Recession significantly impacts financial markets, employment rates, and consumer spending patterns, causing widespread economic uncertainty. Businesses often face reduced demand, leading to budget cuts and strategic shifts to survive challenging conditions. Discover how to navigate these turbulent times and protect your financial well-being by reading the full article.

Table of Comparison

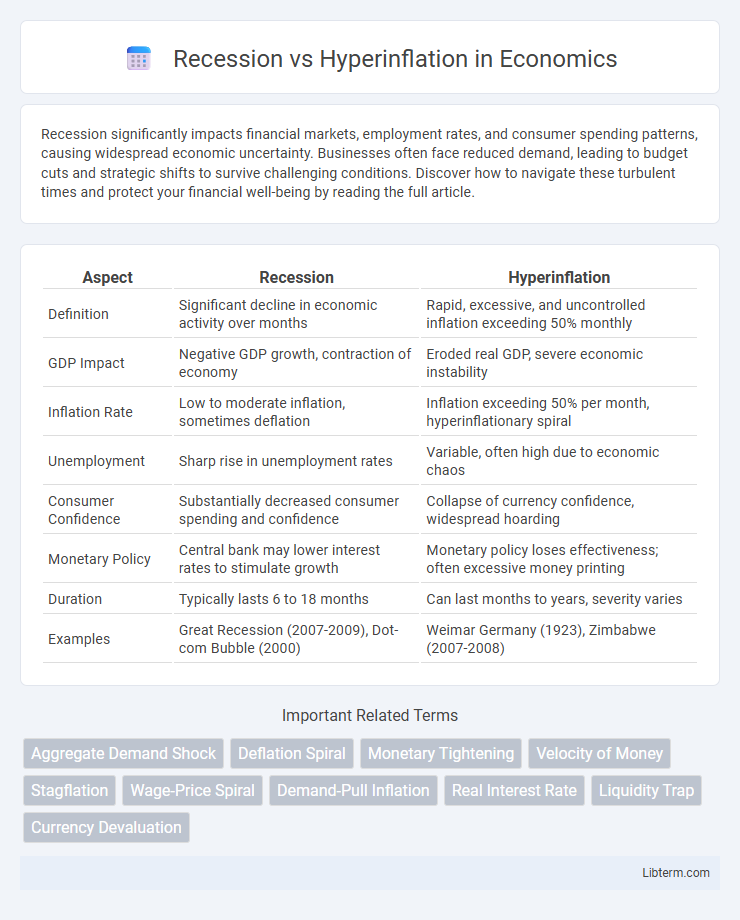

| Aspect | Recession | Hyperinflation |

|---|---|---|

| Definition | Significant decline in economic activity over months | Rapid, excessive, and uncontrolled inflation exceeding 50% monthly |

| GDP Impact | Negative GDP growth, contraction of economy | Eroded real GDP, severe economic instability |

| Inflation Rate | Low to moderate inflation, sometimes deflation | Inflation exceeding 50% per month, hyperinflationary spiral |

| Unemployment | Sharp rise in unemployment rates | Variable, often high due to economic chaos |

| Consumer Confidence | Substantially decreased consumer spending and confidence | Collapse of currency confidence, widespread hoarding |

| Monetary Policy | Central bank may lower interest rates to stimulate growth | Monetary policy loses effectiveness; often excessive money printing |

| Duration | Typically lasts 6 to 18 months | Can last months to years, severity varies |

| Examples | Great Recession (2007-2009), Dot-com Bubble (2000) | Weimar Germany (1923), Zimbabwe (2007-2008) |

Understanding Economic Downturns: Recession vs Hyperinflation

Recession and hyperinflation represent distinct types of economic downturns with different causes and impacts. A recession is characterized by a sustained decline in GDP, rising unemployment, and reduced consumer spending, often triggered by shocks to demand or financial crises. Hyperinflation, in contrast, involves extremely rapid and uncontrolled price increases, eroding currency value and savings, typically caused by excessive money supply growth and loss of confidence in the currency.

Key Definitions: What is a Recession? What is Hyperinflation?

