Monopsony occurs when a single buyer dominates a market, giving them significant power over suppliers and influencing prices or wages. This market structure often results in reduced competition and can lead to lower input costs for the buyer but potentially unfair conditions for sellers or workers. Discover how understanding monopsony can impact your business strategies and economic decisions in the detailed article ahead.

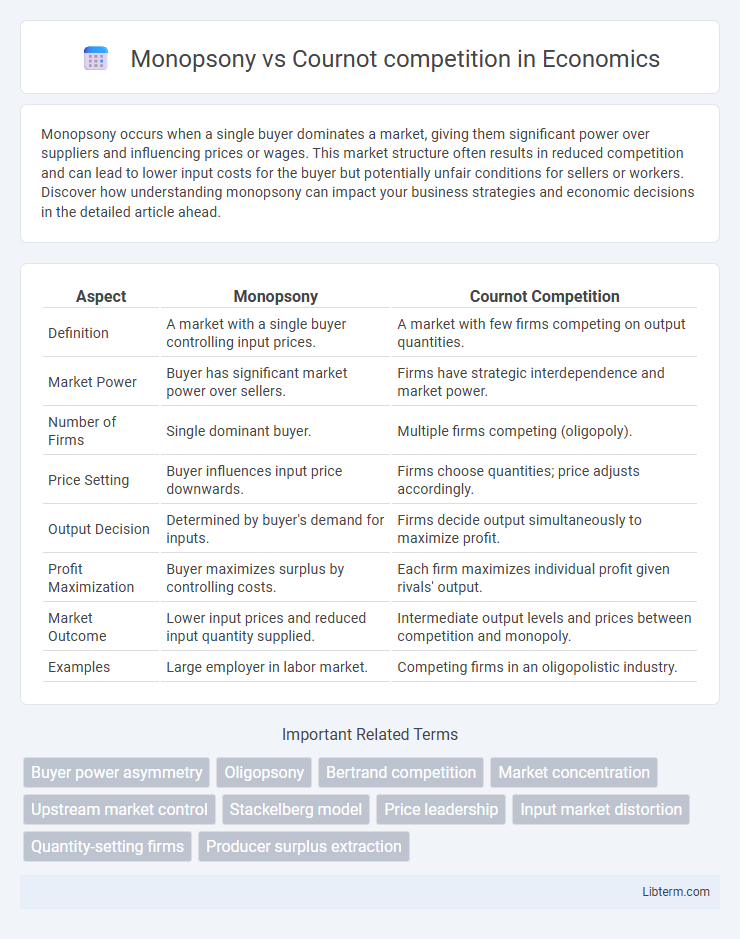

Table of Comparison

| Aspect | Monopsony | Cournot Competition |

|---|---|---|

| Definition | A market with a single buyer controlling input prices. | A market with few firms competing on output quantities. |

| Market Power | Buyer has significant market power over sellers. | Firms have strategic interdependence and market power. |

| Number of Firms | Single dominant buyer. | Multiple firms competing (oligopoly). |

| Price Setting | Buyer influences input price downwards. | Firms choose quantities; price adjusts accordingly. |

| Output Decision | Determined by buyer's demand for inputs. | Firms decide output simultaneously to maximize profit. |

| Profit Maximization | Buyer maximizes surplus by controlling costs. | Each firm maximizes individual profit given rivals' output. |

| Market Outcome | Lower input prices and reduced input quantity supplied. | Intermediate output levels and prices between competition and monopoly. |

| Examples | Large employer in labor market. | Competing firms in an oligopolistic industry. |

Introduction to Monopsony and Cournot Competition

Monopsony is a market structure characterized by a single buyer exerting significant control over price and quantity decisions, often leading to lower input prices and reduced supplier power. Cournot competition involves multiple firms competing by selecting quantities simultaneously, where each firm's output decision influences the market price and the strategies of its rivals. Understanding the dynamics of monopsony and Cournot competition provides insight into market power distribution and strategic interactions within supply and output markets.

