Total assets represent the complete value of everything a company owns, including cash, investments, property, and equipment, reflecting its financial strength and stability. Accurately assessing total assets is crucial for understanding your business's net worth and making informed financial decisions. Explore the rest of the article to learn how to evaluate and optimize your total assets effectively.

Table of Comparison

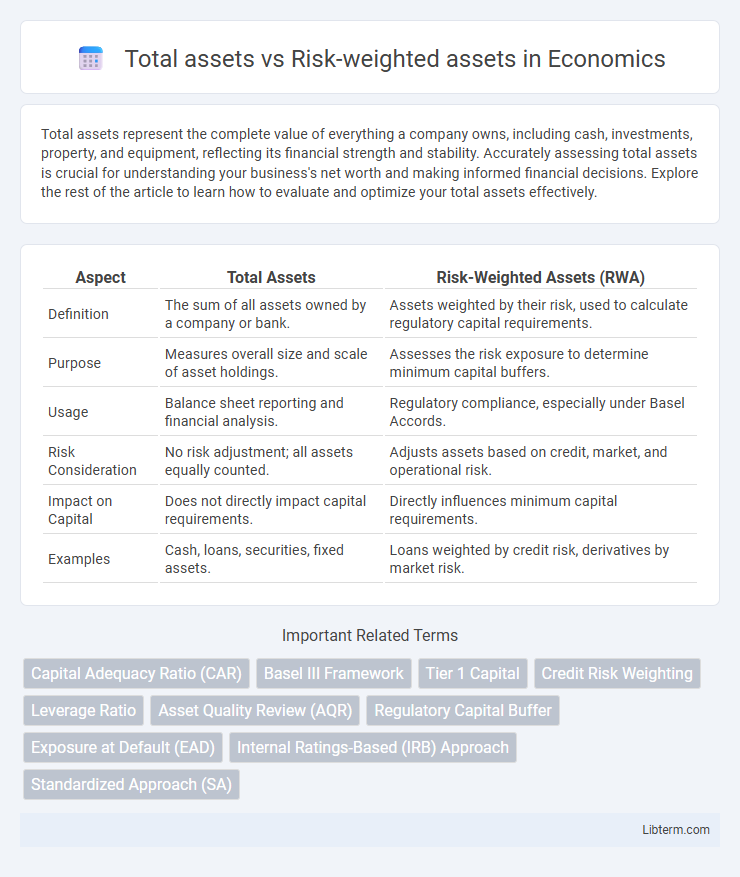

| Aspect | Total Assets | Risk-Weighted Assets (RWA) |

|---|---|---|

| Definition | The sum of all assets owned by a company or bank. | Assets weighted by their risk, used to calculate regulatory capital requirements. |

| Purpose | Measures overall size and scale of asset holdings. | Assesses the risk exposure to determine minimum capital buffers. |

| Usage | Balance sheet reporting and financial analysis. | Regulatory compliance, especially under Basel Accords. |

| Risk Consideration | No risk adjustment; all assets equally counted. | Adjusts assets based on credit, market, and operational risk. |

| Impact on Capital | Does not directly impact capital requirements. | Directly influences minimum capital requirements. |

| Examples | Cash, loans, securities, fixed assets. | Loans weighted by credit risk, derivatives by market risk. |

Introduction to Total Assets and Risk-Weighted Assets

Total assets represent the sum of everything a company owns, including cash, investments, property, and receivables, reflecting the overall size of the balance sheet. Risk-weighted assets (RWA) assign different weights to assets based on their risk profiles, helping regulators assess the capital adequacy of financial institutions more accurately. Understanding the distinction between total assets and RWA is crucial for effective risk management and regulatory compliance in banking.

Defining Total Assets in Banking

Total assets in banking represent the aggregate value of all financial resources owned by a bank, including loans, securities, cash, and physical assets. These assets are recorded on the balance sheet at their book value, reflecting the bank's capacity to generate income and absorb losses. Total assets differ from risk-weighted assets, which adjust asset values based on credit risk to determine regulatory capital requirements.

