The loanable funds theory explains interest rates through the supply and demand for funds available for borrowing, where savers supply funds and borrowers demand them. Fluctuations in these funds impact the equilibrium interest rate, influencing investment and economic growth. Explore the article to understand how this theory affects Your financial decisions and market dynamics.

Table of Comparison

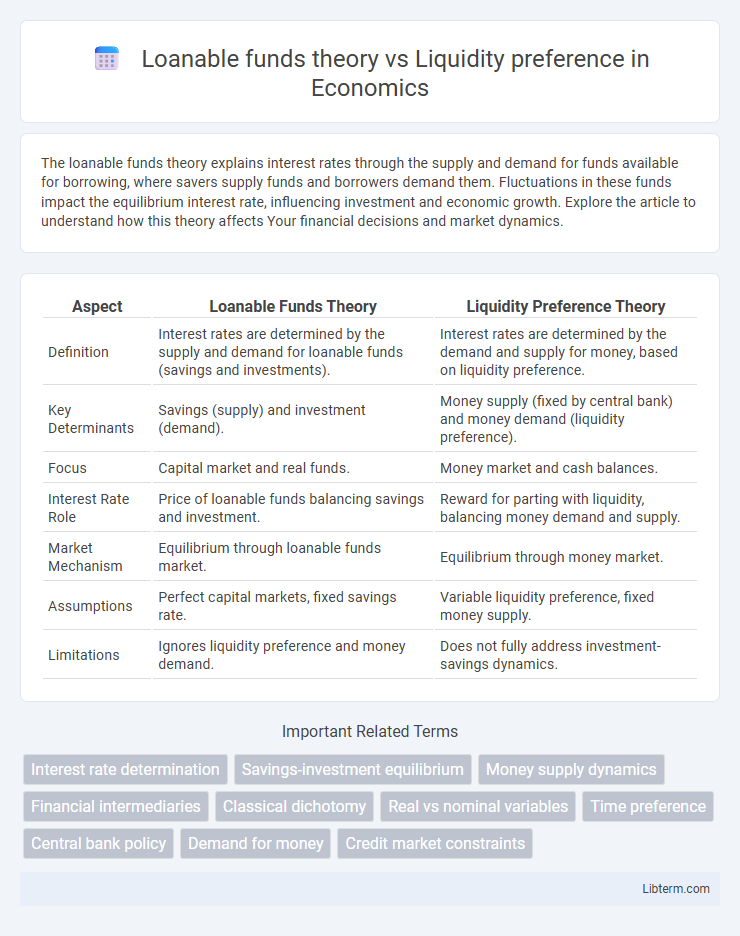

| Aspect | Loanable Funds Theory | Liquidity Preference Theory |

|---|---|---|

| Definition | Interest rates are determined by the supply and demand for loanable funds (savings and investments). | Interest rates are determined by the demand and supply for money, based on liquidity preference. |

| Key Determinants | Savings (supply) and investment (demand). | Money supply (fixed by central bank) and money demand (liquidity preference). |

| Focus | Capital market and real funds. | Money market and cash balances. |

| Interest Rate Role | Price of loanable funds balancing savings and investment. | Reward for parting with liquidity, balancing money demand and supply. |

| Market Mechanism | Equilibrium through loanable funds market. | Equilibrium through money market. |

| Assumptions | Perfect capital markets, fixed savings rate. | Variable liquidity preference, fixed money supply. |

| Limitations | Ignores liquidity preference and money demand. | Does not fully address investment-savings dynamics. |

Introduction to Interest Rate Theories

Loanable funds theory explains interest rates through the supply and demand of savings, where funds are loaned for investment purposes, linking interest rates to real economic activities. Liquidity preference theory focuses on the demand for money, emphasizing interest rates as the price for holding cash instead of bonds, influenced by liquidity needs and monetary policy. Both theories provide foundational perspectives on interest rate formation, with loanable funds highlighting capital markets and liquidity preference centering on money markets.

