A Tobin tax imposes a small levy on currency transactions to reduce market volatility and deter speculative trading. This fiscal policy tool aims to stabilize exchange rates and generate revenue for public goods without hindering genuine trade. Explore the article to understand how a Tobin tax could impact global finance and your investments.

Table of Comparison

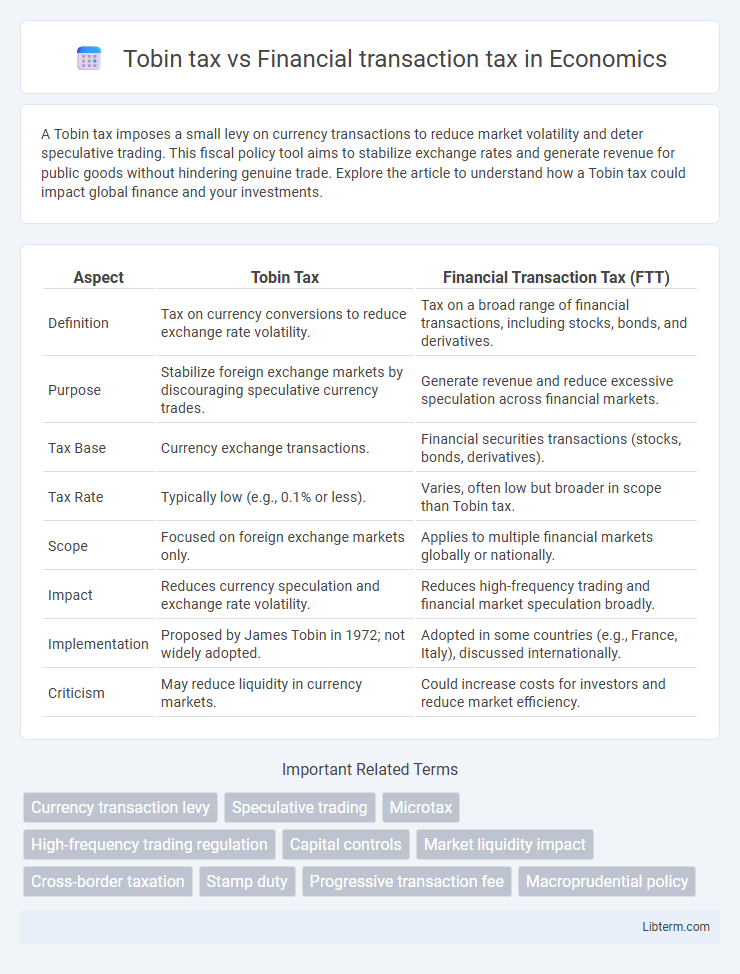

| Aspect | Tobin Tax | Financial Transaction Tax (FTT) |

|---|---|---|

| Definition | Tax on currency conversions to reduce exchange rate volatility. | Tax on a broad range of financial transactions, including stocks, bonds, and derivatives. |

| Purpose | Stabilize foreign exchange markets by discouraging speculative currency trades. | Generate revenue and reduce excessive speculation across financial markets. |

| Tax Base | Currency exchange transactions. | Financial securities transactions (stocks, bonds, derivatives). |

| Tax Rate | Typically low (e.g., 0.1% or less). | Varies, often low but broader in scope than Tobin tax. |

| Scope | Focused on foreign exchange markets only. | Applies to multiple financial markets globally or nationally. |

| Impact | Reduces currency speculation and exchange rate volatility. | Reduces high-frequency trading and financial market speculation broadly. |

| Implementation | Proposed by James Tobin in 1972; not widely adopted. | Adopted in some countries (e.g., France, Italy), discussed internationally. |

| Criticism | May reduce liquidity in currency markets. | Could increase costs for investors and reduce market efficiency. |

Introduction to Tobin Tax and Financial Transaction Tax

The Tobin tax, proposed by economist James Tobin in 1972, aims to reduce currency speculation by imposing a small levy on foreign exchange transactions. The Financial Transaction Tax (FTT) is a broader tax applied to various financial asset trades, including stocks, bonds, and derivatives, designed to curb excessive trading and generate revenue. While both taxes target financial market activities, the Tobin tax specifically focuses on stabilizing foreign exchange markets, whereas the FTT addresses a wider range of financial transactions.

