Price stickiness occurs when prices remain fixed despite changes in supply or demand, often due to menu costs, contracts, or customer expectations. This phenomenon can impact market efficiency and influence a firm's pricing strategy during economic fluctuations. Explore the rest of the article to understand how price stickiness affects your business decisions and market dynamics.

Table of Comparison

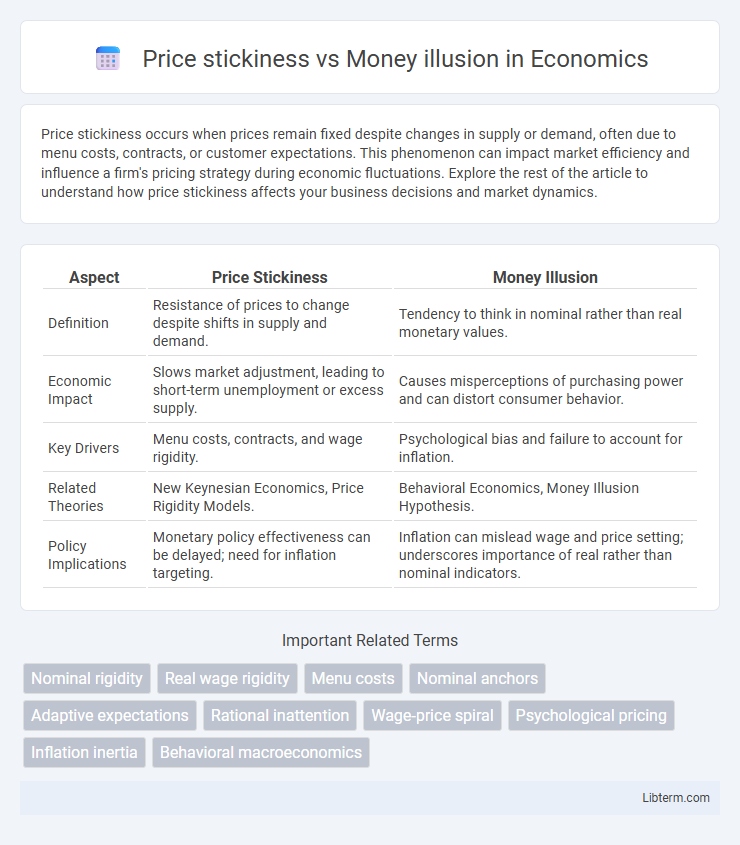

| Aspect | Price Stickiness | Money Illusion |

|---|---|---|

| Definition | Resistance of prices to change despite shifts in supply and demand. | Tendency to think in nominal rather than real monetary values. |

| Economic Impact | Slows market adjustment, leading to short-term unemployment or excess supply. | Causes misperceptions of purchasing power and can distort consumer behavior. |

| Key Drivers | Menu costs, contracts, and wage rigidity. | Psychological bias and failure to account for inflation. |

| Related Theories | New Keynesian Economics, Price Rigidity Models. | Behavioral Economics, Money Illusion Hypothesis. |

| Policy Implications | Monetary policy effectiveness can be delayed; need for inflation targeting. | Inflation can mislead wage and price setting; underscores importance of real rather than nominal indicators. |

Understanding Price Stickiness: Definition and Causes

Price stickiness refers to the resistance of prices to change despite shifts in supply or demand, often caused by menu costs, long-term contracts, and firms' reluctance to disrupt customer expectations. This rigidity in prices can lead to slower market adjustments and persistent economic imbalances. Understanding price stickiness is crucial for analyzing monetary policy effects and inflation persistence.

Exploring Money Illusion in Economics

Money illusion occurs when individuals interpret nominal price changes without adjusting for inflation, leading to distorted economic decisions despite constant real values. Price stickiness exacerbates money illusion by preventing wages and prices from adjusting quickly to monetary changes, causing real effects from nominal shifts. Understanding money illusion is crucial for policymakers to design effective monetary interventions that account for behavioral responses to nominal price changes.

