Floor price sets the minimum value at which an asset, product, or service can be sold, ensuring protection against undervaluation in markets or auctions. Understanding floor price is essential for maximizing profits and making informed decisions in trading or pricing strategies. Discover how floor price impacts your transactions and why it matters by reading the rest of the article.

Table of Comparison

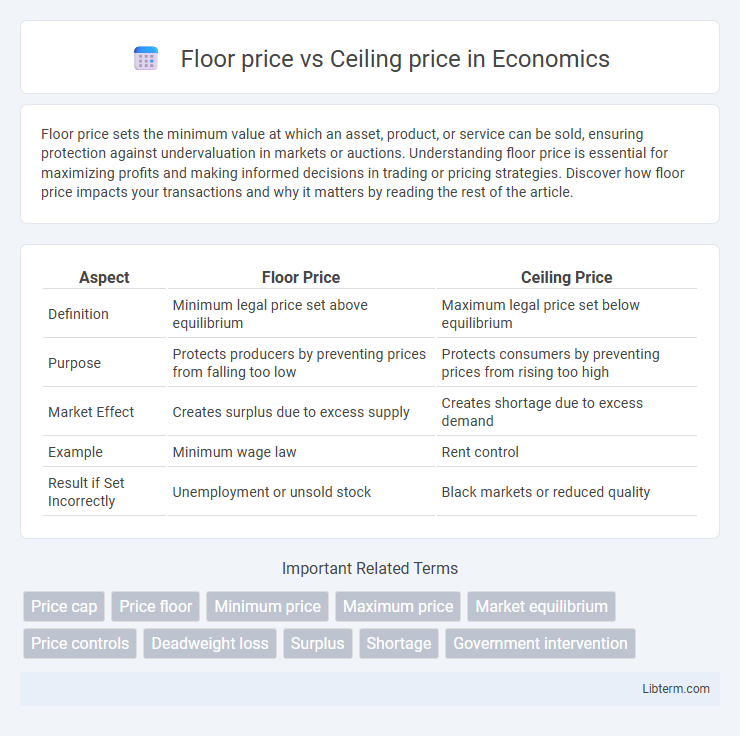

| Aspect | Floor Price | Ceiling Price |

|---|---|---|

| Definition | Minimum legal price set above equilibrium | Maximum legal price set below equilibrium |

| Purpose | Protects producers by preventing prices from falling too low | Protects consumers by preventing prices from rising too high |

| Market Effect | Creates surplus due to excess supply | Creates shortage due to excess demand |

| Example | Minimum wage law | Rent control |

| Result if Set Incorrectly | Unemployment or unsold stock | Black markets or reduced quality |

Understanding Floor Price and Ceiling Price

Floor price is the minimum price set by authorities or sellers below which a product or service cannot be sold, ensuring price stability and protecting producers from market fluctuations. Ceiling price represents the maximum allowable price, designed to protect consumers from exorbitant costs in essential goods or services. Understanding these pricing controls helps balance market fairness, prevent exploitation, and maintain economic equilibrium.

Key Differences between Floor Price and Ceiling Price

The floor price is the minimum price set by authorities to prevent prices from falling below a certain level, ensuring producers receive adequate compensation, whereas the ceiling price is the maximum price that can be charged to protect consumers from exorbitant costs. Floor prices create price floors, often leading to surplus when set above equilibrium, while ceiling prices establish price ceilings, potentially causing shortages if set below equilibrium. The key difference lies in their economic impact: floor prices typically support supply by guaranteeing minimum revenue, whereas ceiling prices aim to increase affordability by capping prices.

The Economic Rationale behind Floor and Ceiling Prices

Floor price and ceiling price policies regulate market prices to address issues of fairness and market failure. A floor price, set above the equilibrium, ensures producers receive a minimum income, preventing prices from falling below sustainable levels, commonly seen in agricultural markets. Conversely, a ceiling price caps prices to protect consumers from exorbitant costs, particularly in essential goods markets, but may lead to shortages if set below equilibrium demand and supply balance.

Real-World Examples of Floor Price

Floor price regulations in agricultural markets, such as India's Minimum Support Price (MSP) for crops, effectively guarantee farmers a basal income and stabilize supply chains. The European Union's intervention buying during surplus milk production sets a floor price to protect dairy farmers from market collapses while ensuring consumer price stability. These real-world applications demonstrate how floor prices can prevent market prices from falling below sustainable levels, promoting economic stability in volatile sectors.

Real-World Examples of Ceiling Price

Ceiling prices, also known as price caps, are government-imposed limits to prevent prices from rising above a certain level, protecting consumers during periods of inflation or shortages. For example, during the COVID-19 pandemic, several countries set ceiling prices on essential goods such as hand sanitizers and face masks to avoid price gouging. In the housing market, rent control policies act as ceiling prices to ensure affordability, as seen in cities like New York and Berlin where rents are capped to protect tenants from steep increases.

Advantages and Disadvantages of Floor Price

Floor price ensures producers receive a minimum income by preventing prices from falling below a set level, which can stabilize markets and encourage production. However, it can lead to surpluses if the floor price is set above equilibrium, causing unsold goods and inefficiencies. Moreover, consumers may face higher prices and reduced access to affordable products due to these artificial price supports.

Pros and Cons of Ceiling Price

Ceiling price limits the maximum price sellers can charge, protecting consumers from excessive costs during high demand or shortages, but it can lead to product scarcity and reduced supply incentives. While it promotes affordability and prevents price gouging, it may cause black markets or reduced quality as producers cut costs to maintain profitability. The effectiveness of a ceiling price depends on careful implementation and balancing market factors to avoid negative economic distortions.

Impacts on Consumers and Producers

Floor price set above equilibrium creates surplus, leading producers to increase supply while consumers reduce demand due to higher prices. Ceiling price imposed below equilibrium causes shortages as consumers demand more at lower prices, but producers supply less due to diminished profit margins. Both price controls distort market efficiency, resulting in welfare losses for consumers, producers, and overall economic equilibrium.

Government Role in Price Regulation

The government sets floor prices to prevent market prices from falling below a level that ensures producers can cover their costs, protecting farmers and essential service providers. Ceiling prices are implemented to cap prices on essential goods and services, preventing inflation and ensuring affordability for consumers. These regulatory mechanisms balance market stability, promote fair trade, and protect vulnerable economic sectors.

Long-Term Effects on Market Efficiency

Floor prices set a minimum allowable price, often leading to surpluses and reduced market efficiency by distorting supply and demand over time. Ceiling prices cap prices below equilibrium, causing persistent shortages and discouraging investment in production, which undermines long-term market stability. Both interventions can create inefficiencies by preventing the market from reaching its natural equilibrium, reducing overall allocative efficiency and economic welfare.

Floor price Infographic

libterm.com

libterm.com