The Environmental Kuznets Curve hypothesizes an inverted U-shaped relationship between environmental degradation and economic growth, where pollution initially rises with income but decreases after reaching a certain income threshold. Understanding this dynamic helps You recognize how sustainable development policies can mitigate environmental impact while promoting economic progress. Explore the rest of the article to learn how the Environmental Kuznets Curve shapes environmental and economic strategies worldwide.

Table of Comparison

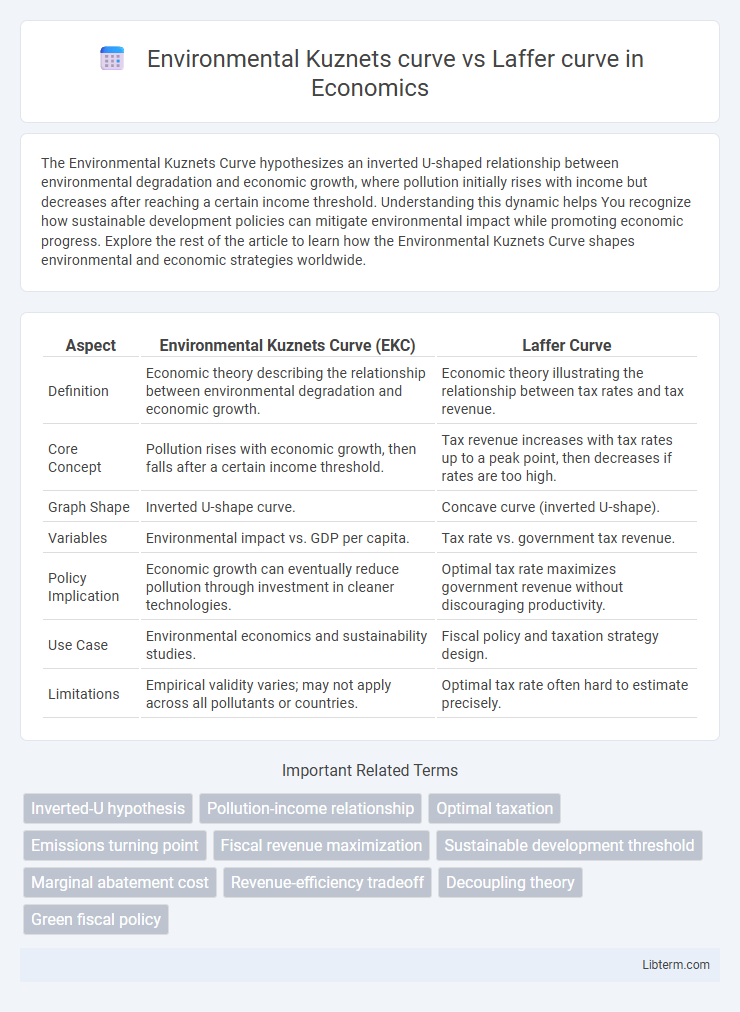

| Aspect | Environmental Kuznets Curve (EKC) | Laffer Curve |

|---|---|---|

| Definition | Economic theory describing the relationship between environmental degradation and economic growth. | Economic theory illustrating the relationship between tax rates and tax revenue. |

| Core Concept | Pollution rises with economic growth, then falls after a certain income threshold. | Tax revenue increases with tax rates up to a peak point, then decreases if rates are too high. |

| Graph Shape | Inverted U-shape curve. | Concave curve (inverted U-shape). |

| Variables | Environmental impact vs. GDP per capita. | Tax rate vs. government tax revenue. |

| Policy Implication | Economic growth can eventually reduce pollution through investment in cleaner technologies. | Optimal tax rate maximizes government revenue without discouraging productivity. |

| Use Case | Environmental economics and sustainability studies. | Fiscal policy and taxation strategy design. |

| Limitations | Empirical validity varies; may not apply across all pollutants or countries. | Optimal tax rate often hard to estimate precisely. |

Introduction to Environmental Kuznets Curve (EKC)

The Environmental Kuznets Curve (EKC) hypothesizes an inverted U-shaped relationship between environmental degradation and economic growth, suggesting pollution rises during early industrialization but declines as economies mature and adopt cleaner technologies. This concept contrasts with the Laffer Curve, which illustrates the relationship between tax rates and government revenue, emphasizing fiscal policy rather than environmental or economic externalities. The EKC is pivotal in environmental economics for understanding how income levels influence environmental quality over time.

Understanding the Laffer Curve

The Laffer Curve illustrates the relationship between tax rates and tax revenue, showing that both very high and very low tax rates result in less revenue, with an optimal midpoint maximizing government income. This economic principle highlights how excessive taxation can discourage work, saving, and investment, ultimately reducing total tax revenue. Understanding this curve aids policymakers in setting tax rates that balance revenue generation without overburdening taxpayers or hindering economic growth.

