Currency ratio measures the proportion of physical cash compared to total money supply within an economy, reflecting liquidity preferences. Understanding this ratio helps you evaluate economic stability and potential inflationary pressures. Explore the full article to learn how currency ratio impacts financial decisions and market dynamics.

Table of Comparison

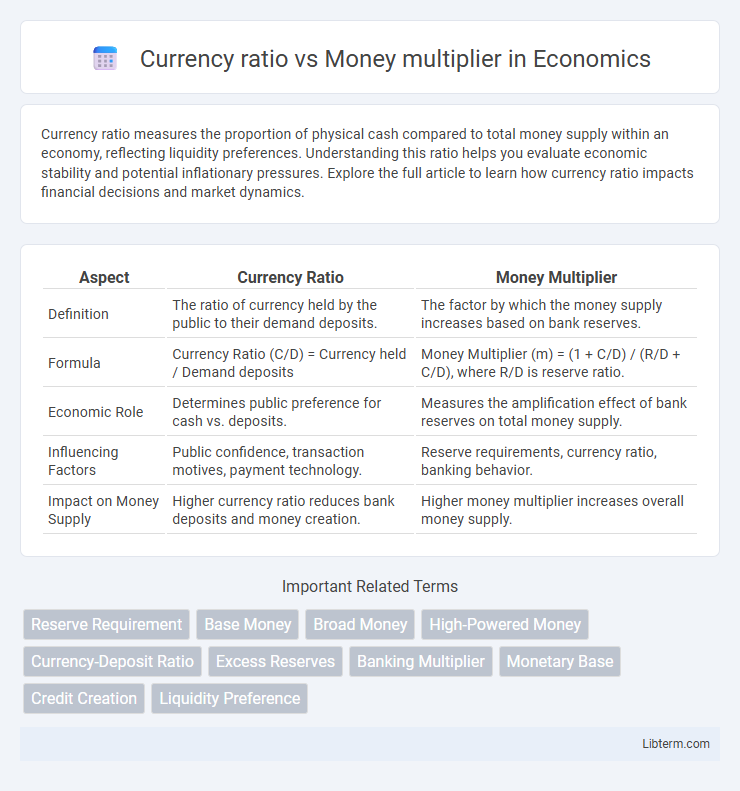

| Aspect | Currency Ratio | Money Multiplier |

|---|---|---|

| Definition | The ratio of currency held by the public to their demand deposits. | The factor by which the money supply increases based on bank reserves. |

| Formula | Currency Ratio (C/D) = Currency held / Demand deposits | Money Multiplier (m) = (1 + C/D) / (R/D + C/D), where R/D is reserve ratio. |

| Economic Role | Determines public preference for cash vs. deposits. | Measures the amplification effect of bank reserves on total money supply. |

| Influencing Factors | Public confidence, transaction motives, payment technology. | Reserve requirements, currency ratio, banking behavior. |

| Impact on Money Supply | Higher currency ratio reduces bank deposits and money creation. | Higher money multiplier increases overall money supply. |

Understanding the Currency Ratio

The currency ratio represents the public's preference for holding cash relative to deposits, significantly influencing the money supply process in an economy. A higher currency ratio reduces the money multiplier because more currency is held outside banks, limiting the amount of deposits that can be used for lending. Understanding the currency ratio is crucial for central banks to accurately predict money creation and implement effective monetary policies.

Defining the Money Multiplier

The money multiplier measures the maximum amount of money the banking system can create from a given level of reserves, calculated as the reciprocal of the reserve ratio. Currency ratio, defined as the proportion of currency households hold relative to deposits, influences the money multiplier by altering the base money available for banks to lend. Higher currency ratios reduce the money multiplier effect by increasing currency holdings outside the banking system, limiting deposit expansion.

Relationship Between Currency Ratio and Money Multiplier

The currency ratio, defined as the public's preference for holding cash relative to deposits, inversely affects the money multiplier, which measures the total money supply created per unit of reserves. A higher currency ratio reduces the money multiplier because more cash withdrawals diminish the deposits banks can use to create loans. Changes in the currency ratio directly influence the effectiveness of monetary policy by altering the banking system's ability to expand the money supply.

Factors Influencing the Currency Ratio

The currency ratio, defined as the proportion of currency held by the public relative to bank deposits, is influenced by factors such as interest rates, financial innovation, and public confidence in the banking system. Higher interest rates on deposits typically lower the currency ratio as people prefer holding interest-bearing accounts, while increased financial technology and digital payment options reduce the need for physical cash. Economic uncertainty or lack of trust in banks can raise the currency ratio as individuals prefer liquidity and safety in cash holdings.

Determinants of the Money Multiplier

The money multiplier is influenced primarily by the currency ratio, reserve ratio, and excess reserves held by banks, determining how much the initial deposit expands through the banking system. A higher currency ratio, indicating that people hold more cash relative to deposits, reduces the money multiplier by limiting the funds banks can lend. Variations in banks' reserve requirements and preferences for holding excess reserves also critically impact the size of the money multiplier and overall money supply expansion.

Impact on Money Supply: Currency Ratio vs Money Multiplier

The currency ratio, which measures the public's preference for holding cash relative to deposits, inversely affects the money multiplier by reducing the funds banks can lend. A higher currency ratio decreases the money multiplier, leading to a contraction in the overall money supply. Conversely, a lower currency ratio increases the money multiplier, amplifying the potential expansion of the money supply through bank lending.

Central Bank Policies and Their Effects

The currency ratio, defined as the public's preference for holding cash relative to deposits, directly influences the money multiplier by altering the base money circulation. Central Bank policies targeting reserve requirements and open market operations affect the money multiplier by controlling the amount of money banks can create through lending. Adjustments in interest rates and reserve ratios modulate the currency ratio's impact, ultimately shaping monetary supply and liquidity in the economy.

Real-world Examples: Currency Ratio and Money Multiplier

The currency ratio measures the proportion of cash people hold relative to deposits, which influences the money multiplier--the factor by which banks can expand the money supply through lending. For instance, during the 2008 financial crisis, the U.S. currency ratio spiked as individuals hoarded cash, causing the money multiplier to shrink and slowing economic growth. In contrast, in countries like Japan where currency preference is low, the money multiplier remains higher, enabling more effective monetary policy transmission.

Economic Implications for Financial Systems

The currency ratio measures the public's preference for holding cash relative to deposits, significantly influencing the money multiplier which quantifies the potential expansion of the money supply through bank lending. A higher currency ratio reduces the money multiplier, constraining bank reserves and limiting credit creation, which can dampen economic growth and liquidity in financial systems. Understanding this dynamic is crucial for policymakers to balance inflation control with economic stimulation through effective monetary policy adjustments.

Conclusion: Key Differences and Policy Takeaways

Currency ratio reflects the public's preference for holding cash relative to deposits, directly influencing the money multiplier, which measures how initial reserves expand into total money supply through banking lending. A higher currency ratio reduces the money multiplier, limiting the central bank's ability to expand money supply via reserve injections. Policymakers must monitor currency preferences to accurately predict money creation effects and tailor monetary interventions accordingly.

Currency ratio Infographic

libterm.com

libterm.com