Overview of Loanable Funds Theory

The Loanable Funds Theory explains interest rate determination through the supply and demand for loanable funds, where savings supply funds and investment demand loans. Interest rates adjust to balance these forces, influenced by factors such as income, wealth, and expectations of future returns. This theory emphasizes the role of financial markets and the overall savings-investment equilibrium in shaping interest rates.

Core Assumptions of Loanable Funds Theory

The Loanable Funds Theory assumes that the interest rate is determined by the supply and demand for loanable funds, where savers provide funds and borrowers demand them, emphasizing the role of real factors such as savings, investment, and capital accumulation. It presumes perfect competition in the financial markets, with a fixed quantity of loanable funds supplied by households and businesses responding to changes in interest rates. The theory also assumes that funds can freely move across borrowing and lending activities without liquidity constraints, contrasting with the Liquidity Preference Theory which focuses on money supply and demand influencing interest rates.

Overview of Liquidity Preference Theory

Liquidity Preference Theory, proposed by John Maynard Keynes, explains the demand for money based on individuals' preference for liquidity over other assets. It suggests that people hold money for three main motives: transactions, precautionary, and speculative purposes, influencing interest rates by balancing money supply and demand. This theory contrasts with Loanable Funds Theory by focusing on money market equilibrium and emphasizing how interest rates adjust to changes in money demand rather than solely capital supply and demand.

Core Assumptions of Liquidity Preference Theory

Liquidity preference theory centers on the assumption that individuals prefer holding cash for its liquidity, balancing their desire for money against interest rates which represent the opportunity cost. It posits that the demand for money is inversely related to interest rates, with higher rates reducing money demand as individuals shift towards interest-bearing assets. This theory assumes a fixed money supply controlled by the central bank, making interest rates the equilibrium price balancing money demand and supply.

Key Differences Between Loanable Funds and Liquidity Preference

The Loanable Funds theory explains interest rate determination through the supply and demand of saved funds, where savings and investments drive equilibrium. Liquidity Preference theory focuses on money demand and supply influencing interest rates, emphasizing the preference for liquidity versus holding bonds. Key differences include the Loanable Funds theory's focus on real saving and investment markets, while Liquidity Preference centers on the money market and the role of liquidity in interest rate fluctuations.

Implications for Money Supply and Demand

Loanable funds theory explains money supply and demand by focusing on the interaction between borrowers and lenders in the capital market, where interest rates adjust to equilibrate savings and investment. Liquidity preference theory emphasizes money demand as driven by individuals' preference for liquidity, making interest rates the price of holding money versus bonds, thereby influencing money supply control through central bank policies. Understanding these theories helps clarify how monetary policy impacts interest rates and liquidity, shaping overall economic stability and growth.

Interest Rate Determination: Contrasting Perspectives

Loanable funds theory explains interest rate determination through the equilibrium between the supply of savings and the demand for investment funds in financial markets. Liquidity preference theory attributes interest rates to the demand and supply of money, emphasizing liquidity motives and speculative demand for cash balances. These contrasting perspectives highlight that while loanable funds focus on capital market interactions, liquidity preference centers on money market behavior in setting interest rates.

Criticisms and Limitations of Each Theory

The Loanable Funds Theory faces criticism for oversimplifying interest rate determination by primarily focusing on savings and investment, often ignoring the role of money supply and central bank policies. Liquidity Preference Theory is limited by its assumption that individuals' preference for liquidity directly dictates interest rates, which may not fully account for factors such as fiscal policy or expectations about future economic conditions. Both theories struggle to incorporate the complexities of modern financial markets, including the influence of international capital flows and credit creation by banks.

Conclusion: Relevance in Modern Economics

Loanable funds theory emphasizes the supply and demand for savings as the primary determinant of interest rates, while liquidity preference theory focuses on the demand for money balances and liquidity's role. Modern economics integrates both theories to explain interest rate fluctuations, recognizing that financial markets are influenced by savings behavior and liquidity preferences simultaneously. This combined approach enhances the understanding of monetary policy impacts and financial market dynamics in contemporary economies.

Loanable funds theory Infographic

libterm.com

libterm.com