A Bertrand competitor typically operates in a market where firms compete by setting prices rather than quantities, leading to price wars that drive prices down to marginal cost. This competitive model highlights how pricing strategies directly impact market equilibrium and profitability. Discover how understanding Bertrand competition can optimize your pricing approach by reading the full article.

Table of Comparison

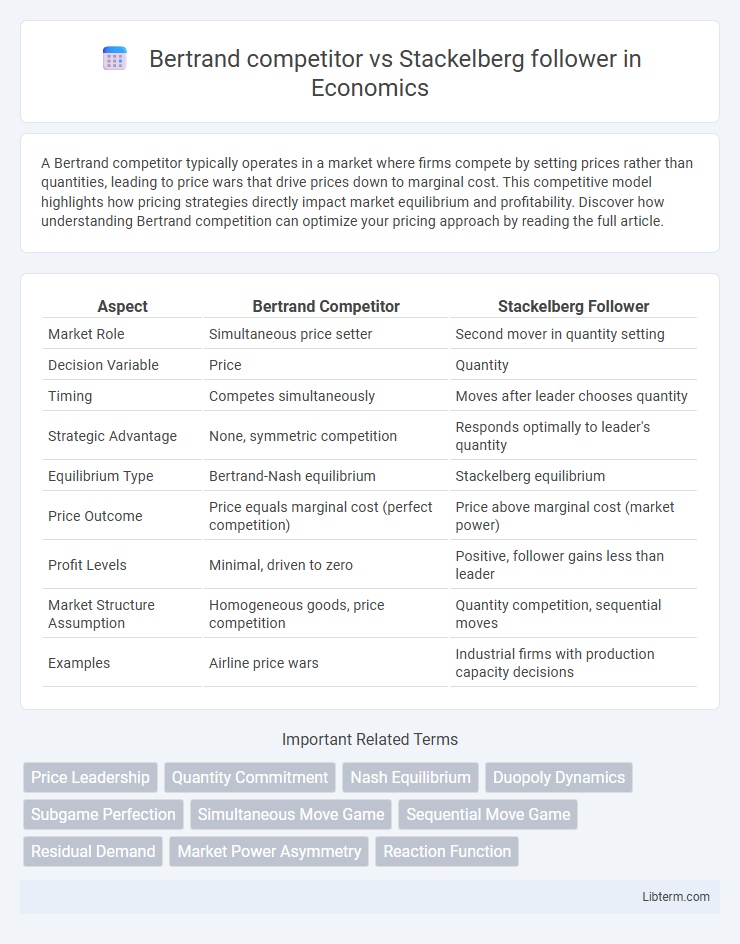

| Aspect | Bertrand Competitor | Stackelberg Follower |

|---|---|---|

| Market Role | Simultaneous price setter | Second mover in quantity setting |

| Decision Variable | Price | Quantity |

| Timing | Competes simultaneously | Moves after leader chooses quantity |

| Strategic Advantage | None, symmetric competition | Responds optimally to leader's quantity |

| Equilibrium Type | Bertrand-Nash equilibrium | Stackelberg equilibrium |

| Price Outcome | Price equals marginal cost (perfect competition) | Price above marginal cost (market power) |

| Profit Levels | Minimal, driven to zero | Positive, follower gains less than leader |

| Market Structure Assumption | Homogeneous goods, price competition | Quantity competition, sequential moves |

| Examples | Airline price wars | Industrial firms with production capacity decisions |

Introduction: Bertrand and Stackelberg Competition Overview

Bertrand competition models firms competing on price, where each firm assumes rivals' prices are fixed and aims to undercut to capture market share, often leading to prices approaching marginal cost. In contrast, Stackelberg competition involves a leader-follower dynamic, where the leader firm moves first by setting quantity, and the follower optimizes its output based on the leader's decision, resulting in different strategic advantages. These models illustrate distinct strategic interactions in oligopolistic markets, influencing pricing and output decisions under varying assumptions of firm behavior and market structure.

Key Concepts: Bertrand Competitor and Stackelberg Follower

Bertrand competitors engage in price competition by simultaneously choosing prices, assuming the rival's price as given, leading to equilibrium at marginal cost under homogeneous products. Stackelberg followers, in contrast, observe the leader's quantity choice before deciding their own, resulting in sequential quantity competition with the leader having a strategic advantage. The key difference lies in timing and strategic variables: Bertrand models focus on price-setting in simultaneous moves, while Stackelberg models emphasize quantity-setting with sequential moves.

