Consumer surplus represents the difference between what consumers are willing to pay for a good or service and the actual price they pay, highlighting the extra value or benefit they receive. Understanding consumer surplus helps businesses optimize pricing strategies and enhances customer satisfaction by aligning prices with perceived value. Discover how grasping consumer surplus can improve your economic decisions and business outcomes in the rest of this article.

Table of Comparison

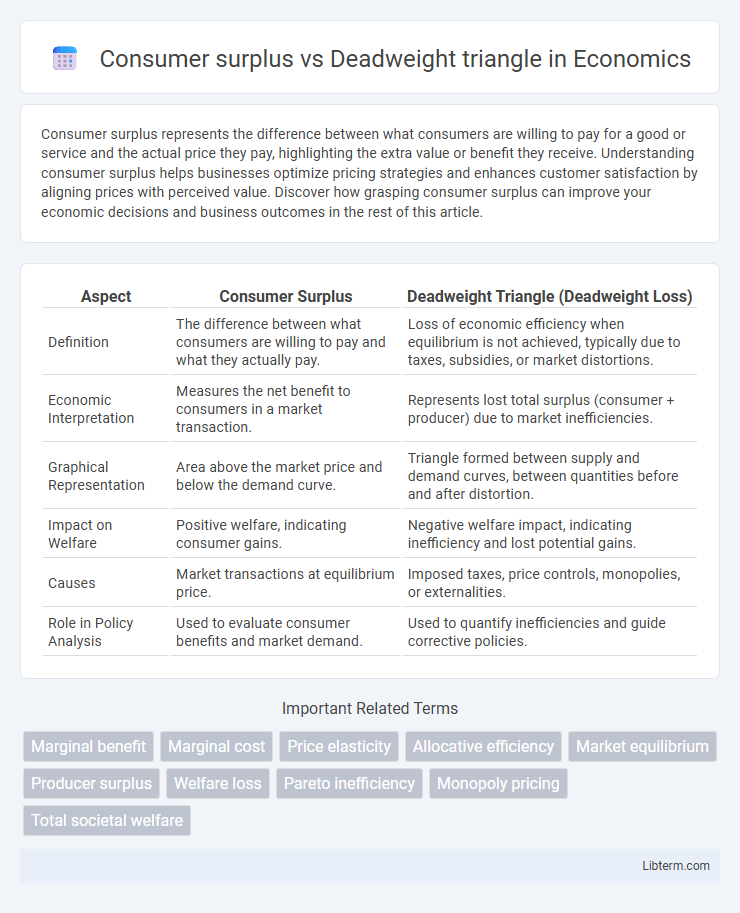

| Aspect | Consumer Surplus | Deadweight Triangle (Deadweight Loss) |

|---|---|---|

| Definition | The difference between what consumers are willing to pay and what they actually pay. | Loss of economic efficiency when equilibrium is not achieved, typically due to taxes, subsidies, or market distortions. |

| Economic Interpretation | Measures the net benefit to consumers in a market transaction. | Represents lost total surplus (consumer + producer) due to market inefficiencies. |

| Graphical Representation | Area above the market price and below the demand curve. | Triangle formed between supply and demand curves, between quantities before and after distortion. |

| Impact on Welfare | Positive welfare, indicating consumer gains. | Negative welfare impact, indicating inefficiency and lost potential gains. |

| Causes | Market transactions at equilibrium price. | Imposed taxes, price controls, monopolies, or externalities. |

| Role in Policy Analysis | Used to evaluate consumer benefits and market demand. | Used to quantify inefficiencies and guide corrective policies. |

Understanding Consumer Surplus

Consumer surplus represents the difference between what consumers are willing to pay and the actual market price, reflecting the net benefit to buyers. The deadweight triangle illustrates the loss of total surplus due to market inefficiencies like taxes or price floors, where both consumer and producer surplus decrease. Understanding consumer surplus helps quantify how much value consumers gain from transactions before market distortions reduce overall welfare.

Defining Deadweight Triangle

Deadweight triangle represents the loss of economic efficiency when market equilibrium is not achieved, such as through taxes, price floors, or monopolies. Consumer surplus quantifies the difference between consumers' willingness to pay and the actual market price, while deadweight triangle highlights the reduction in total surplus caused by market distortions. This graphical area signifies lost gains from trade where neither consumers nor producers benefit, illustrating inefficiency in resource allocation.

