Debt forgiveness can provide crucial financial relief by eliminating part or all of your outstanding debt, helping to improve credit scores and reduce stress. It often requires meeting specific eligibility criteria and understanding the potential tax implications associated with forgiven amounts. Explore the full article to learn how debt forgiveness could impact your financial future and what steps to take next.

Table of Comparison

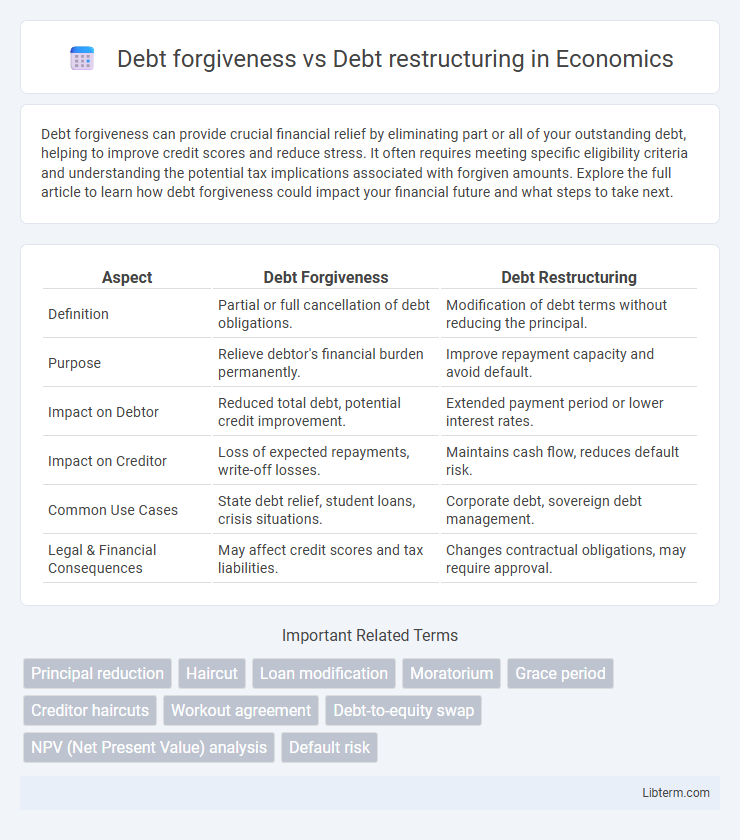

| Aspect | Debt Forgiveness | Debt Restructuring |

|---|---|---|

| Definition | Partial or full cancellation of debt obligations. | Modification of debt terms without reducing the principal. |

| Purpose | Relieve debtor's financial burden permanently. | Improve repayment capacity and avoid default. |

| Impact on Debtor | Reduced total debt, potential credit improvement. | Extended payment period or lower interest rates. |

| Impact on Creditor | Loss of expected repayments, write-off losses. | Maintains cash flow, reduces default risk. |

| Common Use Cases | State debt relief, student loans, crisis situations. | Corporate debt, sovereign debt management. |

| Legal & Financial Consequences | May affect credit scores and tax liabilities. | Changes contractual obligations, may require approval. |

Introduction to Debt Forgiveness and Debt Restructuring

Debt forgiveness involves the cancellation of a portion or entire amount of debt by the creditor, relieving the borrower of repayment obligations and improving financial stability. Debt restructuring refers to the reorganization of debt terms, such as extending repayment periods, lowering interest rates, or reducing principal to enhance the borrower's ability to meet obligations without eliminating the debt entirely. Both approaches aim to alleviate financial distress but differ in the extent of debt relief provided and their impact on credit profiles.

Key Differences Between Debt Forgiveness and Debt Restructuring

Debt forgiveness involves the creditor canceling a portion or all of the debtor's outstanding debt, effectively reducing the total amount owed without requiring repayment, while debt restructuring modifies the terms of the debt through extended deadlines, reduced interest rates, or altered payment schedules to make repayment more manageable. Debt forgiveness directly lowers the principal balance, often impacting the creditor's financial statements and the debtor's credit rating, whereas debt restructuring maintains the debt but adjusts its conditions to prevent default. Key differences include the impact on the borrower's obligations, the creditor's financial recovery approach, and the long-term consequences on creditworthiness and fiscal stability.

