The real balance effect describes how changes in the purchasing power of your money influence consumer spending and overall economic demand. When inflation causes your money to lose value, your real wealth shrinks, reducing your ability to buy goods and services. Explore the rest of this article to understand how the real balance effect impacts economic fluctuations and your financial decisions.

Table of Comparison

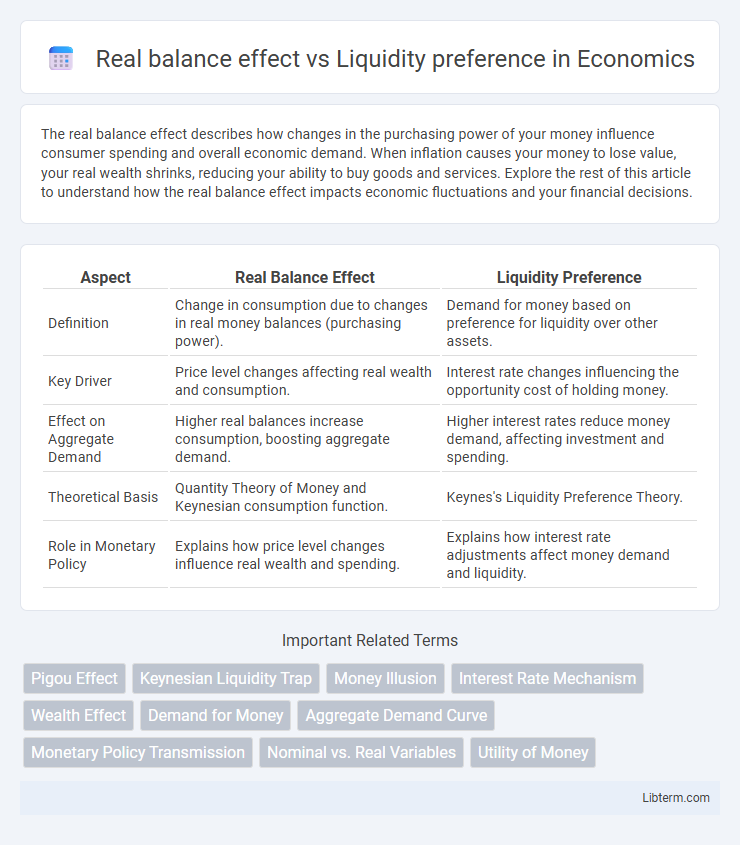

| Aspect | Real Balance Effect | Liquidity Preference |

|---|---|---|

| Definition | Change in consumption due to changes in real money balances (purchasing power). | Demand for money based on preference for liquidity over other assets. |

| Key Driver | Price level changes affecting real wealth and consumption. | Interest rate changes influencing the opportunity cost of holding money. |

| Effect on Aggregate Demand | Higher real balances increase consumption, boosting aggregate demand. | Higher interest rates reduce money demand, affecting investment and spending. |

| Theoretical Basis | Quantity Theory of Money and Keynesian consumption function. | Keynes's Liquidity Preference Theory. |

| Role in Monetary Policy | Explains how price level changes influence real wealth and spending. | Explains how interest rate adjustments affect money demand and liquidity. |

Introduction to Real Balance Effect and Liquidity Preference

Real balance effect explains how changes in the value of money holdings influence consumer spending and aggregate demand, as higher real balances increase purchasing power and stimulate consumption. Liquidity preference theory centers on the demand for money based on its liquidity, with individuals preferring to hold cash for transactions, precautionary, and speculative motives. Both concepts highlight different mechanisms through which money supply and interest rates affect overall economic activity.

Historical Background and Economic Theories

The real balance effect, rooted in classical economics, explains how changes in the price level influence real wealth and consumption through the purchasing power of money, as initially proposed by economists like Irving Fisher in the early 20th century. Liquidity preference theory, developed by John Maynard Keynes in the 1930s, contrasts this by emphasizing the demand for money based on interest rates and uncertainty, explaining how money holdings affect interest rates and investment. These theories reflect divergent approaches to understanding money's role in aggregate demand, with real balance effect focusing on wealth effects and liquidity preference highlighting the speculative motives for holding money.

