Bootstrapping is a self-sustaining method of growing a business using personal finances or generated revenue rather than external funding. This approach allows entrepreneurs to maintain full control over their company and encourages resourcefulness and disciplined financial management. Explore the rest of the article to discover key strategies and benefits of bootstrapping your startup.

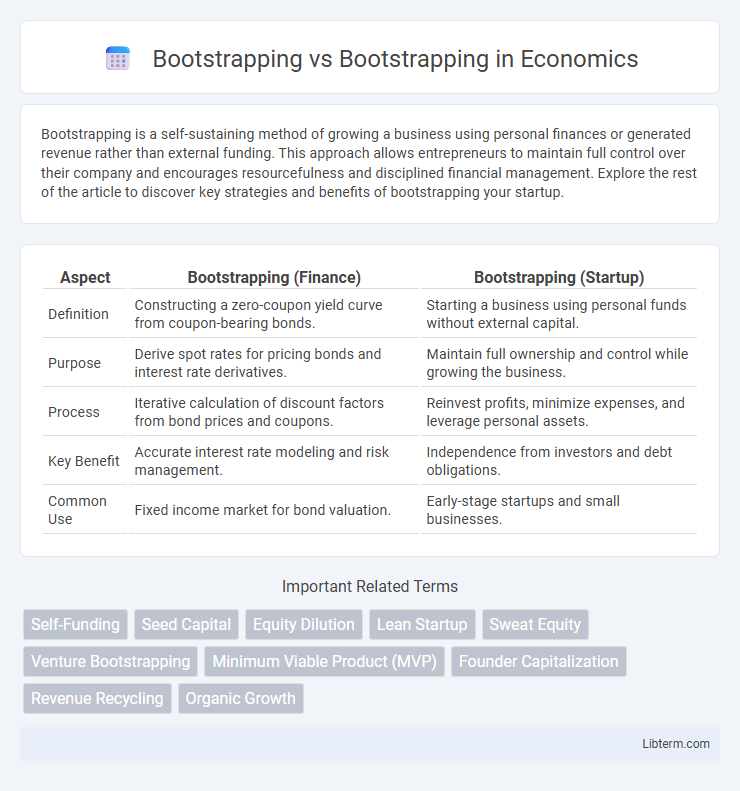

Table of Comparison

| Aspect | Bootstrapping (Finance) | Bootstrapping (Startup) |

|---|---|---|

| Definition | Constructing a zero-coupon yield curve from coupon-bearing bonds. | Starting a business using personal funds without external capital. |

| Purpose | Derive spot rates for pricing bonds and interest rate derivatives. | Maintain full ownership and control while growing the business. |

| Process | Iterative calculation of discount factors from bond prices and coupons. | Reinvest profits, minimize expenses, and leverage personal assets. |

| Key Benefit | Accurate interest rate modeling and risk management. | Independence from investors and debt obligations. |

| Common Use | Fixed income market for bond valuation. | Early-stage startups and small businesses. |

Understanding Bootstrapping: Definition and Applications

Bootstrapping refers to the statistical method of resampling with replacement to estimate the distribution of a dataset and assess the accuracy of sample estimates, making it crucial in inferential statistics. In contrast, bootstrapping in business involves starting a company with minimal external funding, relying on personal resources and revenue to grow. Understanding bootstrapping in statistics highlights its application in hypothesis testing, confidence interval estimation, and model validation, while in entrepreneurship, it emphasizes resourcefulness and sustainability during early-stage business development.

Bootstrapping in Statistics: An Overview

Bootstrapping in statistics is a resampling technique used to estimate the sampling distribution of a statistic by repeatedly sampling with replacement from the observed data. This non-parametric method enables the calculation of confidence intervals, standard errors, and hypothesis testing without relying on strict assumptions about the population distribution. It is widely applied in regression analysis, hypothesis testing, and machine learning for robust inference, especially when the sample size is small or the underlying distribution is unknown.

Bootstrapping in Startups: Building with Limited Resources

Bootstrapping in startups involves building a business using minimal external funding, relying primarily on personal savings, revenue, and resourcefulness. This approach encourages lean operations, prioritizes cash flow management, and fosters innovation by forcing entrepreneurs to maximize limited resources effectively. Bootstrapped startups often maintain greater control and equity, allowing founders to scale sustainably without dilution from investors.

Key Differences: Statistical vs Entrepreneurial Bootstrapping

Statistical bootstrapping is a resampling technique used in data analysis to estimate the distribution of a statistic by repeatedly sampling with replacement from the original data set. Entrepreneurial bootstrapping refers to the practice of building and growing a startup using personal finances, limited external funding, and resourceful strategies to minimize costs. The key difference lies in their domain and purpose: statistical bootstrapping aids in inference and uncertainty estimation in statistics while entrepreneurial bootstrapping focuses on funding and operational strategies for business growth.

Advantages of Bootstrapping in Statistics

Bootstrapping in statistics offers the advantage of making minimal assumptions about the underlying data distribution, enabling robust estimation of standard errors and confidence intervals even with small or complex datasets. It enhances flexibility by allowing repeated resampling with replacement to generate empirical sampling distributions that improve inference accuracy. This non-parametric method supports a wide range of applications including hypothesis testing and model validation, making it essential for modern statistical analysis.

Benefits of Bootstrapping for Entrepreneurs

Bootstrapping empowers entrepreneurs by enabling complete control over their business without reliance on external funding, preserving equity and decision-making power. It fosters disciplined cash flow management, encouraging resourcefulness and efficient use of limited capital. Entrepreneurs who bootstrap often achieve sustainable growth and develop a strong foundation due to hands-on involvement and lean operational practices.

Challenges and Limitations of Each Bootstrapping Approach

Bootstrapping in statistics often faces challenges such as high computational cost and sensitivity to small sample sizes, which can lead to biased or unstable estimates. In contrast, bootstrap funding approaches encounter limitations including resource constraints, scalability issues, and difficulty attracting external investment, which can hinder business growth. Both methods require careful consideration of context-specific factors to optimize outcomes and mitigate inherent limitations.

Real-World Examples: Statisticians vs Startup Founders

Statisticians use bootstrapping techniques to generate numerous resampled datasets, enabling robust estimation of confidence intervals and hypothesis testing without relying on parametric assumptions. Startup founders apply bootstrapping by self-funding or leveraging minimal external resources to grow their companies organically, emphasizing cash flow management and iterative product development. These contrasting examples highlight how bootstrapping in statistics enhances data inference reliability, while in entrepreneurship it drives sustainable business growth through resourcefulness.

When to Use Statistical Bootstrapping vs Business Bootstrapping

Statistical bootstrapping is ideal for estimating the sampling distribution of a statistic when the sample size is small or the underlying distribution is unknown, providing robust confidence intervals and hypothesis testing without relying on strict parametric assumptions. Business bootstrapping suits early-stage startups or entrepreneurs aiming to grow with minimal external funding, focusing on resourcefulness, cost-control, and reinvestment of revenue to sustain operations. Choosing between the two depends on the context: use statistical bootstrapping for rigorous data analysis and business bootstrapping for lean startup growth strategies.

Conclusion: Choosing the Right Bootstrapping Method

Selecting the appropriate bootstrapping method depends on the specific data structure and research goals. Nonparametric bootstrapping suits datasets without strong distributional assumptions, while parametric bootstrapping excels when model parameters are known or assumed. Careful evaluation of computational resources and accuracy requirements guides the optimal choice between these techniques.

Bootstrapping Infographic

libterm.com

libterm.com