Historical Background of EKC and Laffer Curve

The Environmental Kuznets Curve (EKC) emerged in the 1990s, rooted in Simon Kuznets' 1955 theory linking economic growth to income inequality, later adapted to illustrate the relationship between economic development and environmental degradation. The Laffer Curve, developed during the 1970s by economist Arthur Laffer, conceptualizes the relationship between tax rates and tax revenue, revealing that excessively high taxes can reduce total revenue due to decreased incentives to work or invest. Both curves have profoundly influenced economic policy by framing growth-environment and taxation-revenue trade-offs in historical and empirical contexts.

Key Concepts: Environment vs. Taxation

The Environmental Kuznets Curve (EKC) hypothesizes an inverted U-shaped relationship between environmental degradation and economic growth, where pollution increases during early development stages and decreases after reaching a certain income level. In contrast, the Laffer Curve illustrates the relationship between tax rates and tax revenue, showing that there is an optimal tax rate maximizing revenue without discouraging economic activity. Both curves emphasize crucial trade-offs: the EKC highlights the balance between economic growth and environmental impact, while the Laffer Curve focuses on incentivizing productivity without excessive taxation.

Graphical Representation: EKC vs. Laffer Curve

The Environmental Kuznets Curve (EKC) graphically depicts an inverted U-shaped relationship between environmental degradation and economic growth, illustrating that pollution increases in early stages of development before declining as income reaches a higher threshold. The Laffer Curve presents a parabolic shape showing the relationship between tax rates and tax revenue, indicating there is an optimal tax rate that maximizes revenue without discouraging productivity. While the EKC focuses on the trade-off between economic growth and environmental impact, the Laffer Curve highlights the balance between taxation levels and government revenue generation.

Similarities and Differences between EKC and Laffer Curve

The Environmental Kuznets Curve (EKC) and the Laffer Curve both illustrate non-linear relationships between economic variables, with EKC depicting the inverted-U relationship between environmental degradation and income per capita, while the Laffer Curve shows the relationship between tax rates and tax revenue. Both curves suggest an optimal point: EKC identifies a level of income where environmental impact begins to decline, and the Laffer Curve identifies a tax rate that maximizes revenue without deterring economic activity. Differences arise in their focus; EKC addresses environmental economics and sustainability, whereas the Laffer Curve centers on fiscal policy and taxation efficiency.

Implications for Economic Policy

The Environmental Kuznets curve suggests that economic growth initially leads to environmental degradation but improves after reaching a certain income threshold, implying policies should balance growth with sustainable practices. The Laffer curve illustrates the relationship between tax rates and tax revenue, indicating that excessive taxation can reduce government income and economic activity, guiding optimal tax policy design. Both curves emphasize the need for careful calibration in economic policy to achieve sustainable development and efficient resource allocation.

Criticisms and Limitations of Both Models

The Environmental Kuznets Curve (EKC) faces criticism for oversimplifying the relationship between economic growth and environmental degradation, often ignoring factors like technological changes and policy interventions that significantly impact emissions. The Laffer Curve, which illustrates the relationship between tax rates and tax revenue, is limited by its reliance on speculative assumptions about taxpayer behavior and lacks empirical consensus on its optimal tax rate turning point. Both models are constrained by their applicability to specific contexts and may produce misleading policy recommendations if applied universally without accounting for regional, economic, and social variations.

Empirical Evidence and Real-World Applications

Empirical evidence for the Environmental Kuznets Curve (EKC) often shows an inverted U-shaped relationship between economic growth and environmental degradation, with pollution rising in early development stages and declining after reaching a certain income threshold. Studies applying the Laffer Curve focus on taxation revenue, showing that tax rates beyond an optimal point reduce government income by discouraging work or investment, with real-world applications including income and corporate tax policy design. Both curves are used to inform policy: EKC guides sustainable development strategies by indicating when economic growth may lead to environmental improvement, while the Laffer Curve assists in maximizing tax revenue without hindering economic activity.

Conclusion: Relevance in Modern Economic Analysis

The Environmental Kuznets Curve (EKC) illustrates the relationship between economic growth and environmental degradation, suggesting pollution initially increases with growth but decreases after reaching a certain income threshold. The Laffer Curve demonstrates the link between tax rates and tax revenue, indicating there is an optimal tax rate maximizing government revenue without deterring economic activity. Both curves remain relevant in modern economic analysis by providing frameworks for policymakers to balance economic performance with sustainable environmental and fiscal outcomes.

Environmental Kuznets curve Infographic

libterm.com

libterm.com