Remittances are financial transfers sent by migrants to family members in their home countries, providing essential economic support and boosting local economies. These funds often help cover basic needs such as food, education, and healthcare, making a significant impact on poverty reduction and social welfare. Discover how understanding remittances can benefit Your financial planning and community development in the rest of this article.

Table of Comparison

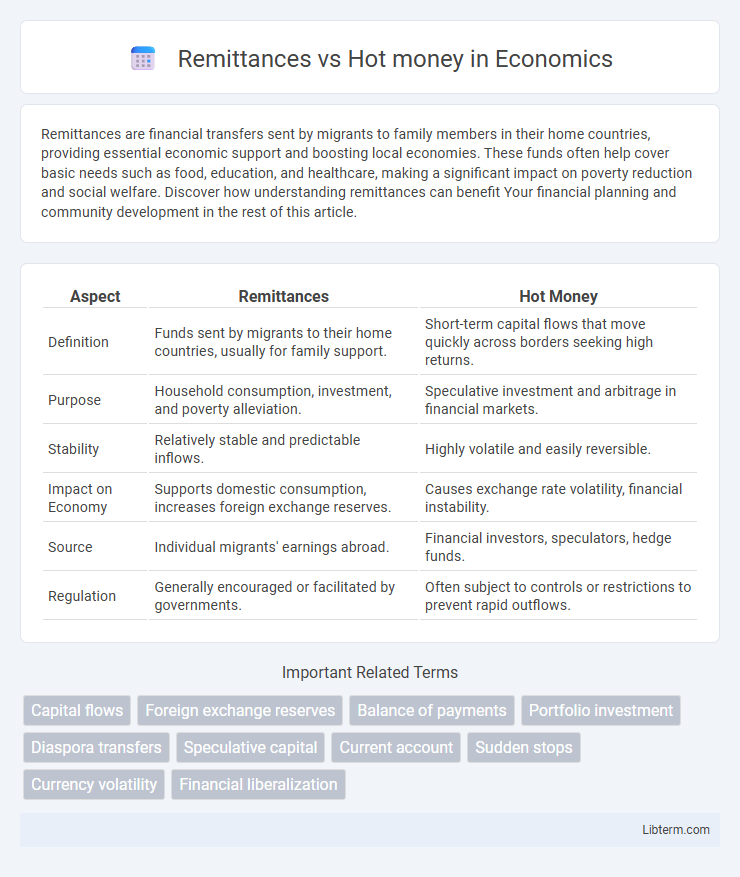

| Aspect | Remittances | Hot Money |

|---|---|---|

| Definition | Funds sent by migrants to their home countries, usually for family support. | Short-term capital flows that move quickly across borders seeking high returns. |

| Purpose | Household consumption, investment, and poverty alleviation. | Speculative investment and arbitrage in financial markets. |

| Stability | Relatively stable and predictable inflows. | Highly volatile and easily reversible. |

| Impact on Economy | Supports domestic consumption, increases foreign exchange reserves. | Causes exchange rate volatility, financial instability. |

| Source | Individual migrants' earnings abroad. | Financial investors, speculators, hedge funds. |

| Regulation | Generally encouraged or facilitated by governments. | Often subject to controls or restrictions to prevent rapid outflows. |

Introduction to Remittances and Hot Money

Remittances represent funds transferred by migrants to their home countries, serving as a stable source of income that supports household consumption and economic development. Hot money refers to the rapid movement of capital across borders seeking short-term financial gains, often causing volatility in financial markets. Understanding the distinct characteristics and impacts of remittances and hot money is crucial for assessing their roles in global financial flows and economic stability.

Definition and Core Differences

Remittances refer to the funds transferred by migrants to their home countries, primarily used for household consumption, education, and healthcare, providing a stable source of foreign exchange for developing economies. Hot money involves short-term capital flows driven by speculative motives, seeking quick returns through interest rate differentials or exchange rate movements, often leading to financial market volatility. The core difference lies in remittances' stable, long-term contribution to domestic income versus hot money's volatile, profit-driven movements affecting exchange rates and financial stability.

Sources and Drivers of Remittances

Remittances primarily originate from migrant workers sending money back to their home countries, driven by family obligations and economic support needs. Hot money consists of short-term capital flows, driven by speculative investments and seeking rapid financial returns in foreign exchange or asset markets. Unlike volatile hot money, remittances provide a stable and consistent source of foreign exchange inflows supporting household consumption and development in recipient countries.

Motivations Behind Hot Money Flows

Hot money flows are primarily driven by short-term profit opportunities, speculative investments, and rapid changes in interest rates or economic conditions. Investors seek to capitalize on currency arbitrage, high-yield interest rates, and stock market fluctuations in emerging or developed economies. Unlike remittances, which are stable funds sent for family support or economic development, hot money is highly volatile and can exacerbate financial instability.

Economic Impact of Remittances

Remittances provide stable and significant financial inflows that support household consumption, poverty reduction, and human capital development in developing countries, contrasting with the short-term, volatile nature of hot money flows that can destabilize economies. Remittance inflows often increase foreign exchange reserves and improve credit ratings, fostering economic resilience and long-term growth. Unlike hot money, which seeks quick profits and can trigger financial crises, remittances directly contribute to sustainable development by enhancing income security and investment in education and health.

Economic Impact of Hot Money

Hot money refers to short-term, speculative capital flows that quickly move in and out of economies seeking high returns, causing significant volatility in exchange rates and financial markets. Unlike stable remittances, hot money can lead to inflationary pressures, asset bubbles, and abrupt capital flight, undermining economic stability. Countries heavily reliant on hot money face challenges in sustaining long-term economic growth due to unpredictable financial inflows and outflows.

Stability and Risks: Remittances vs Hot Money

Remittances provide a stable source of foreign exchange due to their consistent inflow from expatriates supporting families, whereas hot money is highly volatile, driven by speculative capital seeking short-term gains. The stability of remittances helps reduce exchange rate volatility and supports economic development, while hot money inflows and sudden withdrawals can lead to financial instability and crises. Central banks often implement regulatory measures to manage hot money risks, but remittances typically face fewer restrictions because of their vital role in sustaining household incomes.

Policy Implications and Regulatory Challenges

Remittances provide stable foreign exchange inflows supporting economic development, while hot money is volatile and can destabilize financial markets through rapid capital flight. Policymakers face regulatory challenges balancing capital controls to mitigate hot money risks without discouraging remittance flows crucial for livelihoods. Effective regulation requires transparent monitoring systems, cross-border cooperation, and tailored policies that differentiate stable remittances from speculative capital movements.

Case Studies: Global Examples

Remittances play a crucial role in stabilizing the economies of countries like the Philippines and Mexico, providing steady foreign exchange inflow that supports household consumption and poverty reduction. In contrast, hot money flows, observed prominently in emerging markets such as India and Brazil, often lead to currency volatility and pose challenges for monetary policy due to their short-term speculative nature. Case studies reveal that while remittances contribute to long-term economic resilience, hot money requires stringent regulatory frameworks to mitigate financial instability.

Future Trends and Outlook

Remittances are projected to remain a stable source of foreign currency inflows, driven by growing migrant populations and digital payment innovations that enhance transfer efficiency and reduce costs. Hot money flows are expected to become increasingly volatile as global interest rates and geopolitical uncertainties influence short-term capital movements, heightening risks of sudden capital flight in emerging markets. Advances in financial technology and regulatory frameworks will play a critical role in shaping the future dynamics between long-term remittance inflows and short-term speculative hot money.

Remittances Infographic

libterm.com

libterm.com