Firm-specific risk refers to the potential for losses or volatility in a company's stock value caused by factors unique to that business, such as management decisions, product recalls, or competitive pressures. This type of risk can be mitigated through diversification, as it does not typically affect the overall market. Explore the rest of the article to understand how managing firm-specific risk can protect your investment portfolio.

Table of Comparison

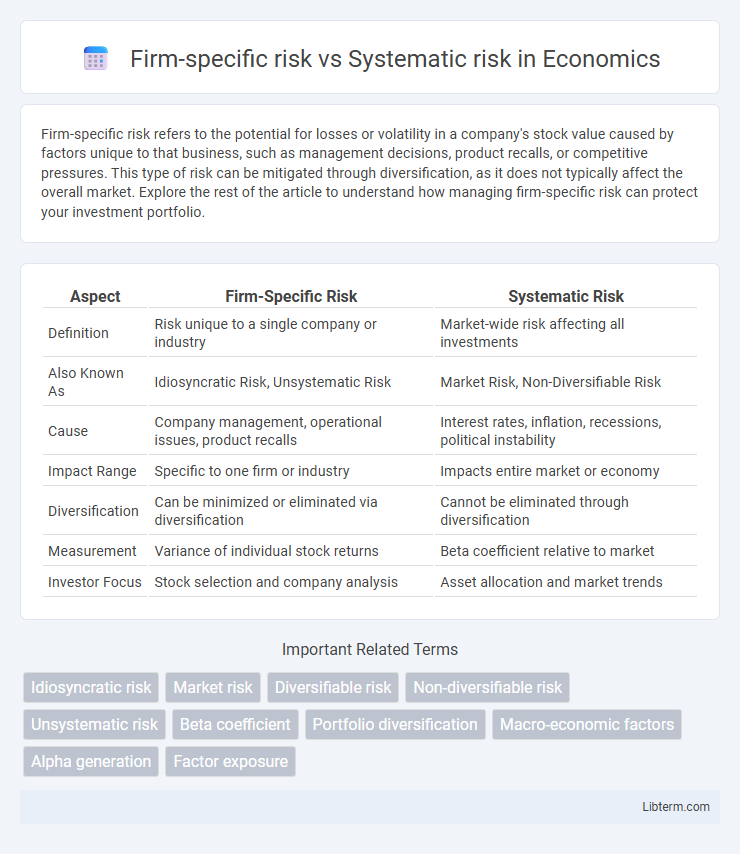

| Aspect | Firm-Specific Risk | Systematic Risk |

|---|---|---|

| Definition | Risk unique to a single company or industry | Market-wide risk affecting all investments |

| Also Known As | Idiosyncratic Risk, Unsystematic Risk | Market Risk, Non-Diversifiable Risk |

| Cause | Company management, operational issues, product recalls | Interest rates, inflation, recessions, political instability |

| Impact Range | Specific to one firm or industry | Impacts entire market or economy |

| Diversification | Can be minimized or eliminated via diversification | Cannot be eliminated through diversification |

| Measurement | Variance of individual stock returns | Beta coefficient relative to market |

| Investor Focus | Stock selection and company analysis | Asset allocation and market trends |

Introduction to Risk in Finance

Firm-specific risk refers to the uncertainty associated with individual companies due to factors like management decisions, product recalls, or competitive pressures, and it can be mitigated through diversification. Systematic risk, also known as market risk, affects the entire market or economy, influenced by macroeconomic variables such as interest rates, inflation, or geopolitical events, and cannot be eliminated through diversification. Understanding the distinction between firm-specific risk and systematic risk is crucial for investors to manage portfolios effectively and optimize risk-adjusted returns.

Defining Firm-Specific Risk

Firm-specific risk refers to the potential for losses or volatility in an individual company's stock caused by factors unique to that firm, such as management decisions, product recalls, or competitive actions. This type of risk is also known as unsystematic or idiosyncratic risk and can be mitigated through diversification within an investment portfolio. Unlike systematic risk, which affects the entire market or economy, firm-specific risk impacts only a particular company or industry.

