The Capital Asset Pricing Model (CAPM) explains the relationship between expected return and risk of investing in a security, helping investors determine a fair expected return based on market volatility and the asset's sensitivity to overall market movements. By calculating the systematic risk through beta, CAPM aids in optimizing your investment portfolio to maximize returns while managing risk. Explore the article to understand how CAPM can improve your investment decisions and portfolio management.

Table of Comparison

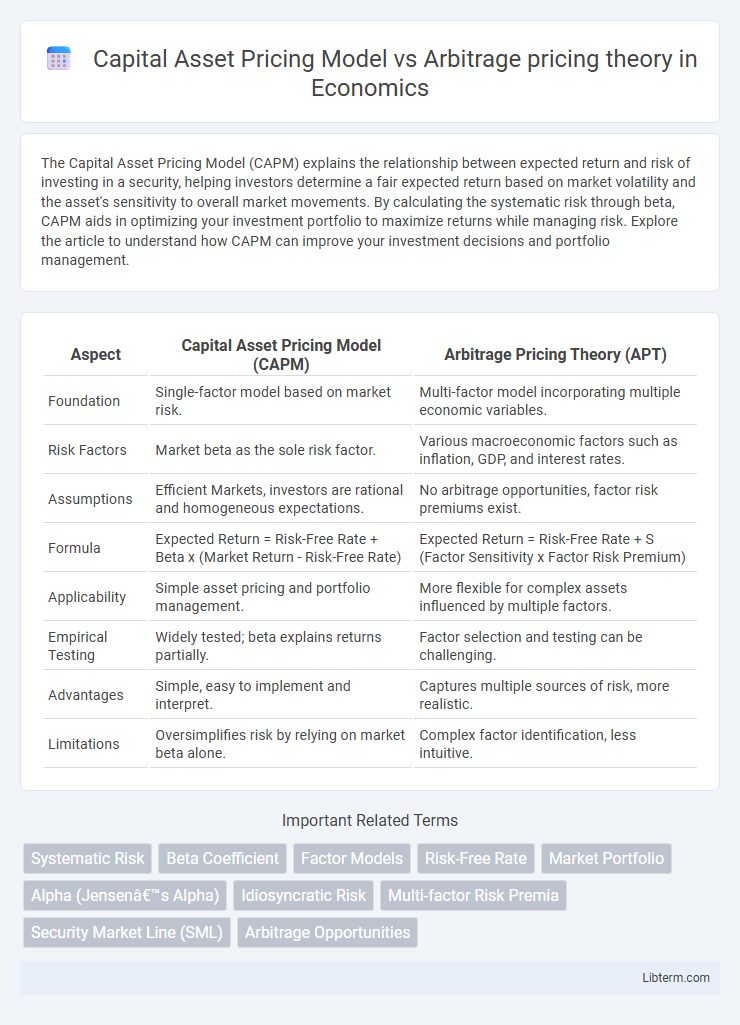

| Aspect | Capital Asset Pricing Model (CAPM) | Arbitrage Pricing Theory (APT) |

|---|---|---|

| Foundation | Single-factor model based on market risk. | Multi-factor model incorporating multiple economic variables. |

| Risk Factors | Market beta as the sole risk factor. | Various macroeconomic factors such as inflation, GDP, and interest rates. |

| Assumptions | Efficient Markets, investors are rational and homogeneous expectations. | No arbitrage opportunities, factor risk premiums exist. |

| Formula | Expected Return = Risk-Free Rate + Beta x (Market Return - Risk-Free Rate) | Expected Return = Risk-Free Rate + S (Factor Sensitivity x Factor Risk Premium) |

| Applicability | Simple asset pricing and portfolio management. | More flexible for complex assets influenced by multiple factors. |

| Empirical Testing | Widely tested; beta explains returns partially. | Factor selection and testing can be challenging. |

| Advantages | Simple, easy to implement and interpret. | Captures multiple sources of risk, more realistic. |

| Limitations | Oversimplifies risk by relying on market beta alone. | Complex factor identification, less intuitive. |

Introduction to Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT)

The Capital Asset Pricing Model (CAPM) quantifies the relationship between expected return and systemic risk through the beta coefficient, emphasizing market portfolio as the sole risk factor influencing asset prices. Arbitrage Pricing Theory (APT) expands on this by incorporating multiple macroeconomic factors such as inflation, interest rates, and GDP growth, allowing more flexibility in explaining asset returns beyond market risk alone. Both models serve as fundamental frameworks in financial economics for asset pricing but differ in assumptions and factor complexity.

Historical Development of CAPM and APT

The Capital Asset Pricing Model (CAPM), developed in the 1960s by William Sharpe, John Lintner, and Jan Mossin, introduced a pioneering framework linking systematic risk to expected asset returns using the market beta concept. In contrast, the Arbitrage Pricing Theory (APT), proposed by Stephen Ross in 1976, expanded on CAPM by incorporating multiple risk factors beyond market risk, offering a more flexible alternative grounded in arbitrage opportunities. Both models emerged to address asset pricing but differ fundamentally in risk factor assumptions and empirical applications.

