Liquidation refers to the process of winding up a company's operations by selling its assets to pay off creditors and distribute any remaining funds to shareholders. Understanding the different types of liquidation, such as voluntary or compulsory, is essential for protecting your financial interests during this transition. Explore the rest of the article to learn how liquidation impacts businesses and what steps you can take to navigate it effectively.

Table of Comparison

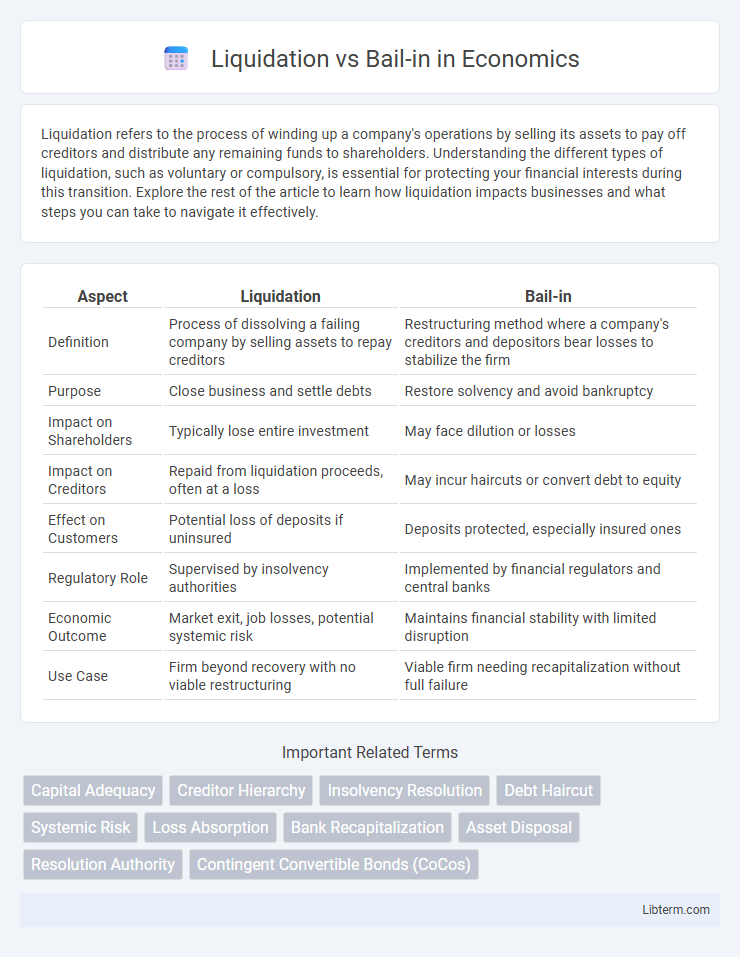

| Aspect | Liquidation | Bail-in |

|---|---|---|

| Definition | Process of dissolving a failing company by selling assets to repay creditors | Restructuring method where a company's creditors and depositors bear losses to stabilize the firm |

| Purpose | Close business and settle debts | Restore solvency and avoid bankruptcy |

| Impact on Shareholders | Typically lose entire investment | May face dilution or losses |

| Impact on Creditors | Repaid from liquidation proceeds, often at a loss | May incur haircuts or convert debt to equity |

| Effect on Customers | Potential loss of deposits if uninsured | Deposits protected, especially insured ones |

| Regulatory Role | Supervised by insolvency authorities | Implemented by financial regulators and central banks |

| Economic Outcome | Market exit, job losses, potential systemic risk | Maintains financial stability with limited disruption |

| Use Case | Firm beyond recovery with no viable restructuring | Viable firm needing recapitalization without full failure |

Introduction to Liquidation and Bail-in

Liquidation involves the process where a financially distressed institution ceases operations, and its assets are sold off to repay creditors and depositors, often leading to the closure of the entity. Bail-in is a resolution mechanism where a failing bank's creditors and depositors, except those protected by insurance, bear some of the losses by having their claims converted into equity or written down to recapitalize the institution. Both approaches aim to manage insolvency while minimizing taxpayer burden and maintaining financial system stability.

