Effective incidence measures the actual economic burden of a tax on individuals or businesses, reflecting who truly pays it after market adjustments. Understanding effective incidence is crucial for policymakers aiming to design fair and efficient tax systems that minimize unintended consequences. Explore the rest of the article to discover how effective incidence impacts economic decision-making and your financial wellbeing.

Table of Comparison

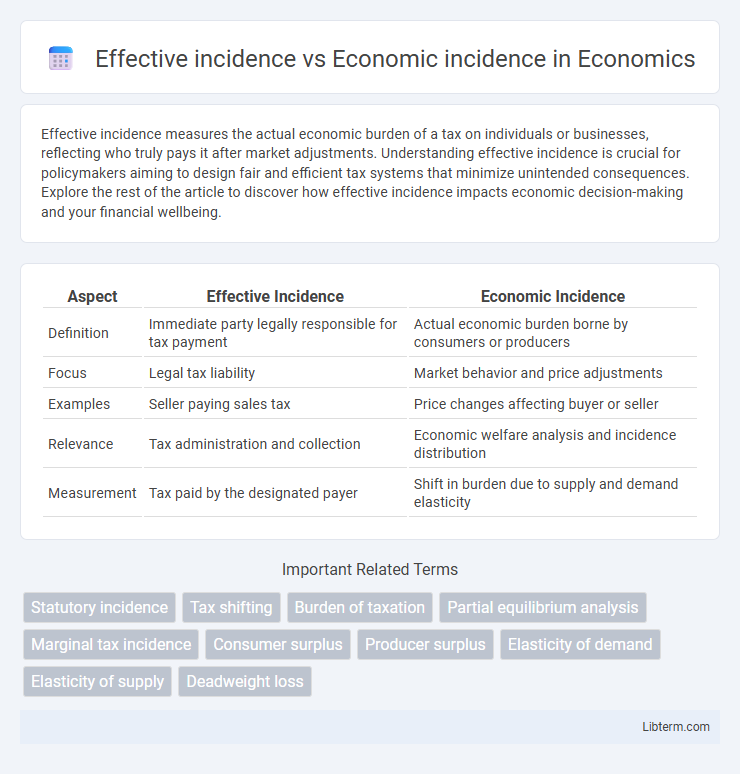

| Aspect | Effective Incidence | Economic Incidence |

|---|---|---|

| Definition | Immediate party legally responsible for tax payment | Actual economic burden borne by consumers or producers |

| Focus | Legal tax liability | Market behavior and price adjustments |

| Examples | Seller paying sales tax | Price changes affecting buyer or seller |

| Relevance | Tax administration and collection | Economic welfare analysis and incidence distribution |

| Measurement | Tax paid by the designated payer | Shift in burden due to supply and demand elasticity |

Understanding Effective Incidence and Economic Incidence

Effective incidence refers to the actual burden of a tax or economic policy on an individual or group, considering both direct payments and behavioral responses. Economic incidence examines who ultimately bears the cost of a tax after market adjustments, shifting the burden between consumers, producers, and factors of production. Understanding the distinction reveals how taxes influence economic decisions and resource distribution beyond statutory obligations.

Defining Key Terms: What Is Incidence in Economics?

Incidence in economics refers to the analysis of who ultimately bears the burden of a tax or economic policy. Effective incidence examines the actual distribution of tax burden among individuals and groups after market adjustments, while economic incidence focuses on the initial statutory assignment of the tax. Understanding the distinction between effective and economic incidence is essential for evaluating the real impact of taxes on consumers, producers, and overall market efficiency.

Theoretical Foundations of Tax Incidence

Effective incidence refers to the actual economic burden of a tax on individuals or entities, reflecting who ultimately pays after all market adjustments. Economic incidence considers the distribution of tax burden between consumers and producers, determined by the relative elasticities of supply and demand. Theoretical foundations of tax incidence stem from partial equilibrium analysis, emphasizing how price changes redistribute tax burdens in competitive markets.

Mechanisms Behind Effective Incidence

Effective incidence refers to the true economic burden of a tax, reflecting who ultimately bears the cost after market adjustments. Mechanisms behind effective incidence include price changes, shifts in supply and demand, and alterations in production decisions that distribute the tax's impact between consumers and producers. Economic incidence captures these redistributions, contrasting statutory incidence, which is the legal obligation to pay the tax.

Unpacking Economic Incidence: Who Really Bears the Burden?

Economic incidence reveals the true burden of taxation by identifying who ultimately pays the tax after market adjustments, contrasting with effective incidence that merely shows the initial tax payment. It analyzes how taxes affect prices, wages, and resource allocation, shifting costs between consumers, producers, and workers. Understanding economic incidence is essential for policymakers to design equitable tax systems that do not disproportionately impact vulnerable groups.

Examples Illustrating Effective vs Economic Incidence

Effective incidence refers to who legally pays a tax or bears its direct financial responsibility, such as a corporation remitting corporate income tax to the government. Economic incidence measures who ultimately bears the cost of the tax through changes in prices, wages, or market behavior, for example, consumers paying higher prices due to a sales tax or workers accepting lower wages because of payroll taxes. A cigarette tax may be effectively paid by manufacturers, but the economic incidence often falls on smokers through increased cigarette prices.

Factors Influencing the Distribution of Incidence

Effective incidence and economic incidence differ in how the tax burden is distributed between buyers and sellers, influenced by factors such as price elasticity of demand and supply. Highly elastic demand shifts more tax burden to producers, while inelastic demand causes consumers to bear a larger share. Market structure, availability of substitutes, and time horizon also critically determine the ultimate incidence of taxation in both approaches.

Incidence in Different Markets: Goods, Services, and Labor

Effective incidence measures the actual burden of a tax on consumers or producers after market adjustments, while economic incidence examines who ultimately bears the tax cost regardless of legal responsibility. In goods markets, effective incidence depends on price elasticity of supply and demand, shifting tax burdens between buyers and sellers; in services markets, factors like service customization and competition influence incidence distribution. Labor markets reveal complex economic incidence patterns where wage adjustments and employment levels reflect tax impacts on both workers and employers, often diverging from statutory tax responsibilities.

Policy Implications of Effective and Economic Incidence

Effective incidence measures the actual burden of a tax or policy on taxpayers, reflecting who ultimately pays after market adjustments, while economic incidence focuses on the true economic effect regardless of statutory responsibility. Policy implications highlight that understanding effective incidence enables governments to design tax systems that achieve equity and efficiency goals, since shifting behaviors can alter who bears the economic cost. Accurate analysis of both incidences informs more effective policymaking by predicting real-world impacts on income distribution, consumption, and labor supply.

Challenges and Limitations in Measuring Incidence

Measuring effective incidence faces challenges in accurately identifying who ultimately bears the tax burden due to market dynamics and behavioral responses that obscure direct tax effects. Economic incidence measurement struggles with isolating the distributional impact amidst complex economic interactions, such as tax shifting, where tax burdens are transferred between producers, consumers, and factors of production. Limitations arise from data availability, difficulty in modeling real-world behaviors, and the interplay between short-term and long-term effects, complicating precise incidence allocation.

Effective incidence Infographic

libterm.com

libterm.com