Nash equilibrium occurs when each player in a strategic game chooses their optimal strategy, assuming the other players' strategies remain unchanged. This concept highlights the point where no participant has an incentive to deviate unilaterally, ensuring stability in competitive scenarios. Discover how understanding Nash equilibrium can enhance Your decision-making skills throughout the rest of the article.

Table of Comparison

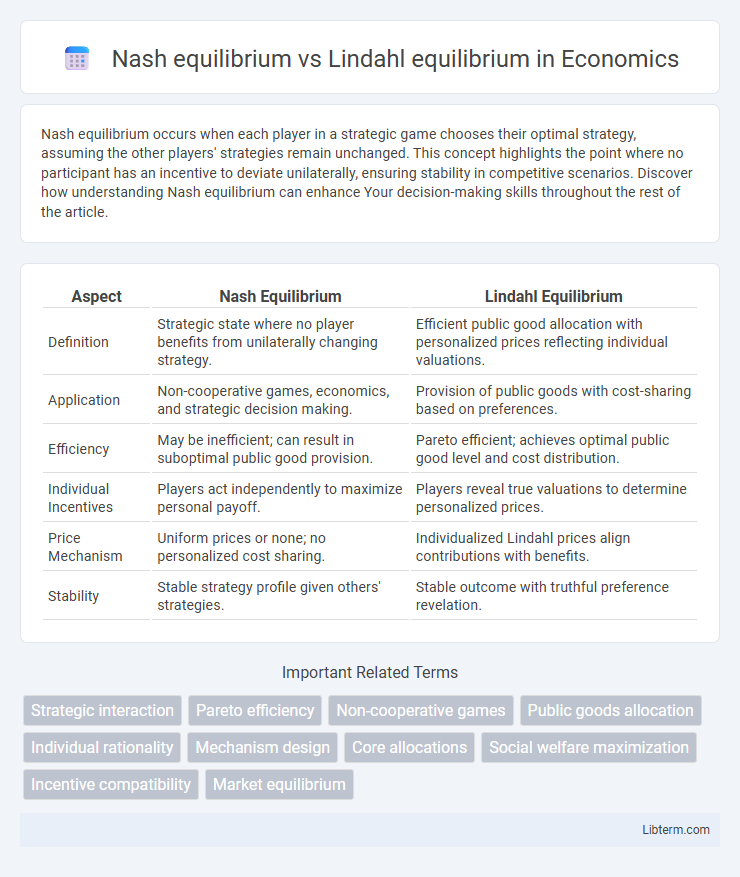

| Aspect | Nash Equilibrium | Lindahl Equilibrium |

|---|---|---|

| Definition | Strategic state where no player benefits from unilaterally changing strategy. | Efficient public good allocation with personalized prices reflecting individual valuations. |

| Application | Non-cooperative games, economics, and strategic decision making. | Provision of public goods with cost-sharing based on preferences. |

| Efficiency | May be inefficient; can result in suboptimal public good provision. | Pareto efficient; achieves optimal public good level and cost distribution. |

| Individual Incentives | Players act independently to maximize personal payoff. | Players reveal true valuations to determine personalized prices. |

| Price Mechanism | Uniform prices or none; no personalized cost sharing. | Individualized Lindahl prices align contributions with benefits. |

| Stability | Stable strategy profile given others' strategies. | Stable outcome with truthful preference revelation. |

Introduction to Economic Equilibria

Nash equilibrium represents a strategic stability concept where no player can improve their payoff by unilaterally changing their strategy, fundamental in non-cooperative game theory. Lindahl equilibrium models efficient public goods provision by assigning personalized prices to individuals, ensuring that collective consumption matches individual valuations and budget constraints. Both equilibria address different economic settings: Nash equilibrium applies to competitive interactions, while Lindahl equilibrium focuses on cooperative solutions in public goods economics.

Understanding Nash Equilibrium

Nash Equilibrium represents a stable state in a non-cooperative game where no player can gain by unilaterally changing their strategy, making it a fundamental concept in game theory and economic analysis. It contrasts with Lindahl Equilibrium, which applies to public goods provision by assigning personalized prices reflecting individual valuation, leading to efficient resource allocation through cooperative behavior. Understanding Nash Equilibrium is crucial for analyzing strategic interactions in competitive markets, auctions, and oligopolies where individual rationality drives outcomes without collaborative agreements.

