Keynesian policy emphasizes government intervention to stabilize economic fluctuations through fiscal measures such as increased public spending and tax adjustments. Critics argue it may lead to long-term deficits and inflation, while supporters highlight its role in reducing unemployment and stimulating demand during recessions. Explore the article to understand how Keynesian policies impact economic growth and your financial future.

Table of Comparison

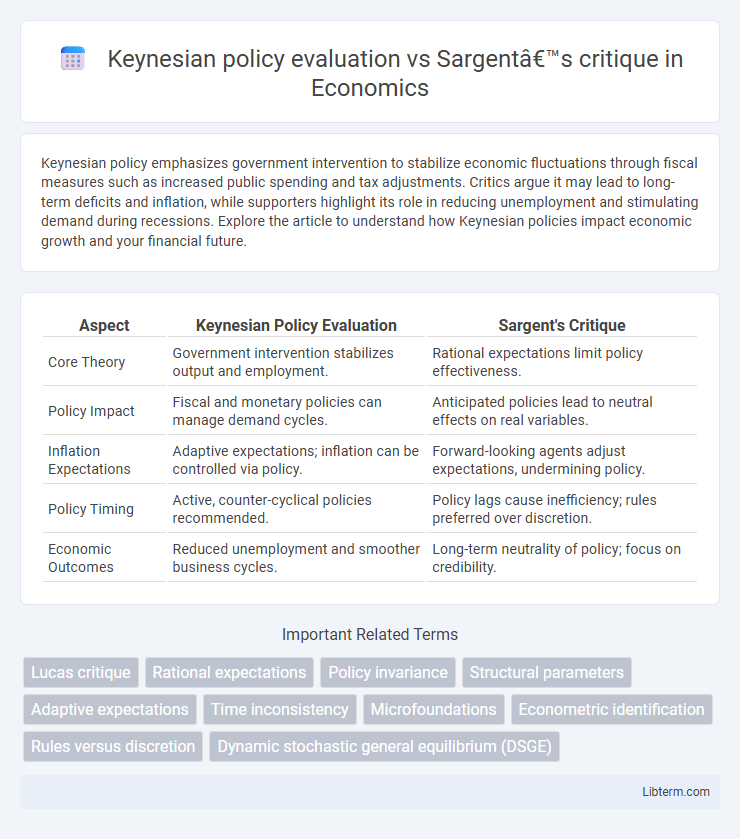

| Aspect | Keynesian Policy Evaluation | Sargent's Critique |

|---|---|---|

| Core Theory | Government intervention stabilizes output and employment. | Rational expectations limit policy effectiveness. |

| Policy Impact | Fiscal and monetary policies can manage demand cycles. | Anticipated policies lead to neutral effects on real variables. |

| Inflation Expectations | Adaptive expectations; inflation can be controlled via policy. | Forward-looking agents adjust expectations, undermining policy. |

| Policy Timing | Active, counter-cyclical policies recommended. | Policy lags cause inefficiency; rules preferred over discretion. |

| Economic Outcomes | Reduced unemployment and smoother business cycles. | Long-term neutrality of policy; focus on credibility. |

Introduction to Keynesian Policy Evaluation

Keynesian policy evaluation emphasizes government intervention to stabilize economic fluctuations through fiscal and monetary policies, targeting unemployment and output gaps. It relies on aggregate demand management, assuming prices and wages are sticky, which justifies active policy to mitigate recessions. Sargent's critique challenges these assumptions by arguing rational expectations and market adjustments undermine the effectiveness of systematic government interventions in the long run.

Core Principles of Keynesian Economics

Keynesian economics centers on the principle that active government intervention through fiscal policy can stabilize economic fluctuations by managing aggregate demand. Keynesians advocate for counter-cyclical spending to mitigate recessions and stimulate growth, emphasizing price and wage rigidity's role in market failures. Sargent's critique challenges this by arguing that rational expectations and market adjustments render policy interventions ineffective, highlighting the importance of time consistency and policy credibility in macroeconomic management.

