Quasi-hyperbolic discounting models how people disproportionately prefer immediate rewards over future gains, reflecting inconsistent time preferences. This concept explains why Your decisions might favor short-term gratification despite long-term benefits. Explore the rest of the article to understand how this cognitive bias shapes economic behavior and decision-making.

Table of Comparison

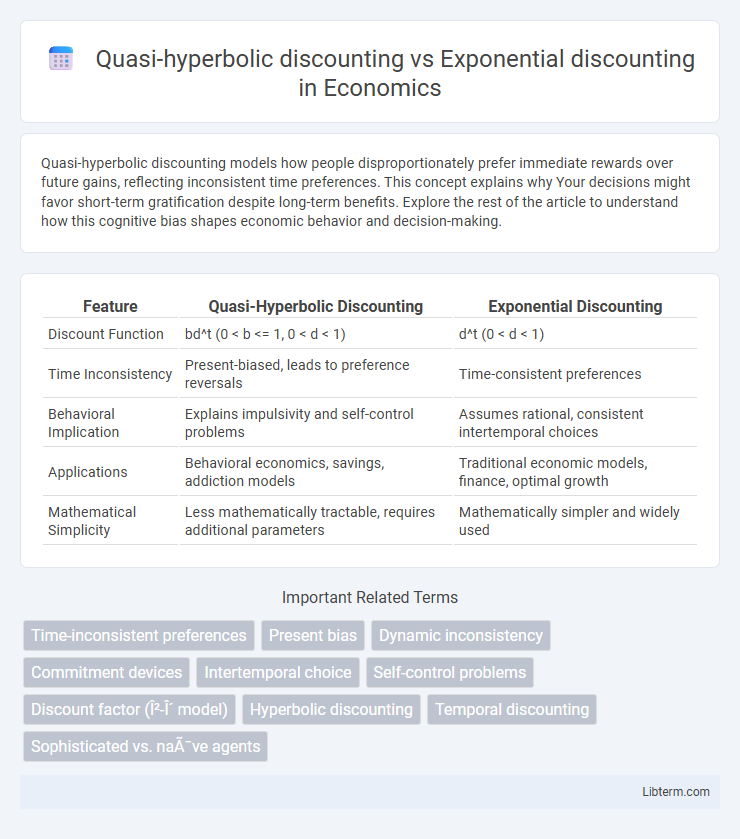

| Feature | Quasi-Hyperbolic Discounting | Exponential Discounting |

|---|---|---|

| Discount Function | bd^t (0 < b <= 1, 0 < d < 1) | d^t (0 < d < 1) |

| Time Inconsistency | Present-biased, leads to preference reversals | Time-consistent preferences |

| Behavioral Implication | Explains impulsivity and self-control problems | Assumes rational, consistent intertemporal choices |

| Applications | Behavioral economics, savings, addiction models | Traditional economic models, finance, optimal growth |

| Mathematical Simplicity | Less mathematically tractable, requires additional parameters | Mathematically simpler and widely used |

Introduction to Time Discounting Models

Time discounting models evaluate how individuals value rewards at different points in time, with exponential discounting assuming a constant discount rate leading to consistent preferences over time. Quasi-hyperbolic discounting captures present bias by applying a separate discount factor for immediate versus future rewards, explaining preference reversals. These models are essential in behavioral economics to analyze decision-making inconsistencies in intertemporal choice.

Understanding Exponential Discounting

Exponential discounting models time preferences by applying a consistent discount rate to future rewards, reflecting a constant rate of impatience over time. This approach assumes individuals evaluate delayed outcomes by multiplying rewards by a factor exponentially decreasing with delay, ensuring dynamic consistency in decision-making. Understanding exponential discounting is crucial for economic theories and behavioral models that predict choices involving time trade-offs and intertemporal consumption.

Exploring Quasi-Hyperbolic Discounting

Quasi-hyperbolic discounting captures the tendency for individuals to disproportionately value immediate rewards compared to future ones, leading to time-inconsistent preferences and impulsive decision-making. This behavioral model introduces a present-bias parameter, differentiating it from exponential discounting, which assumes a constant discount rate over time and consistent intertemporal choices. Understanding quasi-hyperbolic discounting is essential for designing policies and interventions that address procrastination, addiction, and savings behavior by accounting for humans' inherent present bias.