Pros and Cons of Debt Forgiveness

Debt forgiveness eliminates part or all of a borrower's debt, providing immediate financial relief and improving cash flow, but it can negatively impact the lender's balance sheet and credit market stability. It often leads to credit rating downgrades for the borrower, potentially limiting future borrowing capacity, while fostering moral hazard if borrowers expect future debts to be forgiven. Debt forgiveness alleviates economic distress for individuals or countries but may distort market incentives and reduce accountability in debt repayment.

Pros and Cons of Debt Restructuring

Debt restructuring allows borrowers to modify loan terms, often resulting in lower interest rates or extended payment periods, which can improve cash flow and prevent default. However, it may negatively impact credit ratings and could involve fees or stricter loan covenants. Compared to debt forgiveness, restructuring preserves the borrower's obligation to repay, maintaining creditor relationships while providing financial relief.

Financial Impact on Borrowers

Debt forgiveness reduces the borrower's total outstanding balance, offering immediate relief by lowering monthly payments and improving cash flow, which can positively impact credit scores if reported favorably. Debt restructuring modifies the loan terms, such as extending the repayment period or reducing interest rates, resulting in manageable payments without erasing the debt, allowing borrowers to maintain creditworthiness while avoiding default. Both strategies aim to alleviate financial strain, but debt forgiveness provides a more direct reduction in liability, whereas restructuring focuses on enhanced affordability over time.

Consequences for Creditors and Lenders

Debt forgiveness results in creditors absorbing a direct financial loss as the borrower's outstanding debt is partially or fully written off, reducing recoverable assets and potentially impacting profitability and credit risk assessments. Debt restructuring alters the terms of the debt, such as extending maturity dates or lowering interest rates, allowing creditors to recover more funds over time but possibly at a lower total yield and with delayed cash flows. Both strategies affect lenders' balance sheets and risk profiles, but debt restructuring generally preserves creditor claims better, maintaining some level of repayment compared to the definitive loss in debt forgiveness.

Typical Scenarios for Debt Forgiveness

Debt forgiveness typically occurs in scenarios involving severe financial distress, such as in sovereign debt crises where countries cannot meet obligations, or in personal debt cases like student loans and medical bills where borrowers face insurmountable hardship. Creditors may agree to forgive a portion or the entirety of the debt to avoid default or insolvency, often following prolonged negotiations or bankruptcy proceedings. This approach differs from debt restructuring, which usually modifies terms without canceling debt, focusing instead on extending payment periods or reducing interest rates.

Common Approaches to Debt Restructuring

Common approaches to debt restructuring include extending loan maturities, reducing interest rates, and converting debt into equity to improve the borrower's financial stability. These strategies aim to avoid default by adjusting repayment terms while maintaining creditor relationships, unlike debt forgiveness which entails partial or full cancellation of debt obligations. Structured negotiations between creditors and debtors often result in tailored solutions that balance risk mitigation with long-term economic recovery.

Long-Term Effects on Credit Scores

Debt forgiveness typically has a more severe negative impact on credit scores because it involves the lender writing off a portion or all of the debt, which creditors report as a loss and can remain on credit reports for up to seven years. Debt restructuring, on the other hand, often results in modified payment terms that can improve the borrower's ability to repay, potentially stabilizing or even gradually improving credit scores over time. Long-term effects of debt restructuring are generally less damaging than forgiveness, as it demonstrates a commitment to repayment rather than default.

Choosing the Right Option: Which Solution Fits Your Situation?

Debt forgiveness permanently reduces or eliminates the borrower's outstanding debt, often benefiting individuals or businesses facing severe financial hardship. Debt restructuring modifies the terms of the existing loan, such as extending payment periods or lowering interest rates, making it suitable for borrowers aiming to regain financial stability without completely erasing their obligations. Choosing the right option depends on your financial condition, credit impact considerations, and long-term repayment capabilities.

Debt forgiveness Infographic

libterm.com

libterm.com