Bonds credit risk refers to the likelihood that a bond issuer will default on interest or principal payments, impacting the bondholder's returns. Understanding factors like the issuer's credit rating, economic conditions, and market volatility is crucial for assessing this risk. Explore the rest of the article to learn how you can evaluate and manage bonds credit risk effectively.

Table of Comparison

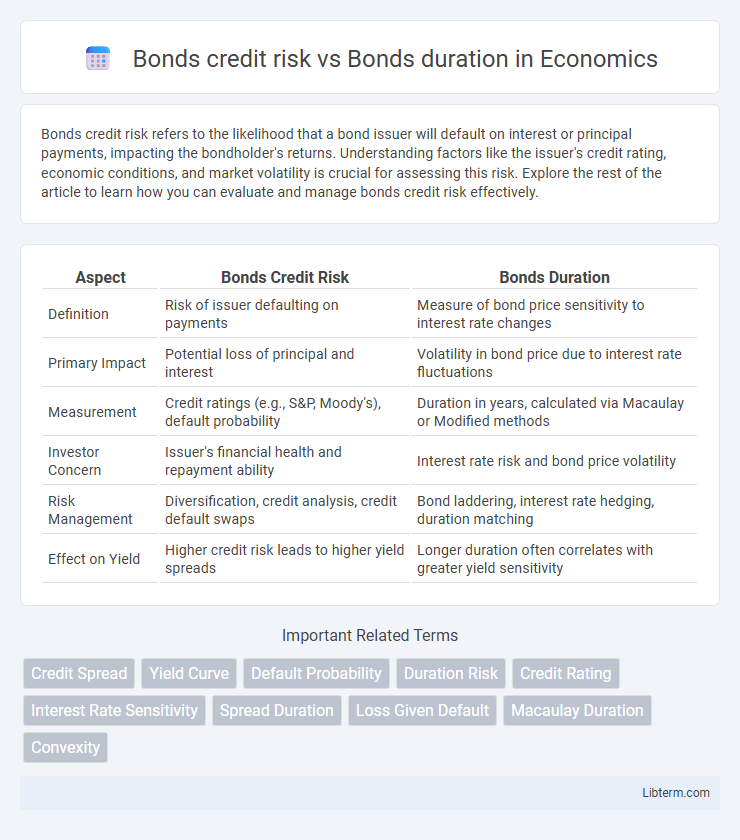

| Aspect | Bonds Credit Risk | Bonds Duration |

|---|---|---|

| Definition | Risk of issuer defaulting on payments | Measure of bond price sensitivity to interest rate changes |

| Primary Impact | Potential loss of principal and interest | Volatility in bond price due to interest rate fluctuations |

| Measurement | Credit ratings (e.g., S&P, Moody's), default probability | Duration in years, calculated via Macaulay or Modified methods |

| Investor Concern | Issuer's financial health and repayment ability | Interest rate risk and bond price volatility |

| Risk Management | Diversification, credit analysis, credit default swaps | Bond laddering, interest rate hedging, duration matching |

| Effect on Yield | Higher credit risk leads to higher yield spreads | Longer duration often correlates with greater yield sensitivity |

Understanding Bonds: Credit Risk vs Duration

Credit risk in bonds refers to the possibility that the issuer may default on interest or principal payments, impacting the bond's creditworthiness and investor returns. Duration measures a bond's sensitivity to interest rate changes, indicating how much its price is expected to fluctuate with shifting rates; longer duration bonds exhibit higher interest rate risk. Investors must balance credit risk and duration to optimize bond portfolio stability and return potential, considering that higher credit risk often demands higher yields while longer durations increase exposure to rate volatility.

Defining Bonds Credit Risk

Bonds credit risk refers to the likelihood that the bond issuer will default on interest or principal payments, impacting the bond's creditworthiness and leading to possible financial loss. Credit rating agencies assign ratings such as AAA, BBB, or junk status to quantify this risk, influencing bond yields and investor decisions. Unlike bond duration, which measures sensitivity to interest rate changes, credit risk specifically assesses issuer solvency and repayment reliability.

