Marginal cost represents the increase in total production cost when producing one additional unit of a good or service, crucial for pricing and output decisions. Understanding marginal cost helps businesses optimize resource allocation and maximize profitability by identifying the cost efficiency of scaling production. Explore the article to gain deeper insights into how marginal cost influences your business strategies and economic outcomes.

Table of Comparison

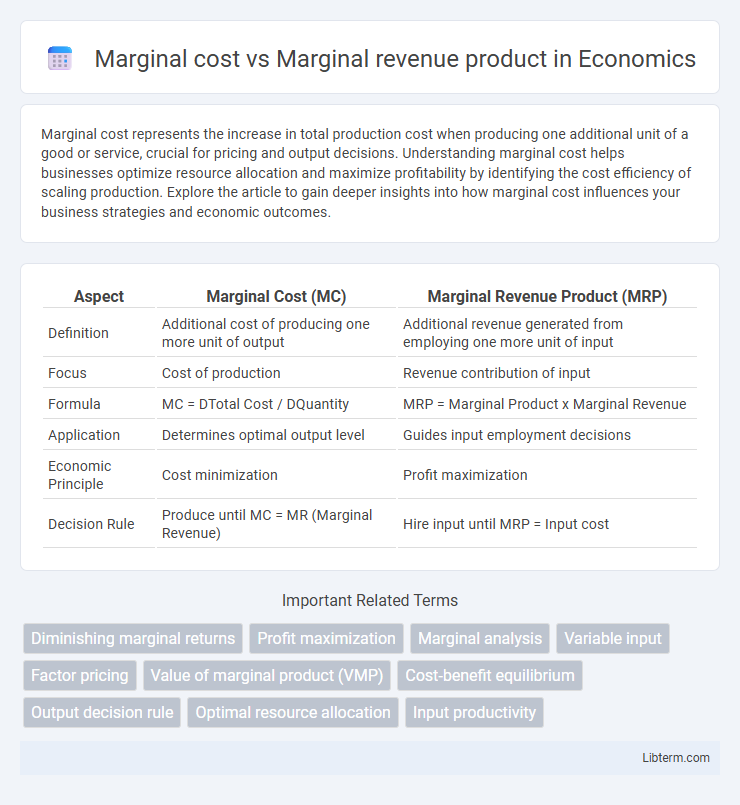

| Aspect | Marginal Cost (MC) | Marginal Revenue Product (MRP) |

|---|---|---|

| Definition | Additional cost of producing one more unit of output | Additional revenue generated from employing one more unit of input |

| Focus | Cost of production | Revenue contribution of input |

| Formula | MC = DTotal Cost / DQuantity | MRP = Marginal Product x Marginal Revenue |

| Application | Determines optimal output level | Guides input employment decisions |

| Economic Principle | Cost minimization | Profit maximization |

| Decision Rule | Produce until MC = MR (Marginal Revenue) | Hire input until MRP = Input cost |

Understanding Marginal Cost: Definition and Importance

Marginal cost refers to the additional expense incurred from producing one more unit of a good or service, crucial for businesses in optimizing production levels and pricing strategies. Understanding marginal cost helps firms determine the efficient scale of production to maximize profit by comparing it directly with marginal revenue product, which measures the additional revenue generated by one more unit of input. Accurate calculation of marginal cost enables informed decisions on resource allocation and cost management, enhancing overall operational efficiency.

What is Marginal Revenue Product? An Overview

Marginal Revenue Product (MRP) measures the additional revenue generated by employing one more unit of a factor of production, typically labor. It is calculated by multiplying the marginal product of the input by the marginal revenue obtained from selling the output. Businesses use MRP to determine the optimal quantity of inputs to maximize profit, ensuring that the marginal cost of input does not exceed its marginal revenue contribution.

Key Differences Between Marginal Cost and Marginal Revenue Product

Marginal cost measures the additional expense incurred from producing one more unit of output, while marginal revenue product represents the additional revenue generated by employing one more unit of input, such as labor. Marginal cost is primarily used to assess production efficiency and profitability, whereas marginal revenue product helps in optimizing input utilization and determining the demand for factors of production. Key differences include marginal cost being an expense metric linked to output quantity changes, whereas marginal revenue product reflects revenue contribution from input factors, highlighting their distinct roles in cost management and resource allocation.

The Role of Marginal Cost in Business Decision-Making

Marginal cost plays a critical role in business decision-making by representing the additional expense incurred when producing one more unit of output, guiding firms to optimize production levels. Businesses compare marginal cost to marginal revenue product--the additional revenue generated by an extra unit of input--to determine profit-maximizing points. Efficient allocation of resources occurs when marginal cost aligns with marginal revenue product, helping firms avoid losses and enhance overall profitability.

Calculating Marginal Revenue Product: Step-by-Step Guide

Calculating Marginal Revenue Product (MRP) involves multiplying the Marginal Product (MP) of an input by the Marginal Revenue (MR) generated from selling the additional output. First, determine the increase in output resulting from an additional unit of input. Then, multiply this marginal product by the marginal revenue per unit to find the MRP, which guides optimal input usage for maximum profit.

Relationship Between Marginal Cost and Marginal Revenue Product

Marginal cost represents the expense incurred by producing one additional unit of output, while marginal revenue product measures the additional revenue generated from employing one more unit of input. The relationship illuminates optimal resource allocation, as firms maximize profit by equating marginal cost to marginal revenue product. When marginal revenue product exceeds marginal cost, increasing input usage is beneficial, whereas if marginal cost surpasses marginal revenue product, resource utilization should decrease.

Marginal Cost vs Marginal Revenue Product in Profit Maximization

Marginal cost (MC) represents the additional expense incurred from producing one more unit of output, while marginal revenue product (MRP) measures the extra revenue generated by employing one additional unit of input, such as labor or capital. In profit maximization, firms optimize input usage by equating marginal cost of input to its marginal revenue product, ensuring resources are allocated efficiently to maximize profits. When MRP exceeds MC, increasing input use adds to profit, whereas if MC surpasses MRP, reducing input prevents losses.

Real-World Examples: Marginal Cost and Revenue Product in Action

Marginal cost represents the additional expense incurred from producing one more unit of a good, while marginal revenue product measures the additional revenue generated by employing one more unit of input, such as labor. For example, a factory producing smartphones might find that the marginal cost of assembling one more phone is $50, but the marginal revenue product of adding an extra worker to the assembly line increases revenue by $70, indicating profitable expansion. In agricultural settings, if the marginal cost of using one more fertilizer bag is $30, but the marginal revenue product of the boosted crop yield amounts to $45, farmers optimize input use to maximize profits.

Common Mistakes in Analyzing Marginal Costs and Revenue Products

Common mistakes in analyzing marginal cost and marginal revenue product include confusing marginal cost with average cost and overlooking the variability of input factors affecting marginal revenue product. Analysts often fail to distinguish between short-run and long-run marginal costs, leading to inaccurate pricing and production decisions. Misinterpreting the marginal revenue product by ignoring market demand elasticity can result in suboptimal resource allocation and profit loss.

Strategies to Optimize Output Using Marginal Analysis

Marginal cost measures the expense of producing one additional unit, while marginal revenue product quantifies the extra revenue generated by that unit, essential for optimizing output decisions. Firms maximize profit by producing output up to the point where marginal cost equals marginal revenue product, ensuring resources are allocated efficiently without incurring losses. Employing marginal analysis strategies helps adjust input levels dynamically, balancing cost with revenue to achieve optimal production and maximize economic returns.

Marginal cost Infographic

libterm.com

libterm.com