Cyclical unemployment occurs when economic downturns reduce demand for goods and services, leading businesses to cut jobs. This type of unemployment fluctuates with the economy's health, rising during recessions and falling in periods of growth. Discover how understanding cyclical unemployment can help you navigate job market challenges by reading the rest of the article.

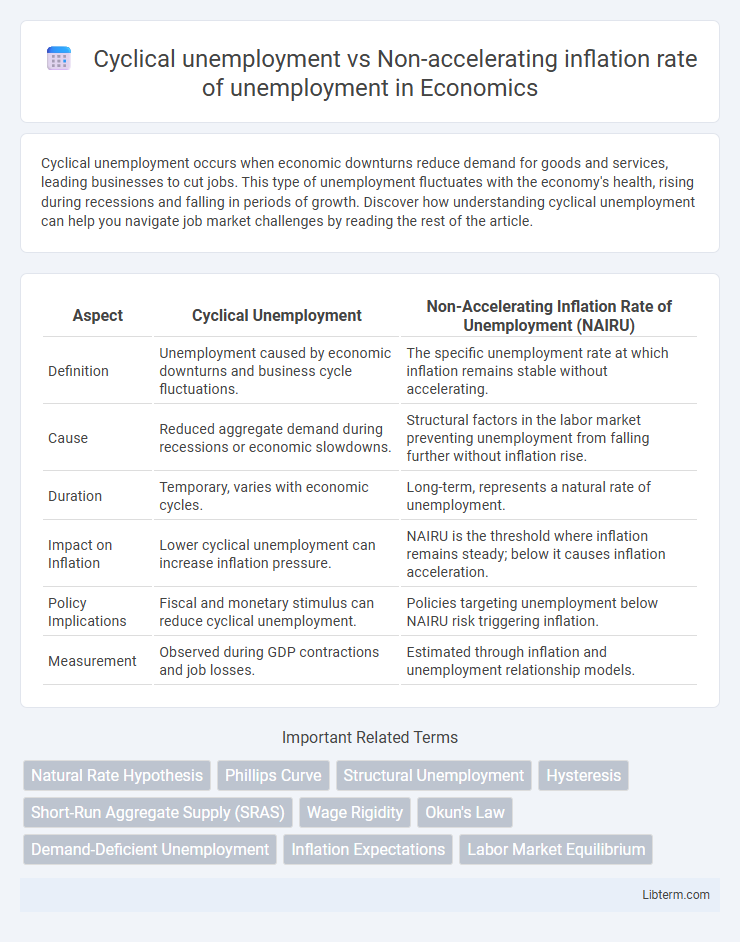

Table of Comparison

| Aspect | Cyclical Unemployment | Non-Accelerating Inflation Rate of Unemployment (NAIRU) |

|---|---|---|

| Definition | Unemployment caused by economic downturns and business cycle fluctuations. | The specific unemployment rate at which inflation remains stable without accelerating. |

| Cause | Reduced aggregate demand during recessions or economic slowdowns. | Structural factors in the labor market preventing unemployment from falling further without inflation rise. |

| Duration | Temporary, varies with economic cycles. | Long-term, represents a natural rate of unemployment. |

| Impact on Inflation | Lower cyclical unemployment can increase inflation pressure. | NAIRU is the threshold where inflation remains steady; below it causes inflation acceleration. |

| Policy Implications | Fiscal and monetary stimulus can reduce cyclical unemployment. | Policies targeting unemployment below NAIRU risk triggering inflation. |

| Measurement | Observed during GDP contractions and job losses. | Estimated through inflation and unemployment relationship models. |

Introduction to Cyclical Unemployment and NAIRU

Cyclical unemployment arises from fluctuations in the business cycle, increasing during economic downturns and decreasing in periods of expansion. The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents the specific unemployment rate at which inflation remains stable, neither accelerating nor decelerating. Understanding the interaction between cyclical unemployment and NAIRU is crucial for policymakers aiming to balance economic growth and inflation control.

Defining Cyclical Unemployment

Cyclical unemployment occurs when there is a decline in total demand for goods and services, leading to reduced production and labor layoffs during economic downturns. It fluctuates with the business cycle, increasing in recessions and decreasing in expansions. Unlike the non-accelerating inflation rate of unemployment (NAIRU), which reflects the unemployment level consistent with stable inflation, cyclical unemployment represents deviations from this equilibrium caused by short-term economic shocks.

