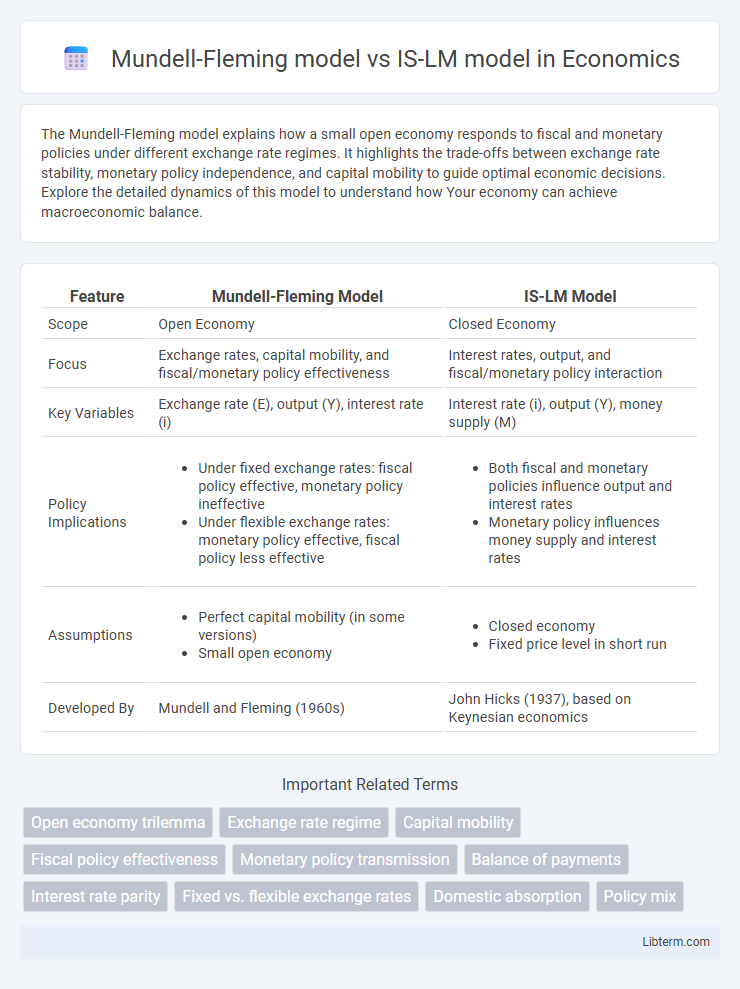

The Mundell-Fleming model explains how a small open economy responds to fiscal and monetary policies under different exchange rate regimes. It highlights the trade-offs between exchange rate stability, monetary policy independence, and capital mobility to guide optimal economic decisions. Explore the detailed dynamics of this model to understand how Your economy can achieve macroeconomic balance.

Table of Comparison

| Feature | Mundell-Fleming Model | IS-LM Model |

|---|---|---|

| Scope | Open Economy | Closed Economy |

| Focus | Exchange rates, capital mobility, and fiscal/monetary policy effectiveness | Interest rates, output, and fiscal/monetary policy interaction |

| Key Variables | Exchange rate (E), output (Y), interest rate (i) | Interest rate (i), output (Y), money supply (M) |

| Policy Implications |

|

|

| Assumptions |

|

|

| Developed By | Mundell and Fleming (1960s) | John Hicks (1937), based on Keynesian economics |

Introduction to Macroeconomic Models

The Mundell-Fleming model extends the IS-LM framework to an open economy, integrating international trade and capital flows with exchange rate dynamics. Unlike the closed-economy IS-LM model, it emphasizes the interaction between monetary policy, fiscal policy, and exchange rate regimes under conditions of perfect capital mobility. This model is crucial for analyzing macroeconomic policy effectiveness in economies exposed to global financial markets.

Overview of the IS-LM Model

The IS-LM model illustrates the interaction between the goods market (Investment-Savings) and the money market (Liquidity preference-Money supply), establishing equilibrium interest rates and income levels in a closed economy. The IS curve represents equilibrium where investment equals savings, while the LM curve reflects money market equilibrium based on liquidity preference and money supply. This model is foundational in macroeconomics for analyzing fiscal and monetary policy effects on output and interest rates without incorporating international trade and capital flows.