Key Assumptions Underlying CAPM and APT

The Capital Asset Pricing Model (CAPM) assumes investors are rational and markets are frictionless with a single-period investment horizon, relying on a linear relationship between expected return and market risk measured by beta. Arbitrage Pricing Theory (APT) relaxes CAPM's restrictive assumptions, allowing multiple macroeconomic risk factors to drive asset returns without requiring market equilibrium or mean-variance optimization. APT assumes no arbitrage opportunities exist, investors are risk-averse, and asset returns have a linear factor structure influenced by several systematic risk factors.

Mathematical Formulation: CAPM vs APT

The Capital Asset Pricing Model (CAPM) mathematically expresses the expected return of an asset as \( E(R_i) = R_f + \beta_i (E(R_m) - R_f) \), where \( R_f \) is the risk-free rate, \( \beta_i \) measures the sensitivity of asset \( i \) to market returns \( R_m \). Arbitrage Pricing Theory (APT) models returns as a linear function of multiple macroeconomic factors: \( R_i = \alpha_i + \beta_{i1}F_1 + \beta_{i2}F_2 + \cdots + \beta_{in}F_n + \epsilon_i \), where \( \beta_{ij} \) represents asset sensitivity to factor \( F_j \) and \( \epsilon_i \) is the idiosyncratic error term. Unlike CAPM's single-factor model, APT's multifactor approach provides a flexible framework for capturing diverse risk sources affecting asset returns.

Risk Factors Considered in CAPM and APT

The Capital Asset Pricing Model (CAPM) considers a single systemic risk factor, represented by the market portfolio's excess return, to explain asset prices and expected returns. In contrast, Arbitrage Pricing Theory (APT) incorporates multiple macroeconomic and firm-specific risk factors, such as inflation, interest rates, and industrial production, offering a multifactor approach to asset pricing. APT's flexibility in capturing diverse risk sources provides a more comprehensive framework for explaining variations in asset returns beyond market risk alone.

Strengths and Limitations of CAPM

The Capital Asset Pricing Model (CAPM) offers a straightforward approach to estimating expected returns based on systematic risk measured by beta, facilitating portfolio management and cost of capital calculations. Its strengths include simplicity, ease of use, and the ability to quantify the relationship between risk and return. Limitations involve unrealistic assumptions such as single-factor market risk, market efficiency, and equal borrowing/lending rates, which can lead to inaccurate predictions in complex, multi-factor real-world markets compared to the Arbitrage Pricing Theory (APT).

Advantages and Drawbacks of APT

Arbitrage Pricing Theory (APT) provides a multi-factor approach to asset pricing that captures various macroeconomic risks, offering greater flexibility and a more realistic explanation of asset returns compared to the single-factor Capital Asset Pricing Model (CAPM). APT's advantages include incorporating multiple systematic risk factors and not relying on the market portfolio assumption, enhancing its empirical applicability. However, its drawbacks involve the difficulty in accurately identifying relevant factors and estimating their risk premiums, leading to potential model specification errors and less intuitive interpretation relative to CAPM.

Practical Applications in Portfolio Management

The Capital Asset Pricing Model (CAPM) is widely used for estimating expected returns based on systematic risk, aiding portfolio managers in optimizing asset allocation through the beta coefficient. Arbitrage Pricing Theory (APT) offers a multifactor approach, allowing portfolio managers to assess multiple economic variables impacting asset returns, thus enhancing risk diversification strategies. Practical application of CAPM suits simpler portfolios emphasizing market risk, while APT supports more complex portfolios requiring sensitivity analysis to multiple macroeconomic factors.

Empirical Evidence and Performance Comparisons

Empirical evidence reveals mixed performance comparisons between the Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT), with CAPM often criticized for its single-factor limitation focusing solely on market risk premium. APT demonstrates superior empirical validation by incorporating multiple macroeconomic factors such as inflation rates, industrial production, and interest rates, enhancing its explanatory power for asset returns. Despite APT's complexity, studies indicate it generally provides more accurate risk-return predictions across diverse portfolios, challenging CAPM's foundational assumptions and practical application.

Choosing Between CAPM and APT: Practical Guidelines

Choosing between the Capital Asset Pricing Model (CAPM) and Arbitrage Pricing Theory (APT) depends on the complexity of the investment environment and data availability. CAPM is ideal for portfolios influenced primarily by market risk and provides a straightforward beta-based risk-return relationship, while APT accommodates multiple macroeconomic factors for more nuanced risk assessment in diverse markets. Investors should prefer CAPM for simplicity and intuitive interpretation, whereas APT is suited for scenarios requiring multifactor modeling and greater specificity in capturing systematic risk.

Capital Asset Pricing Model Infographic

libterm.com

libterm.com