Definition of Real Balance Effect

The Real Balance Effect explains how changes in the real value of money holdings influence consumer spending and aggregate demand, with higher real balances increasing purchasing power and stimulating demand. This effect contrasts with the Liquidity Preference Theory, which focuses on interest rate adjustments as the primary driver of investment and money demand. Understanding the Real Balance Effect is essential for analyzing how shifts in price levels impact the real wealth of consumers and overall economic activity.

Definition of Liquidity Preference

Liquidity preference defines the desire of individuals and businesses to hold cash or easily convertible assets instead of investing in long-term securities, influencing interest rates and money supply in the economy. This concept contrasts with the real balance effect, which emphasizes how changes in the price level affect the real value of money holdings and thus consumption. Understanding liquidity preference helps explain fluctuation in demand for money alongside the impact of price level changes on economic activity.

Key Differences Between Real Balance Effect and Liquidity Preference

The Real Balance Effect explains changes in consumption and aggregate demand due to variations in the real value of money balances caused by price level shifts, while Liquidity Preference theory focuses on the demand for money as an asset driven by interest rates and liquidity needs. Real Balance Effect emphasizes the purchasing power of money influencing spending behavior, whereas Liquidity Preference highlights the preference for liquidity and its impact on interest rate determination in money markets. The key difference lies in Real Balance Effect's relation to price levels and real wealth, contrasting with Liquidity Preference's concern with interest rates and money demand for transactional and precautionary motives.

Impact on Aggregate Demand and Interest Rates

The real balance effect increases aggregate demand as higher real money balances boost consumer spending by enhancing purchasing power, which can lower interest rates by reducing the demand for money. In contrast, the liquidity preference theory emphasizes that interest rates adjust to balance money demand and supply, where increased liquidity preference raises interest rates and dampens investment and aggregate demand. Together, these concepts explain how variations in real balances and money demand influence interest rates and thereby modulate aggregate demand in the economy.

Role in Monetary Policy Formulation

The real balance effect highlights how changes in the price level impact the real value of money holdings, influencing consumer spending and aggregate demand, thereby guiding central banks in setting inflation targets and controlling money supply. Liquidity preference theory emphasizes the demand for money based on interest rate fluctuations, shaping monetary policy by focusing on interest rate management to influence investment and consumption. Both concepts are essential for policymakers to balance inflation control with economic growth through appropriate adjustments in money supply and interest rates.

Strengths and Limitations of Each Theory

The Real Balance Effect highlights how a decrease in the price level increases the real value of money holdings, boosting consumer spending and aggregate demand, which strengthens its role in explaining short-term demand fluctuations during deflationary periods. However, its limitation lies in the assumption of fixed nominal money holdings and ignoring interest rate influences, making it less effective during periods of stable or rising prices. Liquidity Preference Theory emphasizes money demand as a function of interest rates, capturing the trade-off between holding cash and bonds, which robustly explains interest rate fluctuations and monetary policy transmission, but it may undervalue the impact of price level changes and real wealth on consumption.

Empirical Evidence and Case Studies

Empirical evidence from the Great Depression indicates that the real balance effect, where increased wealth from falling price levels boosts consumption, played a significant role in stabilizing aggregate demand, contrasting with liquidity preference theory that emphasizes money demand and interest rates. Case studies from Japan's lost decade show that despite low interest rates, liquidity preference remained high, limiting investment and economic growth, which challenges the simple predictions of the real balance effect. Recent research combining cross-country data highlights that the real balance effect can mitigate recessions in deflationary environments, but its impact is often constrained by liquidity traps and persistent uncertainty underscored in liquidity preference models.

Conclusion: Evaluating Real Balance Effect vs Liquidity Preference

The Real Balance Effect emphasizes changes in purchasing power influencing aggregate demand, while Liquidity Preference Theory highlights interest rate adjustments driven by money supply and demand for liquidity. Evaluating both reveals that the Real Balance Effect provides a direct mechanism for price level changes affecting consumption, whereas Liquidity Preference offers insights into monetary policy impact on investment through interest rates. A comprehensive analysis integrates these perspectives to better understand how money influences output and interest rates in varying economic conditions.

Real balance effect Infographic

libterm.com

libterm.com