Defining Lindahl Equilibrium

Lindahl equilibrium defines a state in public economics where individuals pay personalized prices for public goods, aligning individual contributions with their marginal valuation of the good. Unlike Nash equilibrium, which focuses on strategic decision-making in non-cooperative games without personalized pricing, Lindahl equilibrium ensures efficient provision of public goods through collective willingness to pay. This equilibrium addresses the free-rider problem by equating individual marginal benefits to marginal costs, leading to Pareto optimal outcomes in public good financing.

Key Assumptions of Nash and Lindahl Equilibria

Nash equilibrium assumes that each player in a non-cooperative game chooses their strategy independently, aiming to maximize personal payoff given others' strategies, with complete information about others' choices. Lindahl equilibrium relies on the assumption of public goods, where individuals reveal their truthful marginal valuations to collectively determine personalized prices, ensuring efficient provision of the public good. Both equilibria require rationality and strategic behavior, but Nash focuses on strategic stability in private goods, while Lindahl emphasizes efficient allocation in public goods through personalized pricing.

Mathematical Formulation: Nash vs Lindahl

Nash equilibrium is mathematically formulated as a strategy profile where no player can unilaterally improve their payoff by changing their strategy, typically expressed as \( \forall i, \, u_i(s_i^*, s_{-i}^*) \geq u_i(s_i, s_{-i}^*) \). Lindahl equilibrium involves personalized prices for public goods, where each individual's marginal benefit equals their personalized price, ensuring efficient public goods provision, mathematically captured by \( \sum_i p_i = MC \) and \( MB_i = p_i \) for all individuals \( i \). While Nash equilibrium focuses on individual strategy optimization under fixed strategies of others, Lindahl equilibrium balances personalized pricing and marginal cost to achieve Pareto efficiency in public goods allocation.

Efficiency and Fairness: Comparative Analysis

Nash equilibrium often leads to efficient outcomes in non-cooperative games but may lack fairness as players prioritize individual payoffs, potentially resulting in suboptimal social welfare. Lindahl equilibrium addresses efficiency and fairness by assigning personalized prices for public goods, ensuring that the provision level reflects individuals' marginal valuations and leads to Pareto optimal allocation. While Nash equilibrium emphasizes strategic stability, Lindahl equilibrium provides a more equitable distribution of costs and benefits, promoting both efficiency in resource allocation and fairness in public goods financing.

Application in Public Goods and Private Markets

Nash equilibrium applies to private markets by modeling strategic interactions where each agent's optimal strategy depends on others' strategies, often leading to inefficient public goods provision due to free-rider problems. Lindahl equilibrium addresses public goods allocation by assigning personalized prices reflecting individual marginal benefits, enabling efficient and voluntary contributions that achieve Pareto optimality. The contrast highlights Nash equilibrium's limitation in public goods contexts versus Lindahl equilibrium's tailored cost-sharing mechanism promoting efficiency and fairness in collective financing.

Real-World Examples of Nash and Lindahl Equilibria

Nash equilibrium is commonly observed in competitive markets like the airline industry, where companies independently set prices and routes, resulting in stable but potentially suboptimal outcomes for consumers. Lindahl equilibrium, often applied in public goods provision, illustrates situations such as local governments funding public parks where individuals pay personalized prices reflecting their marginal benefits, leading to efficient resource allocation. Both concepts demonstrate distinct approaches: Nash equilibrium captures strategic interaction among self-interested agents, while Lindahl equilibrium emphasizes equitable cost-sharing based on individual valuations in collective decision-making.

Limitations and Criticisms

Nash equilibrium often faces criticism due to its reliance on the assumption of complete information and rationality, leading to multiple possible outcomes without guaranteeing social optimality. Lindahl equilibrium, while addressing public goods allocation by pricing individual contributions, struggles with practical implementation challenges such as information asymmetry and complexity in determining personalized prices. Both equilibria are limited by their theoretical nature, often lacking robustness in dynamic real-world scenarios where preferences and strategies evolve.

Conclusion: Choosing the Right Equilibrium Model

Choosing the appropriate equilibrium model hinges on the context of strategic interactions and public goods provision. Nash equilibrium effectively addresses scenarios with non-cooperative agents and competitive strategies, while Lindahl equilibrium better captures efficient public goods allocation through personalized pricing and voluntary contributions. Understanding the distinct assumptions and outcomes guides economists in applying the right model for optimal resource distribution and policy design.

Nash equilibrium Infographic

libterm.com

libterm.com