Understanding Non-Accelerating Inflation Rate of Unemployment (NAIRU)

The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents the specific unemployment level at which inflation remains stable, balancing job vacancies and labor market tightness without triggering wage-driven inflationary pressures. Unlike cyclical unemployment, which fluctuates with economic expansions and recessions, NAIRU reflects structural aspects of the labor market where unemployment cannot fall below a certain threshold without accelerating inflation. Policymakers use NAIRU to gauge sustainable employment levels and to guide monetary policy aimed at maintaining price stability.

Key Differences Between Cyclical Unemployment and NAIRU

Cyclical unemployment fluctuates with the business cycle, rising during recessions and falling in expansions, reflecting insufficient aggregate demand. The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents a stable unemployment rate where inflation pressure neither accelerates nor decelerates. Key differences include cyclical unemployment's direct link to economic downturns, while NAIRU is a theoretical benchmark guiding monetary policy to maintain stable inflation.

Economic Impacts of Cyclical Unemployment

Cyclical unemployment arises from fluctuations in the business cycle, leading to reduced demand for labor during recessions and negatively affecting overall economic output and income levels. This drop in employment causes lower consumer spending, which can further depress economic growth and increase government expenditures on social welfare programs. Unlike the Non-Accelerating Inflation Rate of Unemployment (NAIRU), which represents a stable inflation-unemployment equilibrium, cyclical unemployment directly reflects the economy's volatile performance and demand shocks.

The Role of NAIRU in Inflation Control

The Non-Accelerating Inflation Rate of Unemployment (NAIRU) represents the specific unemployment level at which inflation remains stable, playing a critical role in macroeconomic policy to control inflationary pressures. Cyclical unemployment fluctuates around the NAIRU, increasing during economic downturns and decreasing during booms, reflecting demand-driven changes rather than structural factors. Policymakers use the NAIRU to identify the unemployment threshold that avoids accelerating inflation, aiming to balance economic growth and price stability.

Measurement Challenges of Cyclical Unemployment and NAIRU

Measuring cyclical unemployment faces challenges due to its reliance on distinguishing short-term economic fluctuations from structural labor market changes, often complicated by data lags and seasonal adjustments. The Non-Accelerating Inflation Rate of Unemployment (NAIRU) presents difficulties because it is an unobservable, theoretical construct estimated through imperfect econometric models subject to revision and influenced by changing labor market dynamics. Both concepts require careful interpretation of unemployment data since misestimations can lead to ineffective monetary and fiscal policies aimed at stabilizing employment and controlling inflation.

Policy Responses to Cyclical Unemployment and NAIRU

Policy responses to cyclical unemployment primarily involve expansionary fiscal and monetary measures to stimulate aggregate demand and reduce joblessness during economic downturns. Targeting the Non-Accelerating Inflation Rate of Unemployment (NAIRU) helps policymakers balance unemployment and inflation by avoiding demand-driven wage pressures that can accelerate inflation. Central banks adjust interest rates while governments implement stimulus spending programs to maintain unemployment near NAIRU without triggering inflationary spirals.

Real-World Examples and Case Studies

Cyclical unemployment, exemplified by the 2008 global financial crisis, surged as demand plummeted, leading to widespread job losses in industries like manufacturing and construction. In contrast, the non-accelerating inflation rate of unemployment (NAIRU) represents the equilibrium unemployment level where inflation remains stable, illustrated by the U.S. economy during the late 1990s when unemployment hovered around 4-5% without triggering inflation spikes. Case studies from Japan during the 1990s show persistent cyclical unemployment struggles despite low inflation, highlighting the complex relationship between NAIRU and economic cycles.

Conclusion: Linking Cyclical Unemployment and NAIRU in Economic Policy

Cyclical unemployment reflects fluctuations in economic activity and directly influences deviations from the Non-Accelerating Inflation Rate of Unemployment (NAIRU), with rates above NAIRU indicating downward economic pressure and rising cyclical unemployment. Economic policies targeting reduction in cyclical unemployment must balance stimulating demand without pushing unemployment below NAIRU, which risks accelerating inflation. Effective policy design requires monitoring cyclical trends and NAIRU estimates to maintain stable inflation while minimizing unemployment.

Cyclical unemployment Infographic

libterm.com

libterm.com