Historical Background and Evolution

The Tobin tax, proposed by economist James Tobin in 1972, was designed to curb currency speculation by imposing a small levy on foreign exchange transactions, aiming to stabilize volatile currency markets. The Financial Transaction Tax (FTT) concept evolved later with broader application, targeting various types of financial instruments including stocks, bonds, and derivatives to reduce market volatility and generate public revenue. Over decades, the FTT has been considered and implemented in various forms across countries, reflecting ongoing debates on market regulation and financial stability.

Key Definitions: Tobin Tax vs Financial Transaction Tax

The Tobin Tax is a specific type of financial transaction tax aimed at curbing short-term currency speculation by levying a small charge on foreign exchange transactions. Financial Transaction Tax (FTT) is a broader concept that applies to various types of financial trades, including stocks, bonds, derivatives, and currencies, designed to reduce market volatility and generate public revenue. While the Tobin Tax targets currency markets exclusively, the FTT encompasses multiple asset classes and transaction types within financial markets.

Objectives and Intended Outcomes

The Tobin tax targets currency transactions to reduce exchange rate volatility and discourage speculative trading, aiming to stabilize international financial markets. The Financial Transaction Tax (FTT) applies broadly to various financial instruments like stocks, bonds, and derivatives, seeking to generate government revenue and curb excessive short-term trading activities. Both taxes intend to enhance market stability but differ in their scope and primary policy objectives.

Mechanisms and Implementation

The Tobin tax targets currency exchange transactions to reduce exchange rate volatility by imposing a small levy on foreign exchange trades, primarily aimed at short-term speculative flows. In contrast, the Financial Transaction Tax (FTT) applies broadly to various financial assets including stocks, bonds, and derivatives, designed to curb excessive trading and generate revenue. Implementation of the Tobin tax typically requires coordinated international agreements to be effective, while FTTs can be adopted at national or regional levels, with mechanisms involving automated tax collection systems integrated into trading platforms.

Scope: Covered Assets and Markets

The Tobin tax targets currency exchanges exclusively, aiming to reduce volatility in foreign exchange markets by applying a small levy on international currency transactions. In contrast, the Financial Transaction Tax (FTT) encompasses a broader range of assets, including stocks, bonds, derivatives, and other financial instruments across multiple markets. The wider scope of FTT allows it to impact equity markets, debt markets, and derivatives trading, whereas the Tobin tax is narrowly focused on foreign exchange transactions only.

Economic Impacts and Market Reactions

The Tobin tax, originally proposed to curb currency speculation, targets foreign exchange transactions and aims to reduce market volatility and currency crises, potentially stabilizing international markets but limiting short-term speculation liquidity. Financial transaction taxes (FTTs) apply broadly across various asset trades, such as stocks, bonds, and derivatives, generating government revenue while potentially increasing transaction costs, reducing trading volume, and affecting market liquidity. Empirical studies suggest both taxes can dampen excessive speculation but may also lead to adverse effects like market fragmentation, increased bid-ask spreads, and migration of trading activities to untaxed venues, impacting overall market efficiency and economic growth.

Criticisms and Challenges in Adoption

The Tobin tax faces criticism for potentially reducing market liquidity and causing distortions in currency markets, while the Financial Transaction Tax (FTT) often encounters challenges related to implementation complexity and cross-border regulatory coordination. Both taxes struggle with concerns over economic impacts, such as increased trading costs leading to lower market efficiency or evasion strategies through offshore trading hubs. Adoption is hindered by resistance from financial institutions and governments wary of losing competitiveness in the global financial system.

Case Studies and Global Examples

The Tobin tax, originally proposed to curb currency speculation, has been piloted in small-scale experiments like Sweden's 1980s securities transactions tax, which led to a decline in trading volume and market liquidity. In contrast, the Financial Transaction Tax (FTT) has been implemented in broader contexts, such as the European Union's partial FTT adopted by France and Italy, resulting in billions of euros in revenue without significant market disruption. Case studies from South Korea's FTT demonstrate reduced excessive short-term trading while maintaining market stability, highlighting varying impacts depending on tax design and economic environment.

Future Prospects and Policy Considerations

The Tobin tax, primarily targeting currency exchange to reduce speculative short-term trading, faces challenges in global coordination and enforcement but holds potential for stabilizing foreign exchange markets if widely adopted. Financial transaction taxes (FTTs) apply to a broader range of asset trades and may generate significant public revenue while influencing market liquidity and volatility, prompting policymakers to balance revenue goals against potential market distortions. Future prospects depend on international consensus, technological advancements in transaction monitoring, and evolving regulatory frameworks to optimize effectiveness and minimize unintended economic impacts.

Tobin tax Infographic

libterm.com

libterm.com