Free banking refers to a monetary system where private banks issue their own currencies without direct government control, fostering competition and innovation in financial services. This decentralized approach can lead to more efficient money supply management and reduce the risks associated with centralized banking authorities. Explore the rest of the article to understand how free banking might impact your finances and the broader economy.

Table of Comparison

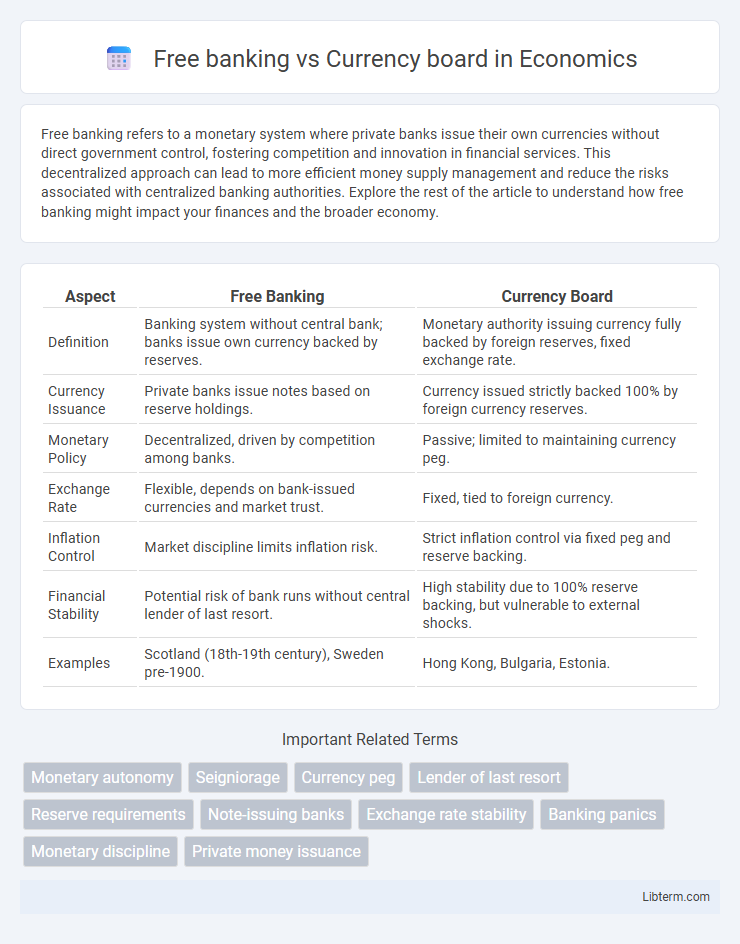

| Aspect | Free Banking | Currency Board |

|---|---|---|

| Definition | Banking system without central bank; banks issue own currency backed by reserves. | Monetary authority issuing currency fully backed by foreign reserves, fixed exchange rate. |

| Currency Issuance | Private banks issue notes based on reserve holdings. | Currency issued strictly backed 100% by foreign currency reserves. |

| Monetary Policy | Decentralized, driven by competition among banks. | Passive; limited to maintaining currency peg. |

| Exchange Rate | Flexible, depends on bank-issued currencies and market trust. | Fixed, tied to foreign currency. |

| Inflation Control | Market discipline limits inflation risk. | Strict inflation control via fixed peg and reserve backing. |

| Financial Stability | Potential risk of bank runs without central lender of last resort. | High stability due to 100% reserve backing, but vulnerable to external shocks. |

| Examples | Scotland (18th-19th century), Sweden pre-1900. | Hong Kong, Bulgaria, Estonia. |

Introduction to Free Banking and Currency Boards

Free banking refers to a monetary system where private banks issue their own currencies without central bank intervention, relying on market mechanisms to regulate supply and stability. Currency boards, on the other hand, are monetary authorities that maintain a fixed exchange rate by backing the domestic currency fully with a foreign reserve currency, thereby limiting discretionary monetary policy. Both systems aim to enhance monetary stability but differ fundamentally in their approach to currency issuance and control.