Understanding Systematic Risk

Systematic risk refers to the inherent uncertainty affecting the entire market or a large segment, driven by macroeconomic factors such as inflation, interest rates, and geopolitical events. Unlike firm-specific risk, which can be mitigated through diversification, systematic risk impacts all investments and cannot be eliminated by holding a diversified portfolio. Understanding systematic risk is crucial for investors as it determines the market volatility and overall risk premium required for investing in equities or bonds.

Key Differences Between Firm-Specific and Systematic Risk

Firm-specific risk, also known as idiosyncratic risk, affects a single company or industry and can be mitigated through diversification by holding a broad portfolio of assets. Systematic risk, also called market risk, impacts the entire market or economy and cannot be eliminated through diversification, influenced by factors such as economic recessions, interest rate changes, and geopolitical events. The key difference lies in their scope and control: firm-specific risk is unique to individual firms and manageable, while systematic risk is pervasive, impacting all investments and requiring risk management strategies like asset allocation or hedging.

Sources of Firm-Specific Risk

Firm-specific risk originates from factors unique to a particular company, such as management decisions, product recalls, regulatory changes affecting the firm, labor strikes, and competitive dynamics within its industry. It contrasts with systematic risk, which stems from macroeconomic factors like interest rate fluctuations, inflation, and geopolitical events impacting the entire market. Understanding the distinct sources of firm-specific risk enables investors to diversify portfolios effectively and mitigate potential losses related to individual company vulnerabilities.

Factors Influencing Systematic Risk

Systematic risk, also known as market risk, is influenced by macroeconomic factors such as inflation rates, interest rate fluctuations, geopolitical events, and changes in fiscal and monetary policies. Unlike firm-specific risk, which arises from individual company events like management decisions or product recalls, systematic risk affects the entire market or a broad segment of it. Investors cannot eliminate systematic risk through diversification, making it crucial to monitor economic indicators and global developments to manage exposure effectively.

Measuring Firm-Specific and Systematic Risk

Measuring firm-specific risk involves analyzing the volatility of an individual company's stock returns relative to its expected performance, often quantified by the asset's unique variance or residual risk from a regression analysis on market returns. Systematic risk is measured by the beta coefficient, representing the sensitivity of a stock's returns to overall market movements, capturing market-wide influences that cannot be diversified away. Combining these metrics allows investors to distinguish between diversifiable firm-specific risks and non-diversifiable market risks, optimizing portfolio risk management.

Portfolio Diversification and Risk Reduction

Firm-specific risk, also known as unsystematic risk, stems from events or factors unique to a particular company and can be significantly reduced through portfolio diversification by holding a variety of stocks across different industries. Systematic risk, or market risk, arises from broad economic, geopolitical, or financial factors impacting the entire market and cannot be eliminated through diversification. Effective portfolio management focuses on minimizing firm-specific risk via diversification while accepting systematic risk that requires other strategies like asset allocation or hedging.

Impact of Risks on Investment Decisions

Firm-specific risk affects individual companies due to events like management changes or product recalls, leading investors to diversify portfolios to minimize these risks. Systematic risk, driven by broader economic factors such as interest rate fluctuations or recessions, impacts the entire market and cannot be eliminated through diversification. Understanding the distinction between these risks is crucial for optimizing asset allocation and enhancing risk-adjusted returns in investment decisions.

Managing Firm-Specific and Systematic Risks

Managing firm-specific risk involves diversification strategies such as holding a well-balanced portfolio to reduce the impact of individual company fluctuations. Systematic risk, however, affects the entire market and requires hedging techniques like asset allocation across different sectors or using derivatives to mitigate exposure. Effective risk management combines these approaches to optimize portfolio resilience and ensure long-term financial stability.

Firm-specific risk Infographic

libterm.com

libterm.com