The Foundations of Policy Evaluation in Keynesianism

Keynesian policy evaluation emphasizes fiscal and monetary interventions to stabilize output and employment by managing aggregate demand, relying on the assumption of wage and price rigidities. Sargent's critique, rooted in rational expectations theory, challenges this framework by arguing that anticipated policy changes are neutralized by forward-looking agents, undermining the effectiveness of traditional Keynesian stabilization policies. The Foundations of Policy Evaluation in Keynesianism rest on adaptive expectations and short-run price non-neutralities, which Sargent counters by advocating for policy evaluation models incorporating rational expectations and microeconomic foundations.

Understanding Sargent’s Critique of Keynesian Models

Sargent's critique of Keynesian models centers on their failure to account for rational expectations, highlighting that individuals anticipate government policies, thereby neutralizing their intended effects on output and employment. By emphasizing the role of time-consistent policy and adaptive expectations, Sargent argues that Keynesian fiscal and monetary interventions often lead to inflation without reducing unemployment. This critique underscores the importance of incorporating microeconomic foundations and expectations into macroeconomic policy analysis for more accurate predictions and policy design.

Rational Expectations Revolution Explained

Keynesian policy evaluation emphasizes the effectiveness of fiscal and monetary interventions in stabilizing economic fluctuations and managing aggregate demand. Sargent's critique, rooted in the Rational Expectations Revolution, argues that agents anticipate policy changes and adjust their behavior accordingly, which neutralizes the intended effects of discretionary policies and leads to policy ineffectiveness. The Rational Expectations Revolution highlights that only unanticipated policy shifts can influence real economic variables, challenging traditional Keynesian prescriptions and promoting rules-based policy frameworks.

Comparing Keynesian and Sargentian Assumptions

Keynesian policy evaluation assumes that government intervention can effectively manage aggregate demand and stabilize the economy through fiscal and monetary measures. In contrast, Sargent's critique emphasizes rational expectations and the role of policy credibility, arguing that systematic policy interventions lead agents to anticipate future inflation, rendering such policies ineffective. The differing assumptions center on the adaptability of economic agents and the impact of policy expectations on macroeconomic outcomes.

Policy Ineffectiveness Proposition: Sargent’s View

Sargent's critique of Keynesian policy highlights the Policy Ineffectiveness Proposition, arguing that systematic monetary policy cannot systematically manage real output or employment due to rational expectations. He maintains that anticipated policy changes are neutralized by private agents adjusting their expectations, rendering fiscal and monetary stimulus ineffective over the long term. This challenges Keynesian views on demand management, emphasizing the importance of policy credibility and information in shaping economic outcomes.

Empirical Evidence: Keynesianism vs. Sargent’s Critique

Empirical evidence supporting Keynesian policy highlights its effectiveness in reducing unemployment and stabilizing economic cycles through fiscal stimulus, as observed in the post-Great Depression recovery and the 2008 financial crisis interventions. In contrast, Sargent's critique, based on rational expectations and empirical studies, argues that anticipated policy changes lead to counterproductive outcomes like inflation without real output gains, emphasizing the importance of credibility and policy consistency. Recent empirical analyses often show mixed results, with Keynesian approaches succeeding in short-term demand management while Sargent's framework better explains long-term inflation dynamics and policy ineffectiveness under rational expectations.

Implications for Modern Economic Policymaking

Keynesian policy emphasizes active fiscal intervention to manage demand and stabilize economic cycles, advocating government spending and monetary measures to reduce unemployment and promote growth. Sargent's critique, rooted in rational expectations theory, argues that systematic policy attempts to manipulate demand are ultimately ineffective, as economic agents adjust their behavior anticipating these changes, leading to policy ineffectiveness or indeterminacy. Modern economic policymaking often incorporates these insights by balancing discretionary fiscal tools with credible, rules-based frameworks to enhance policy credibility and mitigate inflation expectations, influencing central bank independence and inflation targeting regimes.

Conclusion: Synthesizing Keynesian and Sargentian Insights

Synthesizing Keynesian and Sargentian insights reveals that while Keynesian policies effectively address short-term economic fluctuations through fiscal stimulus, Sargent's critique underscores the importance of rational expectations and long-term policy credibility to prevent inflationary biases. Integrating these perspectives suggests that successful economic management requires both proactive stabilization efforts and credible, transparent policy frameworks to anchor expectations. This balanced approach enhances macroeconomic stability by combining demand-side interventions with disciplined monetary and fiscal policies.

Keynesian policy evaluation Infographic

libterm.com

libterm.com