Mathematical Formulations Compared

Quasi-hyperbolic discounting is mathematically formulated as \( U_t = u_t + \beta \sum_{s=t+1}^\infty \delta^{s-t} u_s \), where \( \beta \) captures present-bias and \( \delta \) represents the long-term discount factor, contrasting with exponential discounting \( U_t = \sum_{s=t}^\infty \delta^{s-t} u_s \), which assumes a constant discount rate without present-bias. The quasi-hyperbolic model introduces time-inconsistency by weighting immediate utility differently through \( \beta \), while exponential discounting maintains time-consistency by applying a constant factor \( \delta \) through all future periods. These differences highlight quasi-hyperbolic discounting's ability to better model behavioral anomalies like procrastination and self-control problems, unlike the time-consistent exponential model.

Real-world Applications and Implications

Quasi-hyperbolic discounting better captures human behavior in real-world settings such as retirement saving, addiction treatment, and consumer finance by reflecting present-biased preferences and impulsivity. Exponential discounting, often used in economic models, assumes consistent time preferences, which can underestimate short-term biases observed in decision-making involving delayed rewards. Understanding the distinction informs policy design for commitment devices, behavioral interventions, and incentive structures to improve long-term planning and self-control outcomes.

Behavioral Evidence Supporting Each Model

Behavioral evidence supports quasi-hyperbolic discounting by demonstrating present-bias preferences, where individuals disproportionately prefer immediate rewards over future ones, as seen in choices involving impulsive consumption or procrastination. Exponential discounting aligns with experimental findings of consistent time preferences and stable discount rates over time, often observed in long-term financial decisions and intertemporal choices with delayed outcomes. Studies comparing both models reveal quasi-hyperbolic discounting better explains short-term impulsivity, while exponential discounting captures rational, time-consistent valuation in economic behavior.

Strengths and Limitations of Exponential Discounting

Exponential discounting provides a mathematically consistent model for valuing future rewards by applying a constant discount rate, ensuring time-consistent preferences and straightforward predictions in economic and financial decision-making. Its strength lies in simplifying dynamic optimization problems and enabling tractable models in intertemporal choice contexts. However, exponential discounting fails to capture observed human behaviors such as present-bias and preference reversals, limiting its descriptive accuracy in real-world scenarios where individuals disproportionately favor immediate rewards.

Strengths and Limitations of Quasi-Hyperbolic Discounting

Quasi-hyperbolic discounting captures present-bias by assigning disproportionate weight to immediate rewards, accurately reflecting short-term impulsivity and procrastination behaviors observed in empirical studies. Its strength lies in modeling time-inconsistent preferences, which exponential discounting fails to represent due to its constant discount rate assumption. However, quasi-hyperbolic discounting oversimplifies future discounting by applying a single immediacy parameter, limiting its ability to depict complex intertemporal choices over longer horizons.

Policy and Economic Impacts

Quasi-hyperbolic discounting, characterized by present-bias and declining impatience over time, significantly influences policy design by addressing short-term decision-making inconsistencies, such as savings behavior and addiction control, unlike exponential discounting which assumes consistent time preferences and simplifies long-term cost-benefit analyses. Policy frameworks incorporating quasi-hyperbolic models promote commitment devices and default options to mitigate procrastination and enhance welfare, reflecting more realistic human behavior in economic forecasting and social welfare programs. Economic impacts include more accurate predictions of consumer behavior and improved effectiveness of interventions aimed at promoting sustainable growth and fiscal responsibility.

Summary and Future Directions

Quasi-hyperbolic discounting captures present bias by weighting immediate rewards more heavily than future ones, contrasting with exponential discounting's constant rate of decline over time. This model better explains observed deviations in human intertemporal choice, such as procrastination and impulsivity, by incorporating a parameter that sharpens near-term preferences. Future research should integrate neuroeconomic data and explore personalized discount functions to improve predictive accuracy in behavioral economics and develop tailored interventions for time-inconsistent behaviors.

Quasi-hyperbolic discounting Infographic

libterm.com

libterm.com