Competitive equilibrium occurs when supply equals demand, resulting in an efficient allocation of resources where no participant can improve their outcome by changing their strategy. This state ensures that markets clear at prices balancing buyers' willingness to pay and sellers' willingness to accept. Explore this article to understand how competitive equilibrium shapes market dynamics and influences economic decision-making.

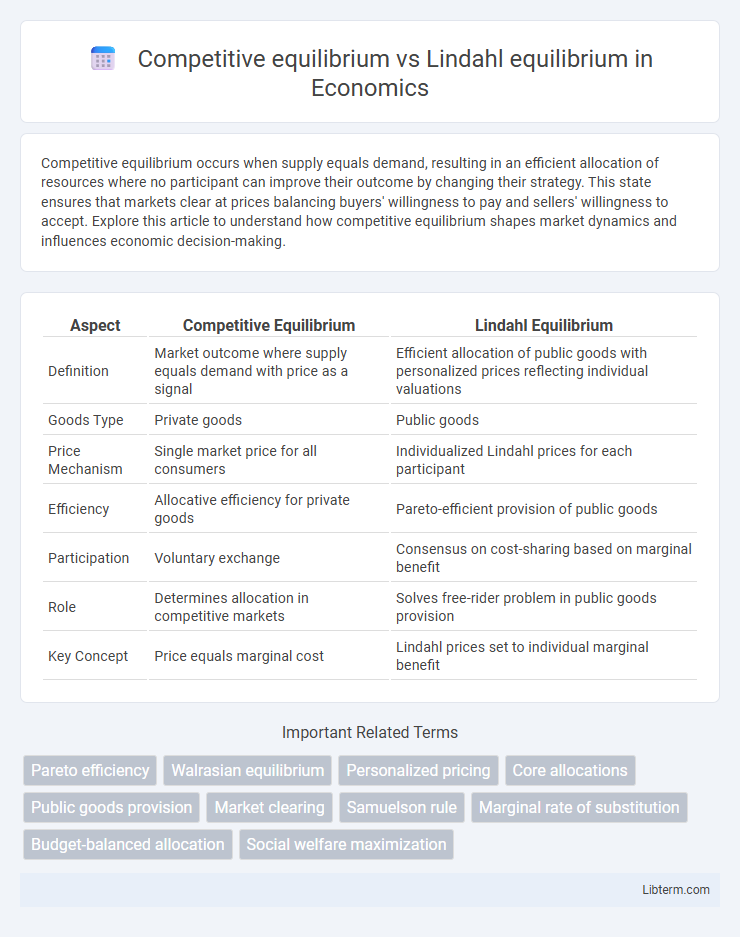

Table of Comparison

| Aspect | Competitive Equilibrium | Lindahl Equilibrium |

|---|---|---|

| Definition | Market outcome where supply equals demand with price as a signal | Efficient allocation of public goods with personalized prices reflecting individual valuations |

| Goods Type | Private goods | Public goods |

| Price Mechanism | Single market price for all consumers | Individualized Lindahl prices for each participant |

| Efficiency | Allocative efficiency for private goods | Pareto-efficient provision of public goods |

| Participation | Voluntary exchange | Consensus on cost-sharing based on marginal benefit |

| Role | Determines allocation in competitive markets | Solves free-rider problem in public goods provision |

| Key Concept | Price equals marginal cost | Lindahl prices set to individual marginal benefit |

Introduction to Market Equilibria

Competitive equilibrium occurs when supply equals demand across all markets, ensuring efficient allocation of resources without external intervention. Lindahl equilibrium extends this concept to public goods by assigning personalized prices, enabling individuals to pay according to their marginal benefits and achieve efficient provision. Both equilibria represent solutions to resource allocation problems, but Lindahl equilibrium specifically addresses the challenge of financing and distributing non-excludable public goods in a way that maximizes social welfare.

Understanding Competitive Equilibrium

Competitive equilibrium occurs when supply equals demand across all markets, ensuring optimal resource allocation without any participant having the power to influence prices. It assumes perfect competition, complete information, and price-taking behavior among consumers and firms. This equilibrium reflects efficient outcomes in markets with private goods but may fail to address public goods or externalities, where alternative concepts like Lindahl equilibrium become relevant.