Fundamentals of the Mundell-Fleming Model

The Mundell-Fleming model extends the IS-LM framework to an open economy by incorporating international capital flows and exchange rate mechanisms, highlighting the impact of monetary and fiscal policies under different exchange rate regimes. It emphasizes the constraints imposed by fixed and flexible exchange rates on policy effectiveness, illustrating how capital mobility can limit the autonomy of monetary policy. This model integrates the goods market equilibrium (IS curve) with money market equilibrium (LM curve) and the balance of payments, providing a comprehensive analysis of open-economy macroeconomic stabilization.

Key Assumptions: Closed vs Open Economy

The Mundell-Fleming model assumes an open economy with perfect capital mobility, allowing for international trade and capital flows that affect exchange rates and monetary policy effectiveness. The IS-LM model operates under a closed economy framework, excluding external trade and capital movements, focusing solely on domestic goods and money markets. This distinction critically influences the policy implications and economic dynamics analyzed within each model.

Fiscal Policy Effectiveness in Both Models

The Mundell-Fleming model highlights fiscal policy effectiveness as highly dependent on exchange rate regimes, where fiscal expansion stimulates output under fixed exchange rates but is less effective under flexible exchange rates due to currency appreciation. In contrast, the IS-LM model, operating in a closed economy framework, assumes fiscal policy always increases output by shifting the IS curve rightward, with no exchange rate influence. Therefore, fiscal policy effectiveness in the Mundell-Fleming model is context-specific, whereas the IS-LM model depicts a more straightforward impact on aggregate demand.

Monetary Policy Impact: IS-LM vs Mundell-Fleming

The Mundell-Fleming model extends the IS-LM framework to an open economy, highlighting how monetary policy effectiveness varies with exchange rate regimes. Under fixed exchange rates, monetary policy has limited impact on output due to capital mobility and central bank interventions, whereas under flexible exchange rates, monetary policy significantly influences aggregate demand by affecting exchange rates and net exports. The IS-LM model, confined to closed economies, predicts monetary policy as a powerful tool to shift output and interest rates, ignoring external sector dynamics critical in open economies.

Role of Exchange Rates: Fixed vs Flexible

The Mundell-Fleming model distinguishes itself from the IS-LM model by incorporating the role of exchange rates under different exchange rate regimes, specifically fixed versus flexible rates. Under fixed exchange rates, the Mundell-Fleming model emphasizes monetary policy ineffectiveness due to central bank interventions maintaining the peg, whereas fiscal policy remains potent. In contrast, under flexible exchange rates, currency depreciation or appreciation autonomously adjusts the balance of payments, enhancing monetary policy effectiveness while diminishing the impact of fiscal policy.

Capital Mobility: Implications in Both Frameworks

The Mundell-Fleming model incorporates varying degrees of capital mobility, demonstrating that with perfect capital mobility, interest rates are determined by the global market, rendering monetary policy ineffective under fixed exchange rates. In contrast, the IS-LM model assumes closed economy conditions, disregarding capital flows, thereby allowing monetary and fiscal policies to directly influence domestic interest rates and output. The key implication is that capital mobility in the Mundell-Fleming framework constrains policymaking autonomy, especially under fixed exchange rate regimes, while the IS-LM model implies greater domestic policy control absent international capital movements.

Limitations and Criticisms of Each Model

The Mundell-Fleming model faces limitations primarily due to its assumption of perfect capital mobility and fixed price levels, which restricts its applicability in small open economies with exchange rate fluctuations and price rigidity. The IS-LM model is criticized for its closed economy framework, neglecting international trade and capital flows, and for assuming fixed prices and wages, which diminishes its relevance in dynamic macroeconomic environments. Both models oversimplify real-world complexities by relying on static equilibrium analysis and ignoring microeconomic foundations, limiting their predictive accuracy under varied economic conditions.

Practical Applications and Policy Relevance

The Mundell-Fleming model extends the IS-LM framework by incorporating international capital flows and exchange rate dynamics, making it crucial for analyzing open economies with flexible or fixed exchange rates. Policymakers use the Mundell-Fleming model to assess the impact of monetary and fiscal policies in a global context, particularly how capital mobility influences the effectiveness of these policies. In contrast, the IS-LM model remains fundamental for understanding domestic economic equilibrium, guiding short-run policy decisions without accounting for external sector interactions.

Mundell-Fleming model Infographic

libterm.com

libterm.com