Cash basis accounting records revenues and expenses only when cash is actually received or paid, providing a straightforward way to track your financial transactions. This method is ideal for small businesses and individuals due to its simplicity and immediate reflection of cash flow. Explore the rest of the article to understand how cash basis accounting impacts your financial decision-making and tax obligations.

Table of Comparison

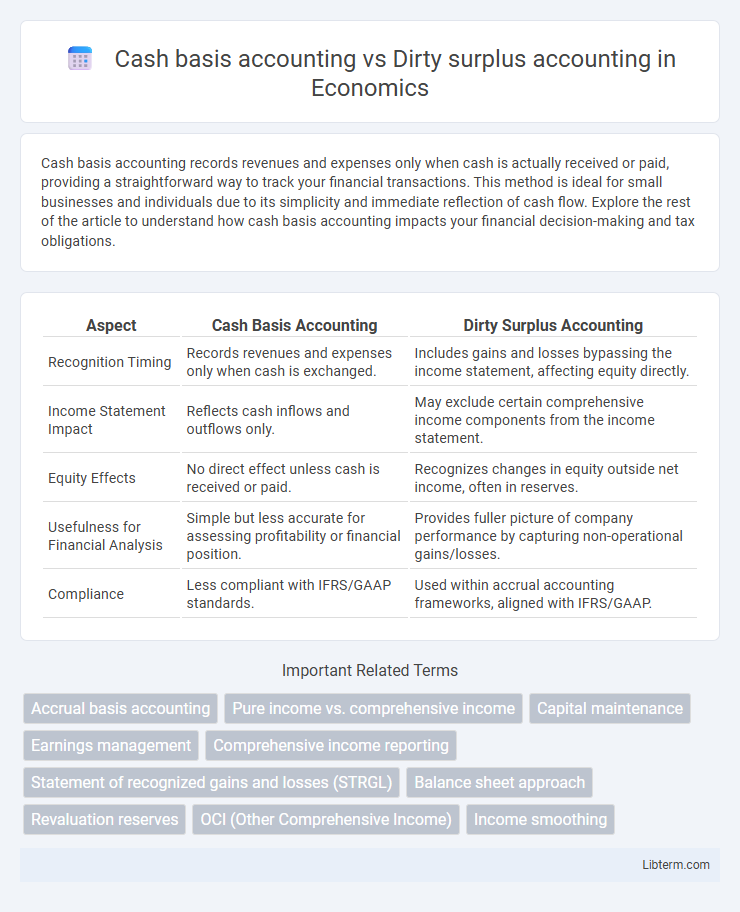

| Aspect | Cash Basis Accounting | Dirty Surplus Accounting |

|---|---|---|

| Recognition Timing | Records revenues and expenses only when cash is exchanged. | Includes gains and losses bypassing the income statement, affecting equity directly. |

| Income Statement Impact | Reflects cash inflows and outflows only. | May exclude certain comprehensive income components from the income statement. |

| Equity Effects | No direct effect unless cash is received or paid. | Recognizes changes in equity outside net income, often in reserves. |

| Usefulness for Financial Analysis | Simple but less accurate for assessing profitability or financial position. | Provides fuller picture of company performance by capturing non-operational gains/losses. |

| Compliance | Less compliant with IFRS/GAAP standards. | Used within accrual accounting frameworks, aligned with IFRS/GAAP. |

Introduction to Cash Basis Accounting

Cash basis accounting records revenues and expenses only when cash is exchanged, providing a straightforward snapshot of cash flow for small businesses and individuals. Unlike dirty surplus accounting, which includes certain gains and losses outside net income, cash basis ignores receivables and payables, leading to less complex financial statements. This method simplifies tax reporting and cash management but may not accurately reflect long-term financial performance.

Overview of Dirty Surplus Accounting

Dirty surplus accounting records certain gains and losses directly in equity without passing through the income statement, distinguishing it from cash basis accounting which recognizes transactions only when cash changes hands. This method captures comprehensive adjustments such as unrealized gains or losses on assets and liabilities, providing a broader view of a company's financial position. By incorporating items outside traditional profit and loss, dirty surplus accounting enhances transparency around equity changes not reflected in net income.