The Concept of Lindahl Equilibrium

Lindahl equilibrium is a concept in public economics that achieves efficient provision of public goods by assigning personalized prices to individuals based on their marginal benefits. Unlike competitive equilibrium, which applies uniform prices in private goods markets, Lindahl equilibrium ensures individuals pay for public goods in proportion to their preferences, leading to a Pareto optimal distribution of resources. This mechanism balances individual incentives and collective welfare by internalizing the externalities inherent in public goods consumption.

Key Differences Between Competitive and Lindahl Equilibria

Competitive equilibrium occurs when supply equals demand in markets with price-taking agents and no public goods, ensuring efficient allocation of private goods through decentralized decisions. Lindahl equilibrium addresses the efficient provision of public goods by assigning personalized prices to individuals based on their marginal benefits, aligning individual incentives with collective welfare. Unlike competitive equilibrium, Lindahl equilibrium requires personalized pricing and voluntary contributions to achieve Pareto efficiency in public goods provision.

Efficiency and Distribution in Both Equilibria

Competitive equilibrium ensures Pareto efficiency by equating marginal rates of substitution with marginal rates of transformation, maximizing social welfare under individual budget constraints, yet may fail to address public goods distribution equitably. Lindahl equilibrium internalizes public goods externalities through personalized prices, achieving both Pareto efficiency and a fairer distribution of costs aligned with individual marginal benefits. This equilibrium balances efficiency with equitable allocation, addressing the free-rider problem inherent in competitive markets for public goods.

Public Goods and Lindahl Pricing

Competitive equilibrium in public goods markets often fails to achieve efficiency because individuals do not reveal their true preferences due to free-rider problems, resulting in underprovision of the public good. Lindahl equilibrium addresses this inefficiency by assigning individualized prices to public goods based on each agent's marginal valuation, ensuring that the sum of personalized contributions equals the cost of provision. Lindahl pricing thus aligns private incentives with social optimality, enabling efficient allocation and financing of public goods.

Market Structures Favoring Competitive Equilibrium

Competitive equilibrium thrives in markets characterized by numerous buyers and sellers, homogeneous products, and perfect information, enabling price-taking behavior and efficient resource allocation. In contrast, Lindahl equilibrium applies to public goods provision, where personalized prices reflect individual valuations, suited for non-rivalrous and non-excludable goods rather than typical market goods. Market structures with high competition and negligible externalities favor competitive equilibrium by ensuring supply and demand balance without the need for personalized pricing mechanisms inherent in Lindahl equilibria.

Real-World Applications of Each Equilibrium

Competitive equilibrium models are widely applied in market pricing and resource allocation scenarios where individual agents act independently, enabling efficient outcomes in perfectly competitive markets such as stock exchanges and commodity markets. Lindahl equilibrium finds practical use in public goods provision, helping to determine personalized tax shares for individuals to fund and optimally consume public goods, as seen in infrastructure financing and environmental policy design. Both equilibria facilitate decision-making in economics but differ in applicability: competitive equilibrium suits private goods markets, while Lindahl equilibrium addresses the complexities of collective financing and consumption.

Limitations and Critiques

Competitive equilibrium assumes price-taking behavior and often neglects public goods' non-excludability and non-rivalry, leading to market failures and inefficiencies. Lindahl equilibrium attempts to address the provision of public goods by assigning personalized prices, but it struggles with practical implementation due to preference revelation problems and strategic manipulation. Both equilibria face limitations in capturing real-world complexities, with criticisms targeting their assumptions of complete information and voluntary participation.

Conclusion: Choosing the Right Equilibrium Framework

Selecting the appropriate equilibrium framework depends on the nature of public goods and the information structure of the economic environment. Competitive equilibrium suits markets with private goods and perfect competition, while Lindahl equilibrium effectively addresses efficient public goods provision by incorporating individual valuations through personalized prices. Policymakers must assess whether price signals or collective preference revelation better aligns with the desired outcomes for resource allocation and social welfare optimization.

Competitive equilibrium Infographic

libterm.com

libterm.com