Classical music is characterized by its structured compositions, rich harmonies, and timeless melodies that have influenced musicians for centuries. It encompasses various periods, from Baroque to Romantic, each with distinct styles and celebrated composers like Mozart and Beethoven. Explore the rest of the article to discover how classical music continues to enrich Your cultural experience.

Table of Comparison

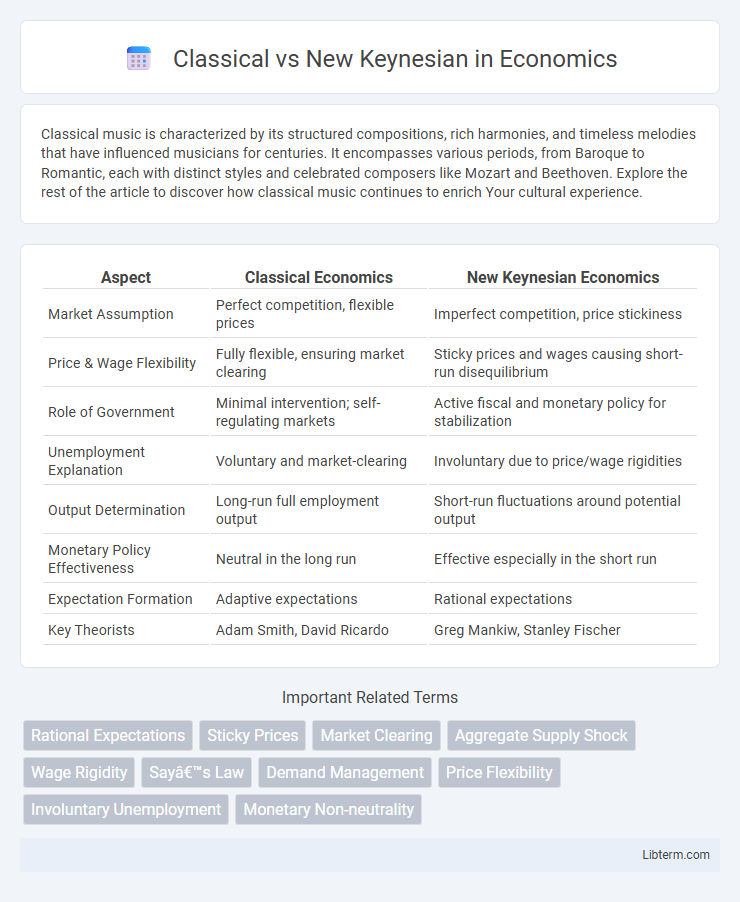

| Aspect | Classical Economics | New Keynesian Economics |

|---|---|---|

| Market Assumption | Perfect competition, flexible prices | Imperfect competition, price stickiness |

| Price & Wage Flexibility | Fully flexible, ensuring market clearing | Sticky prices and wages causing short-run disequilibrium |

| Role of Government | Minimal intervention; self-regulating markets | Active fiscal and monetary policy for stabilization |

| Unemployment Explanation | Voluntary and market-clearing | Involuntary due to price/wage rigidities |

| Output Determination | Long-run full employment output | Short-run fluctuations around potential output |

| Monetary Policy Effectiveness | Neutral in the long run | Effective especially in the short run |

| Expectation Formation | Adaptive expectations | Rational expectations |

| Key Theorists | Adam Smith, David Ricardo | Greg Mankiw, Stanley Fischer |

Overview of Classical and New Keynesian Economics

Classical economics emphasizes rational expectations, flexible prices, and the self-correcting nature of markets, advocating minimal government intervention to maintain equilibrium. New Keynesian economics integrates price stickiness, wage rigidities, and imperfect competition to explain short-term fluctuations and justify active monetary and fiscal policies. Both frameworks address market dynamics but differ in assumptions about price adjustments and the effectiveness of policy measures.