A recession is defined as a significant decline in economic activity across the economy lasting more than a few months, characterized by reduced GDP, employment, and consumer spending. Hyperinflation refers to an extremely rapid and out-of-control increase in prices, typically exceeding 50% per month, eroding currency value and purchasing power. Understanding these key definitions highlights that recessions involve economic contraction, while hyperinflation involves severe currency devaluation.

Core Causes: Drivers Behind Recession and Hyperinflation

Recessions are primarily driven by reduced consumer spending, declining business investment, and tightening credit conditions, often triggered by external shocks or monetary policy tightening. Hyperinflation stems from excessive money supply growth, loss of confidence in currency, and fiscal deficits financed by central banks, leading to rapidly escalating prices. Understanding these core causes helps differentiate economic downturns characterized by shrinking output from those marked by runaway inflation.

Economic Indicators: Signs of Recession vs Signs of Hyperinflation

Economic indicators signaling a recession include rising unemployment rates, declining GDP growth, and reduced consumer spending, highlighting a contraction in economic activity. In contrast, signs of hyperinflation feature rapidly escalating price levels, a sharp depreciation of the national currency, and an exponential increase in money supply. Monitoring central bank interest rates and inflation expectations further differentiates between recessionary stagnation and hyperinflationary spirals.

Impact on Businesses: Operational Challenges and Opportunities

Recession leads to decreased consumer demand and tightened credit, forcing businesses to streamline operations and prioritize cost-cutting measures to maintain liquidity. Hyperinflation causes rapid price increases and currency devaluation, challenging firms with fluctuating input costs and supply chain disruptions while creating opportunities in sectors like commodities and real estate. Both economic conditions compel businesses to adopt agile strategies, such as dynamic pricing and diversified revenue streams, to mitigate risks and capitalize on market shifts.

Effects on Consumers: Spending Power and Financial Security

Recession significantly reduces consumers' spending power due to job losses and lower income, leading to decreased demand for goods and services and increased financial insecurity. Hyperinflation erodes the real value of money rapidly, causing consumers to lose purchasing power sharply and struggle with rising prices for basic necessities, undermining their financial stability. Both economic conditions disrupt savings and investment, but hyperinflation poses a more immediate threat to everyday affordability and long-term financial security.

Policy Responses: Government and Central Bank Strategies

Government policy responses to recession typically involve fiscal stimulus, such as increased public spending and tax cuts, aiming to boost aggregate demand and employment. Central banks often implement monetary easing by lowering interest rates and purchasing assets to increase liquidity and encourage lending. In contrast, hyperinflation demands tight monetary policies, including raising interest rates drastically and reducing money supply growth, while governments may enforce price controls and fiscal austerity to restore currency stability and regain public confidence.

Historical Examples: Notable Cases of Recession and Hyperinflation

The Great Depression of the 1930s stands as a landmark example of a global recession, marked by massive unemployment and deflation, impacting economies worldwide, especially the United States. Hyperinflation episodes, such as Zimbabwe in the late 2000s and the Weimar Republic of Germany in the 1920s, illustrate how runaway price increases can collapse currency value and devastate economic stability. These contrasting phenomena highlight the severe but distinct economic disruptions that recessions and hyperinflations impose on national and global financial systems.

Investing Strategies: Protecting Wealth During Economic Extremes

During a recession, investing strategies emphasize preserving capital through defensive stocks, government bonds, and dividend-paying companies to mitigate risk and maintain income. In contrast, hyperinflation demands allocation to tangible assets like real estate, commodities, and inflation-protected securities (TIPS) to hedge against currency devaluation and rapidly rising prices. Diversifying portfolios with a blend of inflation-resistant and recession-proof assets ensures wealth protection amid economic extremes.

Long-term Consequences: Economic Recovery and Future Risks

Recession causes prolonged unemployment, reduced consumer spending, and slower GDP growth, often requiring years for full economic recovery. Hyperinflation erodes savings, destabilizes currency, and disrupts financial markets, leading to loss of investor confidence and potential social unrest. Long-term risks from both include increased government debt, weakened institutions, and challenges in regaining economic stability and sustainable growth.

Recession Infographic

libterm.com

libterm.com