Key Differences Between Consumer Surplus and Deadweight Triangle

Consumer surplus represents the difference between what consumers are willing to pay and what they actually pay, reflecting the net benefit to buyers in market transactions. The deadweight triangle, also known as deadweight loss, measures the loss in total surplus due to market inefficiencies such as taxes, price controls, or monopolies, indicating a reduction in overall economic welfare. Key differences lie in their focus on benefits versus losses: consumer surplus captures gains to consumers, while the deadweight triangle quantifies losses to both consumers and producers caused by market distortions.

Origins of Consumer Surplus in Market Transactions

Consumer surplus originates from the difference between what consumers are willing to pay and what they actually pay in market transactions, reflecting the net benefit to buyers. Deadweight loss, often visualized as a triangle on supply and demand graphs, arises when market distortions such as taxes or price controls prevent transactions that would create consumer surplus. Understanding the interaction between consumer surplus and deadweight triangles highlights the efficiency losses and welfare impacts caused by market interventions.

Causes and Consequences of Deadweight Loss

Deadweight loss occurs when market efficiency is compromised due to factors such as taxes, subsidies, price ceilings, or floors that prevent equilibrium between supply and demand. This inefficiency reduces consumer surplus and producer surplus, creating a deadweight triangle that represents lost economic value. The consequences include decreased total welfare, misallocation of resources, and reduced incentives for market participants, leading to suboptimal production and consumption levels.

Price Changes: Impact on Consumer Surplus vs Deadweight Loss

Price changes directly affect consumer surplus by altering the difference between what consumers are willing to pay and the market price, with a price drop increasing consumer surplus and a price increase reducing it. Deadweight loss, represented by the deadweight triangle, measures the loss of total surplus due to market inefficiencies, such as taxes or price controls, which prevent mutually beneficial trades. When prices deviate from equilibrium, consumer surplus and producer surplus shrink, creating a deadweight loss that reflects the potential gains lost to society.

Graphical Representation: Consumer Surplus and Deadweight Triangle

Consumer surplus is represented graphically as the area between the demand curve and the market price level, illustrating the benefit consumers receive from purchasing a product at a lower price than their maximum willingness to pay. The deadweight triangle, or deadweight loss, appears as a triangular area formed between the supply and demand curves when market inefficiencies such as taxes, price floors, or ceilings disrupt equilibrium, indicating lost total surplus. Both areas are crucial in welfare economics, highlighting the effects of market interventions on consumer benefits and overall economic efficiency.

Market Efficiency and Welfare Implications

Consumer surplus quantifies the benefit consumers receive when they pay less than their maximum willingness to pay, serving as a key indicator of market efficiency and consumer welfare. Deadweight loss, represented by the deadweight triangle, illustrates the loss in total surplus due to market distortions such as price controls or taxes, highlighting inefficiency and reduced welfare. Analyzing the balance between consumer surplus and deadweight loss is essential for understanding how policies impact overall market efficiency and economic well-being.

Real-World Examples: Taxation, Subsidies, and Market Regulation

Consumer surplus measures the benefit consumers receive when they pay less than their maximum willingness to pay, while the deadweight triangle represents the loss of total surplus due to market distortions like taxation or subsidies. For example, imposing a tax on gasoline reduces consumer surplus by increasing prices and creates a deadweight loss by decreasing the quantity consumed below the efficient equilibrium. Similarly, subsidies for renewable energy increase consumer surplus by lowering prices but can cause inefficiencies reflected by a deadweight triangle, highlighting the trade-offs in market regulation policies.

Maximizing Surplus and Minimizing Deadweight Loss

Maximizing consumer surplus involves setting prices below the equilibrium to increase the quantity demanded, thereby enhancing overall welfare. Deadweight triangle represents lost economic efficiency due to market distortions like taxes or price controls that reduce trade volume below equilibrium. Minimizing deadweight loss requires policies that maintain market equilibrium and optimize the allocation of resources without restricting consumer or producer benefits.

Consumer surplus Infographic

libterm.com

libterm.com