A lump-sum tax is a fixed amount of tax that every taxpayer is required to pay regardless of their income or economic activity. This type of tax is considered efficient because it does not distort economic decisions or behaviors. Explore the article to understand how lump-sum taxes impact fairness and government revenue.

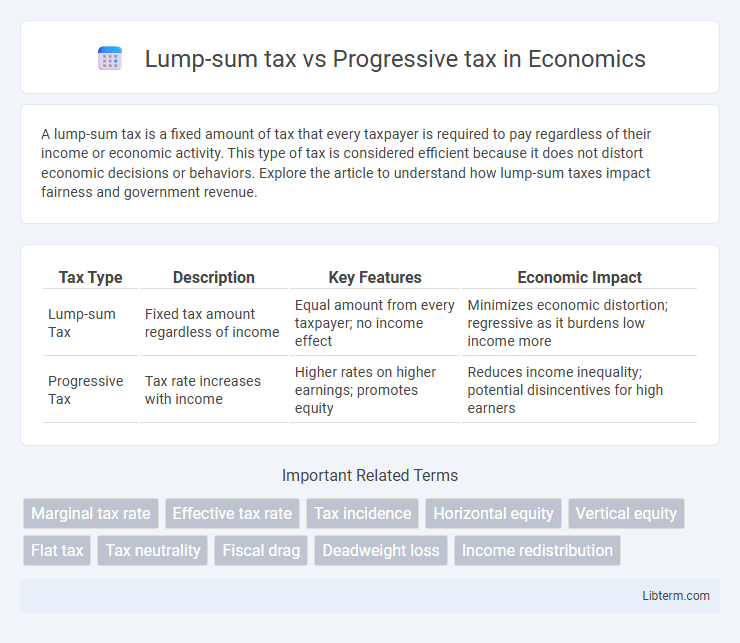

Table of Comparison

| Tax Type | Description | Key Features | Economic Impact |

|---|---|---|---|

| Lump-sum Tax | Fixed tax amount regardless of income | Equal amount from every taxpayer; no income effect | Minimizes economic distortion; regressive as it burdens low income more |

| Progressive Tax | Tax rate increases with income | Higher rates on higher earnings; promotes equity | Reduces income inequality; potential disincentives for high earners |

Introduction to Lump-Sum Tax and Progressive Tax

Lump-sum tax is a fixed amount of tax imposed on individuals or entities regardless of their income or wealth, ensuring simplicity and predictability in tax revenue. Progressive tax, by contrast, imposes higher tax rates on higher income brackets, aiming to reduce income inequality and redistribute wealth. Understanding these two tax systems highlights the trade-offs between tax fairness, efficiency, and administrative complexity.

Defining Lump-Sum Tax: Key Features

A lump-sum tax is a fixed amount of tax imposed on individuals or entities regardless of their income, consumption, or economic activity, making it non-distortionary and simple to administer. Key features include its uniformity, meaning every taxpayer pays the same amount, and its inelasticity, as it does not influence economic behavior or decision-making. Unlike progressive taxes that increase with income levels, lump-sum taxes promote efficiency by avoiding disincentives to work or invest.

Understanding Progressive Tax: Core Principles

Progressive tax system imposes higher tax rates on higher income brackets, ensuring taxpayers contribute according to their ability to pay, which promotes income redistribution and reduces economic inequality. Unlike lump-sum tax, which charges a fixed amount regardless of income, progressive tax adjusts tax burdens progressively, based on individual earnings. Key principles include marginal tax rates, tax brackets, and the principle of vertical equity where taxpayers with greater economic capacity pay proportionally more.

Historical Context of Both Tax Systems

The lump-sum tax system, rooted in ancient civilizations such as Mesopotamia and Rome, was favored for its simplicity and predictability, levying a fixed amount regardless of income. Progressive taxation emerged prominently in the late 19th and early 20th centuries during industrialization, designed to address income inequality by taxing higher incomes at increasing rates, as seen in the landmark implementation in the United States with the Revenue Act of 1913. Historical economic data shows progressive tax systems contributed to wealth redistribution and funding of public services, contrasting with lump-sum taxes that maintained revenue stability but lacked equity considerations.

Economic Impact of Lump-Sum Taxation

Lump-sum taxation imposes a fixed amount on all taxpayers regardless of income, resulting in minimal economic distortion and efficient resource allocation by not altering labor supply or investment incentives. Unlike progressive taxes, which can discourage high earners and affect economic behavior, lump-sum taxes maintain neutral incentives, promoting stable economic growth. However, the regressive nature of lump-sum taxes may increase inequality and reduce overall social welfare.

Economic Implications of Progressive Taxation

Progressive taxation impacts income distribution by imposing higher tax rates on individuals with greater earnings, which can reduce income inequality and increase government revenue for public services. This system incentivizes social welfare investments but may also influence labor supply decisions and economic productivity due to higher marginal tax rates. In contrast to lump-sum taxes, progressive taxes adjust according to ability to pay, aiming to achieve a more equitable economic outcome.

Equity and Fairness: Comparing Tax Structures

Progressive tax systems enhance equity by taxing higher incomes at increased rates, ensuring that those with greater ability to pay contribute more, which reduces income inequality. Lump-sum taxes impose a fixed amount regardless of income, often burdening lower-income individuals disproportionately and lacking fairness in tax burden distribution. Equity considerations typically favor progressive taxation for its capacity to promote social justice and economic balance through income redistribution.

Administrative Complexity and Efficiency

Lump-sum taxes exhibit minimal administrative complexity due to their fixed amount regardless of income, enabling straightforward collection and enforcement. In contrast, progressive taxes require extensive income verification, tiered rate calculations, and ongoing adjustments, increasing administrative burden and potential for errors. Consequently, lump-sum taxes are more efficient to administer but may lack the equity motivations that drive the complexity of progressive tax systems.

Social Consequences of Different Tax Approaches

Lump-sum taxes impose a fixed amount on all individuals regardless of income, potentially placing a disproportionate burden on low-income households and exacerbating income inequality. Progressive taxes, which increase rates with higher income levels, promote wealth redistribution and can reduce social disparities by funding public services and social welfare programs. The choice between these tax systems significantly affects social equity, economic mobility, and overall societal cohesion.

Choosing the Optimal Tax System: Factors to Consider

Choosing the optimal tax system requires evaluating equity, efficiency, and administrative simplicity. Lump-sum taxes provide predictability and minimal behavioral distortion but may be regressive and politically unpopular. Progressive taxes enhance vertical equity by taxing higher incomes at greater rates, potentially reducing income inequality but can introduce economic inefficiencies and complex compliance costs.

Lump-sum tax Infographic

libterm.com

libterm.com