Explaining Bonds Duration

Bonds duration measures the sensitivity of a bond's price to changes in interest rates, expressed in years, reflecting weighted average time to receive cash flows. Higher duration indicates greater price volatility and risk from interest rate fluctuations, while credit risk involves the likelihood of issuer default impacting bond value independently of duration. Understanding duration is crucial for managing interest rate risk, especially when comparing bonds with varying credit qualities and maturities.

Key Differences Between Credit Risk and Duration

Credit risk in bonds refers to the possibility that the issuer will default on interest or principal payments, directly impacting the bond's creditworthiness and potential loss. Duration measures a bond's sensitivity to interest rate changes, indicating how much the bond's price will fluctuate with shifts in market yields. While credit risk affects the likelihood of payment failure, duration reflects exposure to interest rate volatility, making them distinct but crucial risk factors for bond investors.

How Credit Risk Affects Bond Prices

Credit risk directly impacts bond prices as higher credit risk increases the likelihood of issuer default, leading investors to demand higher yields and thus causing bond prices to fall. Bonds with lower credit ratings typically exhibit greater price volatility because market perception of default risk fluctuates more significantly. Duration measures interest rate sensitivity but does not account for credit risk, making it crucial for investors to assess both factors to understand price movements holistically.

The Impact of Duration on Bond Volatility

Bond duration measures the sensitivity of a bond's price to interest rate changes, directly impacting its volatility, with longer durations indicating higher price fluctuations. Credit risk reflects the likelihood of default by the bond issuer, primarily affecting the bond's yield spread rather than its sensitivity to interest rate shifts. Understanding that duration drives interest rate risk helps investors assess potential price volatility, while credit risk informs about the issuer's creditworthiness and potential default losses.

Assessing Portfolio Risks: Credit vs Duration

Assessing portfolio risks involves analyzing bond credit risk, which measures the issuer's default probability and affects yield spreads, alongside bond duration, a sensitivity metric indicating price volatility relative to interest rate fluctuations. Credit risk primarily influences the likelihood of principal loss in a bond portfolio, while duration directly impacts interest rate risk exposure and price sensitivity to rate changes. Effective risk management requires balancing these factors to optimize yield and preserve capital, especially in diversified fixed-income portfolios with varying credit qualities and maturities.

Strategies for Managing Credit Risk in Bonds

Managing credit risk in bonds involves diversifying across issuers with varying credit ratings to minimize default exposure and regularly monitoring issuer financial health using credit rating agencies' reports. Investors can employ laddering strategies with bonds of staggered maturities to balance duration risk while maintaining credit quality, thereby smoothing income streams and reducing sensitivity to interest rate fluctuations. Utilizing credit derivatives or investing in bonds with embedded credit enhancements like guarantees or insurance offers additional protection against credit deterioration.

Tactics to Mitigate Duration Risk

Mitigating duration risk in bonds involves strategies such as laddering bond maturities, which helps spread exposure across different interest rate environments, and using bond funds or ETFs with shorter duration to reduce sensitivity to rate fluctuations. Another effective tactic is incorporating floating rate notes, which adjust coupons based on benchmark rates, thereby decreasing duration risk. Active management with interest rate derivatives like interest rate swaps can also hedge against adverse rate movements, ensuring portfolio duration aligns with risk tolerance.

Balancing Credit and Duration Risk in Fixed-Income Investing

Balancing credit risk and duration risk is crucial in fixed-income investing as credit risk impacts the likelihood of default, while duration risk measures sensitivity to interest rate changes. Investors must carefully select bonds with appropriate credit ratings and maturities to optimize returns while minimizing volatility. Diversifying across different credit qualities and maturities helps manage overall portfolio risk and stabilize income streams.

Bonds credit risk Infographic

libterm.com

libterm.com