Historical Evolution of Monetary Systems

The historical evolution of monetary systems reveals that free banking, characterized by minimal government intervention and competitive issuance of banknotes, emerged prominently in Scotland and the United States during the 18th and 19th centuries. In contrast, currency boards originated in colonial territories like Hong Kong and Argentina in the late 19th century, establishing a fixed exchange rate system backed by foreign reserves to maintain monetary stability. These frameworks reflect divergent responses to banking crises and inflation, shaping modern monetary policy development and institutional design globally.

Core Principles of Free Banking

Free banking operates on the principle of competitive issuance of currency by private banks without central authority control, promoting market-driven regulation of the money supply through supply and demand dynamics. Banks maintain full convertibility of their banknotes into a commodity like gold, ensuring trust and stability within the monetary system. Unlike currency boards, free banking relies on decentralized decision-making and voluntary reserve management, minimizing government intervention and fostering innovation in banking practices.

Key Features of Currency Board Systems

Currency board systems maintain a fixed exchange rate by holding reserves of foreign currency equal to the domestic currency in circulation, ensuring full convertibility and preventing discretionary monetary policy. These systems impose strict rules limiting the central bank's ability to issue domestic currency without sufficient foreign reserves, promoting monetary stability and anchoring inflation expectations. Unlike free banking, currency boards rely on legal frameworks to guarantee currency value, providing credibility through automatic currency backing rather than market-driven competition.

Economic Stability: Free Banking vs Currency Board

Free banking systems rely on market-determined currency issuance, which can lead to greater financial innovation but may increase risks of bank runs and instability without adequate regulation. Currency boards maintain strict monetary discipline by pegging the domestic currency to a foreign anchor with fixed reserves, significantly reducing inflation and exchange rate volatility. While currency boards enhance economic stability through fixed exchange mechanisms, free banking offers flexibility that can foster competition but potentially at the cost of increased systemic risk.

Monetary Policy Flexibility and Constraints

Free banking allows financial institutions to issue currency with minimal government intervention, promoting competitive money supply but limiting centralized monetary policy control. Currency boards strictly peg the domestic currency to a foreign anchor, enforcing rigid monetary discipline and eliminating discretionary policy flexibility. This structure constrains the central bank's ability to adjust interest rates or engage in open market operations, ensuring currency stability at the cost of adaptability during economic shocks.

Impact on Inflation and Exchange Rates

Free banking systems often lead to greater monetary stability by allowing market forces to regulate money supply, which can reduce inflation volatility and foster more flexible exchange rates. Currency boards strictly peg the domestic currency to a foreign anchor, which typically stabilizes exchange rates and curbs inflation by limiting monetary policy discretion but can reduce the central bank's ability to respond to economic shocks. Studies indicate that currency boards provide stronger inflation control, while free banking may offer more adaptability but with a higher risk of inflation fluctuations and exchange rate volatility.

Banking Crises and Financial Stability

Free banking systems, characterized by minimal regulation and the issuance of private currencies, can lead to frequent banking crises due to lack of central oversight and potential liquidity shortages during panics. Currency boards enforce strict monetary discipline by pegging the domestic currency to a foreign anchor, enhancing financial stability and limiting inflation but reducing flexibility in monetary policy. Empirical evidence shows that currency boards reduce the risk of banking crises by maintaining currency convertibility and market confidence, while free banking's stability heavily depends on the robustness of private banks and market mechanisms.

Case Studies: Global Examples and Outcomes

Hong Kong's currency board system, established in 1983, has maintained a stable peg to the US dollar, contributing to low inflation and strong investor confidence, while fostering economic growth. In contrast, free banking examples such as Scotland in the 18th and 19th centuries showcased competitive note issuance by private banks, resulting in a resilient banking sector but occasional instability due to variable practices. Argentina's currency board in the 1990s initially curbed hyperinflation but collapsed under fiscal pressures, demonstrating risks of rigid monetary regimes compared to the flexibility seen in free banking systems like the Canadian provinces during the 1800s.

Conclusion: Comparative Effectiveness and Future Prospects

Free banking systems offer decentralized monetary control and greater financial innovation but face challenges in maintaining stability and preventing bank runs. Currency boards provide strict monetary discipline and exchange rate stability, reducing inflation risk but limiting monetary policy flexibility. Future prospects depend on economic context and policy priorities, with hybrid models potentially balancing autonomy and stability more effectively.

Free banking Infographic

libterm.com

libterm.com