Zero profit occurs when a business's total revenues equal its total costs, resulting in no net gain or loss. This scenario often indicates a break-even point, where fixed and variable costs are fully covered without generating surplus earnings. Explore the following sections to understand how zero profit impacts your business strategy and financial health.

Table of Comparison

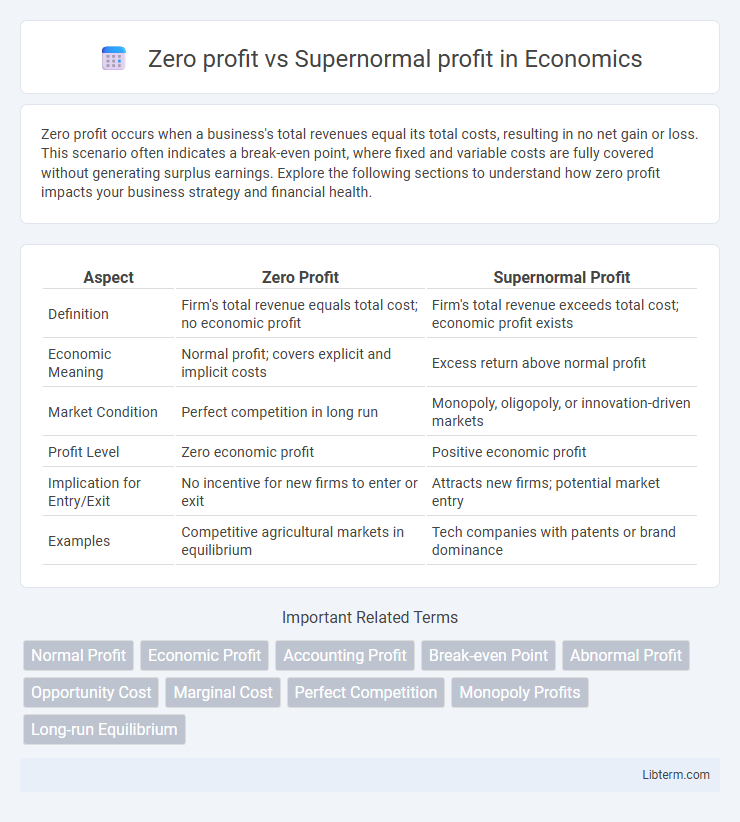

| Aspect | Zero Profit | Supernormal Profit |

|---|---|---|

| Definition | Firm's total revenue equals total cost; no economic profit | Firm's total revenue exceeds total cost; economic profit exists |

| Economic Meaning | Normal profit; covers explicit and implicit costs | Excess return above normal profit |

| Market Condition | Perfect competition in long run | Monopoly, oligopoly, or innovation-driven markets |

| Profit Level | Zero economic profit | Positive economic profit |

| Implication for Entry/Exit | No incentive for new firms to enter or exit | Attracts new firms; potential market entry |

| Examples | Competitive agricultural markets in equilibrium | Tech companies with patents or brand dominance |

Introduction to Zero Profit and Supernormal Profit

Zero profit occurs when a firm's total revenue equals its total costs, including both explicit and implicit costs, indicating no economic gain or loss. Supernormal profit refers to earnings that exceed the normal profit, representing returns above the opportunity costs of all resources employed. Understanding these concepts is essential for analyzing firm behavior and market efficiency in microeconomics.

Defining Zero Profit: Economic Normalcy

Zero profit, or normal profit, occurs when total revenue equals total costs, including both explicit and implicit expenses, signaling that a firm covers all opportunity costs without generating extra income. This equilibrium reflects economic normalcy, where resources are allocated efficiently, and firms have no incentive to enter or exit the market. In contrast, supernormal profit arises when revenue exceeds total costs, indicating abnormal gains and attracting new competitors.

Understanding Supernormal Profit: Beyond the Norm

Supernormal profit occurs when a firm's total revenue exceeds all explicit and implicit costs, resulting in earnings above the normal profit level, which only covers opportunity costs. This profit signals a firm's competitive advantage or market power, enabling reinvestment, innovation, and expansion beyond typical business operations. Contrasted with zero profit, where firms break even by covering costs without excess, supernormal profit motivates strategic growth and can attract new entrants seeking to capitalize on higher returns.

Key Differences Between Zero Profit and Supernormal Profit

Zero profit occurs when a firm's total revenue equals its total costs, including both explicit and implicit costs, resulting in no economic profit but covering all opportunity costs. Supernormal profit, also known as economic profit, arises when total revenue exceeds total costs, generating earnings above the normal expected return. The key differences lie in profit levels, with zero profit indicating break-even status and supernormal profit signaling exceptional returns and competitive advantage.

Zero Profit in Perfect Competition

Zero profit occurs in perfect competition when firms earn just enough revenue to cover all explicit and implicit costs, including opportunity costs, resulting in normal profit without economic gain. In this equilibrium, price equals average total cost, ensuring no incentive for firms to enter or exit the market. Zero economic profit signifies efficient resource allocation and long-term market stability under perfect competition.

Supernormal Profit in Imperfect Markets

Supernormal profit, also known as economic profit, occurs in imperfect markets when firms earn returns exceeding normal profit due to market power or barriers to entry. These profits arise from product differentiation, limited competition, or control over key resources, enabling firms to set prices above average total costs. Unlike zero profit equilibrium in perfect competition, supernormal profits incentivize innovation and can signal inefficiencies or market imperfections requiring regulatory oversight.

Causes of Zero Profit in Businesses

Zero profit in businesses occurs when total revenue equals total costs, including both explicit and implicit expenses, leading to normal profit but no economic profit. This situation often arises due to intense market competition, causing prices to align with average total costs, or when firms face high fixed costs and marginal returns diminish. In perfectly competitive markets, zero profit is a long-run equilibrium condition as entry and exit of firms drive profits to zero.

Factors Leading to Supernormal Profit

Supernormal profit arises when a firm's total revenue exceeds all explicit and implicit costs, often driven by factors such as market monopolization, innovation leading to unique products, and high barriers to entry that limit competition. Firms achieving supernormal profit typically benefit from strong brand loyalty, economies of scale, and strategic control over scarce resources. These conditions enable sustained abnormal returns, contrasting with zero profit scenarios where firms only cover opportunity costs and earn normal profit.

Long-run vs Short-run Profit Scenarios

In the short-run, firms may earn supernormal profits when total revenue exceeds total costs, including opportunity costs, due to temporary market conditions or limited competition. In contrast, the long-run equilibrium typically results in zero economic profit as new entrants increase supply, driving prices down to the point where firms cover all explicit and implicit costs but do not earn excess returns. This distinction highlights how short-run supernormal profits provide incentive for market entry, while zero profit in the long-run indicates an efficient, competitive market.

Implications for Entrepreneurs and Investors

Zero profit indicates that a firm's total revenue equals its total costs, signaling a break-even point where entrepreneurs cover all expenses without earning extra returns, often deterring new investments due to limited reward potential. In contrast, supernormal profit represents earnings exceeding all costs, attracting investors by signaling higher-than-average returns and encouraging entrepreneurs to innovate and expand operations. The presence of supernormal profits usually leads to increased market competition, driving efficiency and potentially benefiting consumers through improved products or lower prices.

Zero profit Infographic

libterm.com

libterm.com