Key Differences Between Price Stickiness and Money Illusion

Price stickiness refers to the resistance of prices to change despite shifts in supply or demand, maintaining nominal prices rigid over short to medium terms. Money illusion involves individuals confusing nominal price changes with real changes, leading to behavioral biases when inflation distorts purchasing power without immediate price adjustments. The key difference lies in price stickiness being a market-level phenomenon affecting actual price adjustments, whereas money illusion is a cognitive bias influencing consumer perception and decision-making under changing nominal values.

Historical Perspectives on Price Stickiness

Historical perspectives on price stickiness reveal that prices often remain rigid despite changes in demand or cost conditions, challenging classical economic theories that assume flexible prices. Early 20th-century studies, such as those by Keynes, emphasized the role of nominal rigidities in explaining economic fluctuations, highlighting how firms may resist lowering prices due to menu costs or wage contracts. This historical insight into price stickiness laid the groundwork for understanding how money illusion--the tendency to perceive nominal rather than real changes in prices--can influence consumer and business behavior during periods of inflation or deflation.

Psychological Roots of Money Illusion

Money illusion arises from individuals perceiving nominal values rather than real purchasing power, causing them to overlook inflation's impact on income and prices. Psychological factors such as cognitive biases and heuristic thinking lead consumers to anchor on face-value amounts, resulting in price stickiness despite changes in real economic conditions. This misperception hampers efficient market adjustments, reinforcing rigid wage and price settings in the presence of nominal shocks.

Price Stickiness: Effects on Inflation and Economic Policy

Price stickiness, characterized by slow adjustments in prices despite changes in economic conditions, significantly impacts inflation dynamics and monetary policy effectiveness. When prices remain rigid, central banks face challenges in stabilizing inflation, as delayed price changes can cause persistent output fluctuations and unemployment. Understanding price stickiness is crucial for policymakers to design interventions that mitigate inflation volatility and promote economic stability.

Money Illusion’s Impact on Consumer Decision-Making

Money illusion causes consumers to perceive nominal price changes without adjusting for inflation, leading to distorted decision-making and inefficient spending. This effect can mask the real cost variations, resulting in consumers failing to respond appropriately to price increases or wage adjustments. Understanding money illusion helps explain persistent consumer behavior anomalies despite changing economic conditions.

Real-World Examples: Price Stickiness and Money Illusion

Price stickiness is evident in the labor market where companies hesitate to reduce nominal wages during economic downturns, resulting in unemployment instead of wage cuts, demonstrating resistance to flexible pricing. Money illusion occurs when consumers perceive their income or prices in nominal terms, such as failing to adjust spending when inflation erodes purchasing power despite unchanged real wages. For example, during periods of inflation, homeowners may continue housing payments unaware that real mortgage costs decline, illustrating money illusion's impact on consumer behavior.

Policy Implications: Addressing Price Stickiness vs. Money Illusion

Price stickiness limits the effectiveness of monetary policy by causing slow adjustments in wages and prices, thereby delaying economic stabilization. Money illusion can distort consumers' and firms' real perceptions of inflation, leading to suboptimal spending and investment decisions. Policymakers should implement clear communication strategies and consider nominal wage and price rigidities to enhance policy responsiveness and minimize the adverse effects of money illusion.

Comparing Solutions: Tackling Price Stickiness and Money Illusion

Price stickiness can be addressed through flexible wage policies and enhanced market competition, allowing prices to adjust more rapidly to economic changes, while money illusion is mitigated by improving financial literacy and promoting indexation of wages and contracts to inflation. Monetary and fiscal policies designed to anchor inflation expectations help reduce both phenomena by stabilizing price perceptions and adjustments. Technological advancements in pricing algorithms also facilitate dynamic price revisions, directly targeting price rigidity and reducing the impact of money illusion on consumer behavior.

Price stickiness Infographic

libterm.com

libterm.com