, firms' output decisions are interdependent, leading to a Nash equilibrium where each firm's quantity reflects mutual best responses, while a monopolist's output maximizes profit without competitive constraints. The Cournot model typically yields prices closer to marginal cost, improving consumer surplus relative to monopolistic pricing.

Consumer Welfare under Each Market Structure

Consumer welfare under Monopoly typically declines due to higher prices and reduced output, which limits product availability and choice. In contrast, Cournot competition fosters greater consumer welfare by encouraging firms to produce more output at lower prices, improving market efficiency and access. Empirical studies show that consumer surplus is generally higher in Cournot oligopolies compared to monopolistic markets, as competitive pressures drive prices closer to marginal cost.

Profit Maximization: Monopoly vs. Cournot Firms

Monopoly firms maximize profit by setting output where marginal revenue equals marginal cost, producing less quantity at a higher price than competitive firms. Cournot competition involves multiple firms choosing quantities simultaneously, leading to a total output between monopoly and perfect competition levels, reducing the market price compared to a monopoly. As a result, Cournot firms earn lower individual profits than a monopolist but higher than in perfect competition, balancing market power and competitive pressures.

Barriers to Entry and Long-Term Industry Dynamics

Monopoly markets feature significant barriers to entry such as high capital requirements and control over essential resources, restricting competition and sustaining long-term market power. In contrast, Cournot competition models industries with moderate barriers where firms strategically adjust quantities, leading to fluctuating market shares and more dynamic long-term interactions. Over time, monopolies tend to maintain stable market dominance, while Cournot frameworks predict evolving equilibria influenced by entry and capacity expansions.

Real-World Examples: Monopoly and Cournot Competition

In real-world markets, monopolies like utility companies often control entire regions due to high infrastructure costs and regulatory barriers, enabling them to set prices without direct competition. Cournot competition is observed in industries such as oil production, where firms like Saudi Aramco and ExxonMobil strategically decide output quantities to influence market prices while considering rivals' quantities. These examples highlight how market structures impact pricing and production decisions, reflecting the balance between exclusive power in monopolies and strategic interdependence in Cournot oligopolies.

Policy Implications and Regulatory Perspectives

Monopoly markets often result in higher prices and reduced output compared to Cournot competition, prompting regulators to implement antitrust laws to prevent market abuse and promote consumer welfare. Cournot competition leads to more efficient market outcomes with greater output and lower prices, making policies that encourage competitive entry and reduce barriers essential for maintaining market health. Regulatory frameworks thus focus on balancing market power to prevent monopolistic dominance while fostering conditions conducive to competitive equilibria.

Monopoly Infographic

libterm.com

libterm.com