Understanding Risk-Weighted Assets (RWA)

Risk-weighted assets (RWA) represent a bank's total assets adjusted for credit risk, market risk, and operational risk, reflecting the potential losses the institution could face. Unlike total assets, which include all holdings at face value, RWAs assign varying risk weights to different asset classes to measure the actual risk exposure more accurately. Understanding RWA is crucial for regulatory capital requirements, as it determines the minimum capital banks must hold to be protected against financial distress.

Key Differences Between Total Assets and Risk-Weighted Assets

Total assets represent the entire value of a bank's holdings, including loans, securities, and cash, without adjusting for risk, while risk-weighted assets (RWA) assign specific risk weights to different asset types to assess the bank's exposure to credit risk. RWAs are essential for regulatory capital calculations, ensuring banks maintain sufficient capital buffers based on the riskiness of their assets rather than their total size. Key differences include that total assets provide a gross measure of size, whereas RWAs offer a risk-adjusted measure critical for evaluating financial stability and regulatory compliance.

Importance of Measuring Total Assets

Measuring total assets provides a comprehensive snapshot of a company's or bank's entire asset base, which is crucial for assessing overall financial size and operational capacity. Total assets include all owned resources such as cash, investments, property, and receivables, offering a broader perspective than risk-weighted assets (RWA), which focus solely on risk exposure. Understanding total assets enables better strategic planning, liquidity management, and regulatory compliance by capturing the full scale of asset holdings beyond risk-adjusted values.

Significance of Risk-Weighted Assets in Regulatory Compliance

Risk-weighted assets (RWAs) represent the total assets adjusted for credit, market, and operational risks, serving as a critical metric for banks in assessing regulatory capital requirements. Regulatory frameworks like Basel III mandate that financial institutions maintain a minimum capital ratio based on RWAs to ensure stability and absorb potential losses. Unlike total assets, which quantify overall holdings, RWAs provide a risk-sensitive measure that directly influences capital adequacy, safeguarding the banking system against systemic risks.

Impact on Capital Adequacy Ratios

Total assets represent the overall value of a bank's holdings, while risk-weighted assets (RWAs) adjust this value based on the credit risk associated with each asset. Capital adequacy ratios, such as the Common Equity Tier 1 (CET1) ratio, are calculated using capital divided by RWAs, making RWAs more critical than total assets for regulatory assessments. A higher level of RWAs relative to total assets typically results in a lower capital adequacy ratio, impacting a bank's perceived financial stability and regulatory capital requirements.

Role in Banking Risk Management

Total assets represent the complete value of everything a bank owns, while risk-weighted assets (RWAs) adjust these assets based on their credit, market, and operational risks to reflect potential losses more accurately. RWAs play a critical role in banking risk management by determining the minimum capital requirements banks must hold under regulatory frameworks like Basel III, ensuring resilience against financial stress. Effective management of RWAs helps banks optimize capital allocation, maintain solvency, and comply with regulatory standards to mitigate systemic risk.

Implications for Financial Reporting and Analysis

Total assets represent the book value of all assets held by a financial institution, while risk-weighted assets (RWA) adjust these assets based on their credit, market, and operational risk profiles, influencing regulatory capital requirements. Financial reporting must distinguish between these measures to accurately reflect the institution's risk exposure and capital adequacy under frameworks like Basel III. Analysts rely on RWA to assess the true risk-adjusted performance and stability of financial entities, as total assets alone may obscure underlying risk levels.

Conclusion: Choosing the Right Metric for Financial Assessment

Total assets provide a broad measure of a company's or bank's size and overall financial strength, while risk-weighted assets (RWA) offer a more precise evaluation by adjusting asset values according to their risk profiles, which is essential for regulatory capital requirements. Selecting between total assets and RWA depends on the context of the financial assessment; total assets suit general size and leverage analysis, whereas RWA is critical for understanding risk exposure and capital adequacy under Basel III frameworks. Effective financial decision-making and regulatory compliance hinge on the integration of both metrics, leveraging total assets for scale and RWA for risk-sensitive capital evaluation.

Total assets Infographic

libterm.com

libterm.com