Definition of Liquidation

Liquidation is the process by which a financially distressed company sells its assets to repay creditors and cease operations. It involves dissolving the business, converting assets into cash, and distributing proceeds according to legal priorities, often resulting in the company's closure. Unlike a bail-in, liquidation removes the entity from the market rather than restructuring its liabilities to maintain ongoing operations.

Definition of Bail-in

A bail-in is a financial mechanism where a failing bank's creditors and depositors bear some of the losses by having their debt converted into equity or written down to stabilize the institution without requiring taxpayer-funded bailouts. Unlike liquidation, which involves selling off assets to pay creditors and results in the bank's closure, a bail-in aims to keep the bank operational while recapitalizing it internally. This method helps maintain financial stability by protecting critical banking functions and minimizing systemic risk.

Key Differences Between Liquidation and Bail-in

Liquidation involves the complete winding up of a failing financial institution's assets to pay off creditors, often leading to the closure of the entity. Bail-in refers to the internal recapitalization process where creditors and depositors' funds are converted into equity to stabilize the institution without external bailouts. The key difference lies in liquidation ending the business and distributing assets, while bail-in preserves the institution's operations by restructuring its liabilities.

The Legal Framework for Liquidation

The legal framework for liquidation is governed by insolvency laws that establish procedures for the orderly winding down of a failing financial institution's assets to satisfy creditor claims. Liquidation involves court-supervised processes where a liquidator is appointed to sell assets, settle liabilities, and distribute remaining funds to stakeholders according to the priority of claims defined in the law. This framework ensures creditor protection, preserves market stability, and aims to minimize systemic risk while providing legal certainty throughout asset disposition and debt settlement.

Regulatory Approach to Bail-in

The regulatory approach to bail-in prioritizes maintaining financial stability by requiring creditors and shareholders to absorb losses instead of relying on taxpayer-funded bailouts. This method is embedded in frameworks such as the EU's Bank Recovery and Resolution Directive (BRRD) and the Financial Stability Board's Key Attributes, ensuring that critical bank functions continue during distress. Bail-in tools enforce recapitalization through the conversion or write-down of debt, thereby minimizing systemic risk and protecting public funds.

Impact on Creditors and Shareholders

Liquidation results in the sale of a company's assets to repay creditors, often leaving shareholders with little to no recovery as liabilities take precedence. Bail-in restructures a failed bank's debt by converting certain liabilities into equity, protecting depositors and senior creditors while diluting or wiping out existing shareholders. Creditors face losses in both scenarios, but bail-ins aim to minimize systemic impact and preserve the institution's ongoing operations.

Effects on Financial Stability

Liquidation can lead to significant disruptions in financial stability due to the sudden loss of asset value and creditor confidence, often triggering systemic risk in interconnected markets. Bail-in mechanisms help mitigate these risks by recapitalizing troubled financial institutions using internal resources, preserving critical functions and preventing contagion. This approach enhances stability by protecting taxpayers and maintaining market confidence through orderly resolution processes.

Case Studies: Liquidation vs Bail-in

Case studies of liquidation versus bail-in reveal significant differences in handling bank failures, where liquidation involves selling off assets to repay creditors, often resulting in losses for depositors and investors. Bail-in cases, such as the 2013 Cypriot banking crisis, demonstrate how recapitalization through creditor and shareholder losses can stabilize banks without resorting to taxpayer bailouts. These cases illustrate the strategic shift towards bail-ins for preserving financial stability while minimizing systemic risk in modern banking regulations.

Conclusion: Choosing the Right Resolution Strategy

Selecting the appropriate resolution strategy between liquidation and bail-in depends on the financial institution's stability, stakeholder impact, and systemic risk considerations. Liquidation is often suited for institutions beyond recovery, ensuring orderly asset distribution but potentially causing greater market disruption. Bail-in preserves critical functions by recapitalizing the institution through creditor losses, maintaining financial stability while protecting taxpayer funds.

Liquidation Infographic

libterm.com

libterm.com