Historical Context and Development

Classical economics, rooted in the 18th and 19th centuries, emphasized self-regulating markets, rational behavior, and long-term growth with figures like Adam Smith and David Ricardo shaping its principles. New Keynesian economics emerged in the late 20th century as a response to the limitations of classical theories, incorporating elements such as price stickiness, wage rigidity, and market imperfections to better explain short-term economic fluctuations and justify government intervention. This development was heavily influenced by the Keynesian revolution initiated by John Maynard Keynes during the Great Depression, which challenged classical assumptions and laid the groundwork for modern macroeconomic policy frameworks.

Core Assumptions of Classical Economics

Classical economics assumes markets are perfectly competitive with flexible prices and wages that ensure full employment and optimal resource allocation. It posits that individuals and firms have rational expectations and that supply creates its own demand, known as Say's Law. This framework emphasizes long-term economic growth driven by capital accumulation and technological progress, minimizing the role of government intervention.

Foundational Principles of New Keynesian Theory

New Keynesian theory builds on classical economics by incorporating price and wage rigidities, which explain why markets may not clear instantaneously. It emphasizes imperfect competition, nominal rigidities, and the role of expectations in influencing economic fluctuations. This framework justifies active monetary policy interventions to stabilize output and control inflation.

Key Differences in Price and Wage Flexibility

Classical economics assumes fully flexible prices and wages, enabling markets to clear quickly and maintain long-term equilibrium. New Keynesian theory argues that prices and wages are sticky due to menu costs, contracts, and wage rigidities, leading to short-term market disequilibria and unemployment. This distinction explains why classical models predict self-correcting economies, whereas New Keynesian models emphasize the role of monetary and fiscal policy in stabilizing output.

Role of Government Intervention

Classical economics asserts that markets are self-correcting and government intervention often disrupts natural equilibrium, advocating minimal state involvement. New Keynesian economics emphasizes market imperfections, such as sticky prices and wages, justifying proactive government policies to stabilize output and employment. Empirical findings support that fiscal and monetary interventions can mitigate business cycle fluctuations and enhance economic stability within New Keynesian frameworks.

Perspectives on Market Equilibrium

Classical economics posits that markets naturally achieve equilibrium through flexible prices and wages, ensuring full employment without government intervention. New Keynesian economics challenges this view by emphasizing price and wage stickiness, which can prevent markets from clearing and lead to persistent unemployment. This divergence underscores the New Keynesian focus on the need for active fiscal and monetary policies to stabilize the economy.

Policy Implications and Macroeconomic Stability

Classical economics emphasizes minimal government intervention, advocating that markets naturally adjust to achieve full employment and macroeconomic stability through price and wage flexibility. New Keynesian economics supports active monetary and fiscal policies to address price and wage rigidities, aiming to stabilize output and control inflation during economic fluctuations. Policymakers relying on New Keynesian insights implement interest rate adjustments and stimulus measures to mitigate recessions and smooth business cycles, contrasting with the Classical preference for self-correcting markets.

Criticisms and Limitations of Each Approach

Classical economics faces criticism for assuming perfect market flexibility and rational expectations, which often fails to explain persistent unemployment and price stickiness observed in real economies. New Keynesian models address these issues by incorporating price and wage rigidities, but they are often criticized for relying heavily on assumptions about market imperfections and microfoundations that can complicate policy application. Both approaches struggle with accurately predicting economic fluctuations, as classical models overlook short-term frictions while New Keynesian models may overemphasize rigidities and fail to capture long-term growth dynamics.

Relevance in Contemporary Economic Policy

Classical economics emphasizes market self-regulation and minimal government intervention, influencing policies that prioritize deregulation and supply-side measures. New Keynesian economics incorporates price stickiness and market imperfections, supporting active monetary and fiscal policies to stabilize output and control inflation. In contemporary economic policy, New Keynesian frameworks are widely applied for managing demand shocks, while classical principles guide long-term growth strategies.

Classical Infographic

libterm.com

libterm.com