Key Principles of Cash Basis Accounting

Cash basis accounting records revenues and expenses only when cash is actually received or paid, emphasizing simplicity and immediate cash flow tracking. This method does not recognize accounts receivable or payable, focusing solely on cash transactions to provide a clear view of actual cash position. Key principles include recognizing income upon receipt and expenses upon payment, facilitating straightforward financial management for small businesses and individuals.

Main Features of Dirty Surplus Accounting

Dirty surplus accounting records certain income and expense items directly in equity without passing through the income statement, diverging from cash basis accounting, which recognizes transactions only when cash changes hands. It captures unrealized gains and losses, revaluations, and other comprehensive income elements outside net income, providing a broader view of financial performance. This method enhances transparency regarding changes in shareholders' equity that are not reflected in net profit, aiding stakeholders in assessing long-term financial health.

Recognition of Revenue and Expenses

Cash basis accounting recognizes revenue and expenses only when cash is received or paid, providing a straightforward reflection of cash flow but potentially distorting the matching of revenues with related expenses. Dirty surplus accounting, also known as comprehensive income accounting, includes certain gains and losses in equity that are bypassed from the income statement, affecting how revenue and expenses are recognized by incorporating unrealized changes such as foreign currency translation adjustments and certain financial instrument valuations. This approach offers a more comprehensive view of financial performance by capturing items that impact equity directly, beyond the traditional revenue and expense recognition under cash basis accounting.

Impact on Financial Statements

Cash basis accounting records revenues and expenses only when cash is exchanged, resulting in financial statements that reflect actual cash flow but may omit accrued liabilities or receivables. Dirty surplus accounting includes certain gains and losses directly in equity rather than in the income statement, affecting the presentation of comprehensive income and potentially obscuring the true profitability during a period. The choice between these methods significantly impacts financial statement transparency, comparability, and the assessment of a company's financial performance.

Transparency and Reliability Comparison

Cash basis accounting records transactions only when cash changes hands, often limiting transparency by excluding receivables and payables, which may result in less reliable financial statements. Dirty surplus accounting adjusts equity without affecting net income, potentially obscuring comprehensive income components and reducing clarity for stakeholders seeking transparent financial performance. Comparing the two, cash basis provides straightforward cash flow insight but lacks accrual accuracy, while dirty surplus includes unrealized gains or losses, complicating transparency and reliability assessments.

Advantages and Disadvantages of Each Method

Cash basis accounting offers simplicity and immediate recognition of cash flow, making it ideal for small businesses with straightforward transactions, but it can misrepresent long-term financial health by ignoring receivables and payables. Dirty surplus accounting recognizes all changes in equity that bypass net income, providing a fuller picture of financial performance, especially for complex financial instruments, but it complicates analysis and reduces comparability due to the inclusion of unrealized gains and losses. The choice between cash basis and dirty surplus accounting impacts financial transparency, tax reporting, and decision-making quality depending on the organization's size, regulatory environment, and stakeholder needs.

Regulatory and Compliance Considerations

Cash basis accounting simplifies regulatory compliance by recording transactions only when cash changes hands, often leading to fewer reporting requirements for small businesses. Dirty surplus accounting, which involves recognizing gains and losses directly in equity without passing through the income statement, presents challenges for regulators due to the reduced transparency in financial performance reporting. Regulatory frameworks like IFRS and GAAP generally prefer accrual accounting methods, making adherence to dirty surplus principles more complex under compliance standards.

Choosing the Right Accounting Method

Cash basis accounting records revenues and expenses only when cash is exchanged, providing a straightforward view of cash flow suitable for small businesses and simple financial monitoring. Dirty surplus accounting recognizes changes in equity from non-owner sources, including unrealized gains and losses, offering a comprehensive approach useful for assessing true economic performance and comprehensive income. Choosing the right accounting method depends on the organization's complexity, regulatory requirements, and the need for detailed financial insight versus simplicity in reporting.

Cash basis accounting Infographic

libterm.com

libterm.com