Defining Monopsony Power

Monopsony power refers to a market condition where a single buyer dominates the purchasing side, enabling them to influence prices and terms more significantly than in competitive markets. Unlike Cournot competition, which involves multiple firms competing on output quantities, a monopsonist reduces input prices by restricting quantity demanded to maximize buyer surplus. This market asymmetry leads to lower prices for suppliers and potentially inefficient allocation of resources compared to competitive equilibria.

Understanding Cournot Competition

Cournot competition models an industry where firms simultaneously choose quantities to maximize profits under the assumption their competitors' output levels remain fixed. Each firm's output decision affects the market price, leading to an equilibrium where firms produce quantities balancing marginal cost with expected market price. This strategic interaction contrasts with monopsony, where a single buyer controls the market, emphasizing how multiple sellers in Cournot compete on quantities rather than prices.

Market Structure: Monopsony vs Cournot

A monopsony represents a market structure where a single buyer dominates, exerting significant control over suppliers and driving prices downward due to limited competition among buyers. In contrast, Cournot competition models an oligopolistic market where several firms simultaneously choose output quantities, influencing market price through strategic interdependence. The monopsonistic buyer's market power contrasts with Cournot firms' equilibrium outputs determined by mutual quantity decisions, highlighting differing dynamics in supply-demand interactions and price-setting mechanisms.

Price Setting Mechanisms

Monopsony markets feature a single buyer exerting significant control over input prices, driving prices below competitive levels due to lack of buyer competition. In Cournot competition, multiple firms simultaneously choose quantities to produce, leading to equilibrium prices determined by aggregate output rather than direct price setting. Price mechanisms in monopsony reflect buyer power reducing supplier prices, while Cournot competition relies on strategic quantity decisions influencing market prices indirectly.

Output Decisions and Efficiency

Monopsony power leads to lower input prices and reduced quantities purchased compared to competitive markets, resulting in allocative inefficiency and deadweight loss. In Cournot competition, firms simultaneously choose output levels, leading to higher total industry output than monopoly but lower than perfect competition, with equilibrium quantities balancing firms' strategic interdependence. Efficiency under monopsony is reduced due to market power suppressing input demand, while Cournot outcomes yield intermediate efficiency by limiting output to maximize profit given rivals' output decisions.

Welfare Implications and Consumer Impact

Monopsony, characterized by a single buyer exerting market power, typically results in lower input prices but reduced supplier surplus, leading to potential inefficiencies and welfare loss compared to Cournot competition, where multiple firms compete by setting quantities. Cournot competition generally enhances consumer welfare by increasing output and lowering prices relative to monopsony markets, which constrain supply and reduce consumer choice. Welfare implications favor Cournot competition as increased market rivalry promotes better resource allocation and higher overall social surplus.

Real-World Examples of Monopsony and Cournot

Monopsony occurs when a single buyer dominates the market, as seen in the labor market for professional sports referees in certain countries, where teams exert wage-setting power over officials. Cournot competition is exemplified by firms in the cement industry, such as Lafarge and Cemex, which strategically decide output quantities affecting market prices in an oligopolistic setting. These real-world examples illustrate how monopsony impacts wage dynamics, while Cournot models demonstrate firms' quantity competition influencing market equilibrium.

Regulatory Approaches and Policy Responses

Regulatory approaches to monopsony focus on preventing buyer power abuse by enforcing antitrust laws that limit buyer concentration and promote market entry. In Cournot competition, policies aim to reduce collusion potential through merger control and monitoring strategic firm behavior to maintain competitive equilibrium. Both frameworks require tailored interventions to balance market power and protect efficient price-setting mechanisms.

Conclusion: Key Differences and Strategic Insights

Monopsony establishes market power on the buyer's side, controlling input prices and quantities, whereas Cournot competition involves firms simultaneously setting output quantities to maximize profits under mutual interdependence. The strategic insight lies in recognizing that monopsonists influence input markets and can exploit supplier dependencies, while Cournot competitors engage in quantity-based rivalry, leading to equilibrium outputs that reflect mutual strategic anticipation. Understanding these distinctions informs regulatory policies and firm strategies by highlighting where market power resides and how it affects pricing and output decisions.

Monopsony Infographic

libterm.com

libterm.com