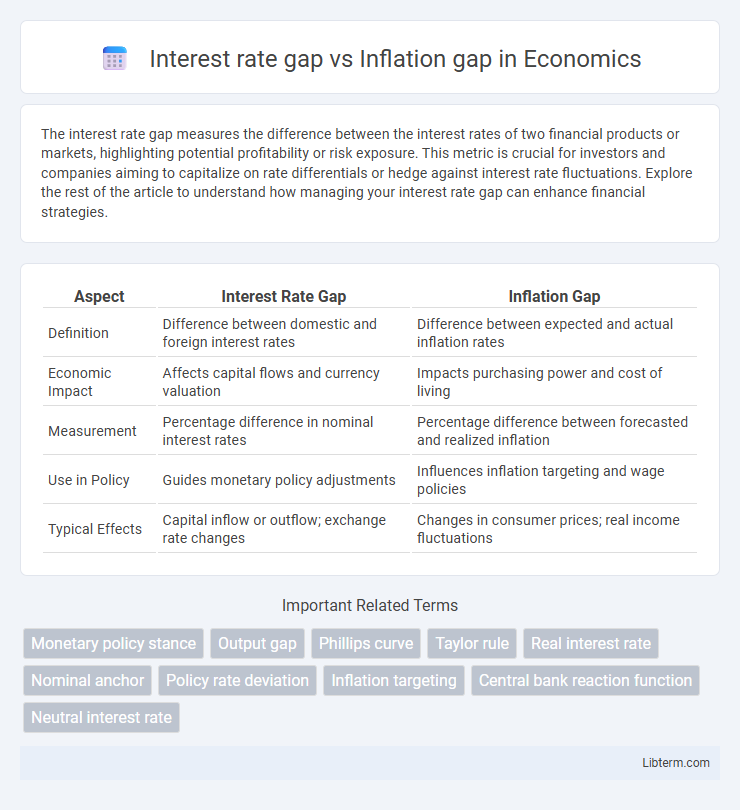

The interest rate gap measures the difference between the interest rates of two financial products or markets, highlighting potential profitability or risk exposure. This metric is crucial for investors and companies aiming to capitalize on rate differentials or hedge against interest rate fluctuations. Explore the rest of the article to understand how managing your interest rate gap can enhance financial strategies.

Table of Comparison

| Aspect | Interest Rate Gap | Inflation Gap |

|---|---|---|

| Definition | Difference between domestic and foreign interest rates | Difference between expected and actual inflation rates |

| Economic Impact | Affects capital flows and currency valuation | Impacts purchasing power and cost of living |

| Measurement | Percentage difference in nominal interest rates | Percentage difference between forecasted and realized inflation |

| Use in Policy | Guides monetary policy adjustments | Influences inflation targeting and wage policies |

| Typical Effects | Capital inflow or outflow; exchange rate changes | Changes in consumer prices; real income fluctuations |

Understanding Interest Rate Gap

The interest rate gap measures the difference between a country's nominal interest rates and its real interest rates adjusted for inflation, reflecting monetary policy stance and economic conditions. A positive interest rate gap indicates that nominal rates exceed inflation, promoting savings and attracting foreign capital, while a negative gap suggests real interest rates are negative, stimulating borrowing and spending. Understanding the interest rate gap is crucial for evaluating central bank policies, predicting currency movements, and assessing economic growth prospects relative to inflationary pressures.

Defining Inflation Gap

The inflation gap measures the difference between the current inflation rate and the target inflation rate set by central banks, reflecting deviations from desired price stability. Interest rate gap, by contrast, refers to the difference between short-term and long-term interest rates, influencing economic growth and monetary policy effectiveness. Understanding the inflation gap is crucial for adjusting interest rates to maintain economic equilibrium and control inflationary pressures.

Key Differences Between Interest Rate Gap and Inflation Gap

The interest rate gap measures the difference between short-term and long-term interest rates, reflecting monetary policy stance and economic outlook. The inflation gap quantifies the deviation of actual inflation from target inflation, indicating pricing stability and demand pressures. While the interest rate gap influences borrowing costs and investment decisions, the inflation gap directly impacts purchasing power and wage adjustments.

How Central Banks Respond to Interest Rate Gap

Central banks respond to an interest rate gap, which measures the difference between policy rates and equilibrium rates, by adjusting interest rates to stabilize economic growth and control inflation. When the interest rate gap is negative, indicating rates are below their natural level, central banks may raise rates to prevent overheating and curb inflationary pressures. Conversely, a positive interest rate gap prompts rate cuts to stimulate borrowing and investment, helping to close output gaps and maintain price stability amid fluctuating inflation gaps.

Impact of Inflation Gap on Monetary Policy

The inflation gap, defined as the difference between actual inflation and target inflation, critically influences monetary policy decisions by compelling central banks to adjust interest rates to stabilize prices. A positive inflation gap typically prompts tightening monetary policy through higher interest rates to curb inflationary pressures, while a negative gap leads to lowering rates to stimulate economic activity. This dynamic shapes the central bank's response aimed at maintaining economic stability and achieving inflation targets, distinct from the interest rate gap which reflects discrepancies between real and nominal rates.

Relationship Between Interest Rate Gap and Inflation Gap

The interest rate gap, defined as the difference between nominal interest rates and real interest rates, directly reflects the inflation gap, which measures the deviation of actual inflation from the target inflation rate. When the inflation gap widens, central banks adjust nominal interest rates to influence the interest rate gap, aiming to stabilize inflation expectations and economic growth. A positive correlation exists between a rising inflation gap and an increased interest rate gap, as monetary policy tightens to counteract inflationary pressures.

Economic Implications of Narrow vs. Wide Gaps

A narrow interest rate gap relative to the inflation gap often signals tighter monetary policy, which can restrain borrowing and slow economic growth, while a wide gap may indicate accommodative conditions encouraging spending but risking overheating and higher inflation. Economies with narrow gaps typically face less inflation uncertainty, promoting stable investment environments, whereas wide gaps can lead to volatility in exchange rates and capital flows. Policymakers must balance these gaps to maintain price stability without stifling economic expansion.

Historical Examples: Interest Rate Gap vs. Inflation Gap

Historical examples reveal that the interest rate gap, calculated as the difference between nominal interest rates and inflation rates, significantly impacts economic stability. During the 1970s stagflation, the inflation gap widened as inflation outpaced nominal interest rates, eroding purchasing power and destabilizing markets. Contrastingly, the Volcker era in the early 1980s saw a deliberately increased interest rate gap to combat inflation, resulting in a recession but ultimately restoring price stability.

Strategies for Managing Interest Rate and Inflation Gaps

Strategies for managing interest rate and inflation gaps involve adjusting monetary policies to stabilize economic growth and control inflation. Central banks use interest rate hikes to narrow the inflation gap by curbing excessive demand, while lowering rates can stimulate economic activity when inflation is below target. Implementing forward guidance and inflation targeting frameworks helps align market expectations, reducing volatility caused by interest rate and inflation discrepancies.

Future Trends in Interest Rate Gap and Inflation Gap

Future trends indicate that the interest rate gap, defined as the difference between nominal interest rates and expected inflation, may widen as central banks adjust monetary policies to combat volatile inflation rates. Inflation gap, measured as the deviation of actual inflation from the target rate, is expected to fluctuate due to supply chain disruptions and changing consumer demand patterns in a post-pandemic economy. Monitoring these gaps provides critical insights for investors and policymakers aiming to balance economic growth while maintaining price stability.

Interest rate gap Infographic

libterm.com

libterm.com