Market Assumptions: Price vs Quantity Leadership

Bertrand competition assumes firms compete by setting prices simultaneously, leading to outcomes where products are perfect substitutes and price equals marginal cost in equilibrium. Stackelberg competition models sequential quantity-setting, with the leader firm committing to output first and the follower adjusting thereafter, creating strategic output advantages. Market assumptions differ as Bertrand emphasizes price rivalry under homogeneous products, while Stackelberg focuses on quantity leadership with capacity commitment influencing market power and equilibrium outcomes.

Strategic Decision-Making: Simultaneous vs Sequential Moves

In the Bertrand model, competitors simultaneously set prices to capture market share, leading to price competition that typically drives prices down to marginal cost. In contrast, the Stackelberg model features sequential moves where the leader firm commits to a quantity first, influencing the follower's output decision and allowing the leader to achieve a strategic advantage. This sequential decision-making in Stackelberg equilibrium results in different market outcomes compared to the simultaneous pricing strategies in Bertrand competition.

Equilibrium Outcomes: Price and Quantity Determination

Bertrand competitors set prices simultaneously, resulting in an equilibrium where prices equal marginal cost and quantity is maximized, leading to zero economic profits. In contrast, the Stackelberg follower reacts to the leader's quantity choice, producing a lower quantity and facing a higher price than the Bertrand equilibrium. The Stackelberg model yields a subgame perfect equilibrium where the leader secures a strategic advantage, influencing total output and market prices differently than in Bertrand competition.

Profitability: Bertrand Competitor vs Stackelberg Follower

The Stackelberg follower generally achieves lower profitability compared to the Bertrand competitor when firms compete on quantity and price, respectively, due to the follower's reactive position in the market hierarchy. Bertrand competitors drive prices down to marginal cost, potentially eroding profits, but can still secure higher returns if product differentiation or capacity constraints exist. The Stackelberg follower's profit is constrained by the leader's strategic quantity choice, often resulting in a profit disadvantage relative to the Bertrand competitor's more dynamic pricing strategy.

Consumer Welfare and Market Efficiency Comparison

Bertrand competition typically results in lower prices and higher consumer welfare due to firms pricing at marginal cost, enhancing market efficiency by eliminating economic profits. In contrast, Stackelberg followers, acting after leaders, often face higher prices and reduced consumer surplus because leaders exploit first-mover advantage, leading to less efficient market outcomes. Empirical studies show Bertrand competition aligns closer to perfect competition, while Stackelberg models reveal strategic firm behavior that compromises allocative efficiency.

Impacts of Market Entry and Barriers

Bertrand competitors aggressively undercut prices to capture market share, intensifying price competition and lowering profits, which can heighten barriers to entry for new firms due to the risk of predatory pricing. In contrast, Stackelberg followers accept the leader's output decision, resulting in less aggressive pricing and providing more stable market conditions that may reduce entry barriers. Market entry is often deterred more in Bertrand settings because firms must withstand immediate price wars, whereas Stackelberg competition allows entrants to anticipate leader reactions and adjust strategies accordingly.

Real-World Applications and Industry Examples

Bertrand competition models markets where firms compete on price, commonly seen in highly competitive retail sectors like airlines and electronics where price wars drive consumer choice. Stackelberg followers, as part of sequential game theory, appear in industries such as automotive manufacturing or energy markets, where a leader firm sets output first and followers adjust, influencing supply chain dynamics and market equilibrium. Understanding these frameworks helps firms strategize in dynamic pricing and production decisions, optimizing market position in oligopolistic environments.

Conclusion: Strategic Implications for Firms

Bertrand competitors prioritize price-setting simultaneously, leading to aggressive price competition and often lower market prices, while Stackelberg followers react to the leader's quantity decisions, enabling the leader to secure a strategic advantage by committing first. Firms positioned as Stackelberg leaders can leverage first-mover advantage to influence market outcomes and enhance profits, whereas Bertrand competitors face intense rivalry that compresses margins. Understanding these dynamics allows firms to tailor competitive strategies, optimize market positioning, and anticipate rival behaviors effectively in oligopolistic markets.

Bertrand competitor Infographic

libterm.com

libterm.com