The Permanent Income Hypothesis suggests that an individual's consumption decisions are driven by their long-term income expectations rather than current income fluctuations, promoting smoother spending patterns over time. This theory helps explain why temporary changes in income have less impact on consumption behavior compared to permanent income shifts. Discover how understanding this concept can enhance your insights into economic behavior in the rest of the article.

Table of Comparison

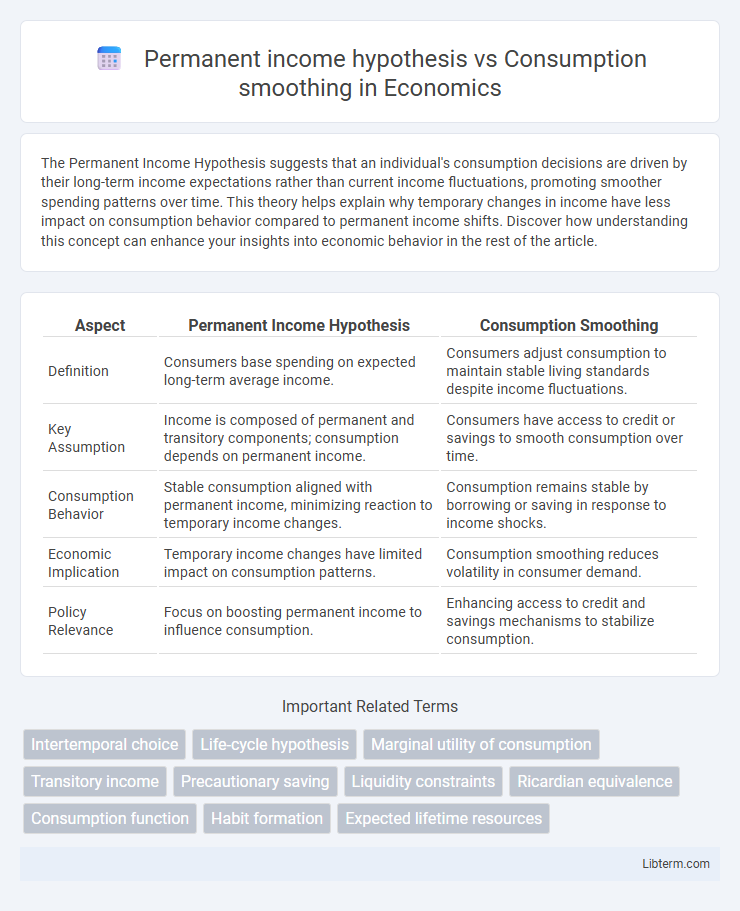

| Aspect | Permanent Income Hypothesis | Consumption Smoothing |

|---|---|---|

| Definition | Consumers base spending on expected long-term average income. | Consumers adjust consumption to maintain stable living standards despite income fluctuations. |

| Key Assumption | Income is composed of permanent and transitory components; consumption depends on permanent income. | Consumers have access to credit or savings to smooth consumption over time. |

| Consumption Behavior | Stable consumption aligned with permanent income, minimizing reaction to temporary income changes. | Consumption remains stable by borrowing or saving in response to income shocks. |

| Economic Implication | Temporary income changes have limited impact on consumption patterns. | Consumption smoothing reduces volatility in consumer demand. |

| Policy Relevance | Focus on boosting permanent income to influence consumption. | Enhancing access to credit and savings mechanisms to stabilize consumption. |

Introduction to Permanent Income Hypothesis

The Permanent Income Hypothesis (PIH) posits that individuals base their consumption decisions on expected long-term average income rather than current income fluctuations, aiming to stabilize consumption over time. This theory contrasts with consumption smoothing, which emphasizes minimizing changes in consumption by adjusting saving and borrowing in response to income variability. PIH suggests that transitory income changes have minimal effects on consumption patterns, highlighting the importance of anticipated permanent income in economic behavior analysis.

Understanding Consumption Smoothing

Understanding consumption smoothing involves analyzing how individuals allocate spending to maintain stable consumption despite fluctuating income levels, aligning closely with the Permanent Income Hypothesis (PIH). The PIH posits that consumers base their expenditure on expected long-term average income rather than current income, promoting consumption stability over time. This mechanism supports the idea that rational households save or borrow to smooth consumption, mitigating the impact of temporary income shocks.

Key Differences Between Permanent Income Hypothesis and Consumption Smoothing

The Permanent Income Hypothesis (PIH) suggests that individuals base their consumption on an estimate of their long-term average income rather than current income, implying consumption responds primarily to changes in permanent income. Consumption smoothing emphasizes the strategy where consumers adjust their savings and borrowing to maintain stable consumption levels despite income fluctuations, focusing on minimizing short-term consumption volatility. Key differences include PIH's theoretical focus on lifetime income expectations, while consumption smoothing centers on practical behavior to manage income variability.

Core Assumptions Underlying Each Theory

The Permanent Income Hypothesis assumes individuals base consumption on expected long-term average income rather than current earnings, emphasizing forward-looking behavior and rational expectations. Consumption smoothing theory centers on minimizing fluctuations in consumption by saving or borrowing, assuming consumers prefer stable consumption patterns despite income variability. Both theories rely on the core assumption of intertemporal optimization but differ in focusing on income expectations versus consumption stability.

Income Shocks and Their Impact on Consumption

The Permanent Income Hypothesis posits that consumers base their consumption on expected long-term average income, leading to minimal immediate changes in consumption following temporary income shocks. Consumption smoothing theory emphasizes individuals' efforts to maintain stable consumption levels by saving or borrowing when faced with income fluctuations, mitigating the impact of short-term shocks. Income shocks, especially those that are unexpected and temporary, often result in only minor consumption adjustments, while permanent shocks typically cause more significant consumption changes aligned with revised lifetime income expectations.

Role of Expectations in Consumption Decisions

The Permanent Income Hypothesis (PIH) posits that consumers base their consumption decisions primarily on expected long-term average income rather than current income fluctuations, emphasizing the role of future income expectations in stabilizing consumption patterns. Consumption smoothing involves adjusting saving and spending behavior to maintain stable consumption despite short-term income changes, relying heavily on accurate expectations about future income and economic conditions. Both theories underscore how expectations of lifetime resources critically influence the timing and magnitude of consumption, guiding households in optimizing welfare over time.

Empirical Evidence: Testing the Theories

Empirical evidence on the Permanent Income Hypothesis (PIH) highlights that consumers base consumption on expected lifetime income, with studies using panel data confirming stable consumption despite transitory income shocks. Consumption smoothing research supports this by showing households adjust savings and borrowing to maintain steady consumption patterns despite income fluctuations, as demonstrated in experiments tracking consumption responses to predictable versus unpredictable income changes. Combined empirical tests reveal nuanced behavior where liquidity constraints and precautionary savings influence deviations from perfect consumption smoothing predicted by the PIH.

Policy Implications for Fiscal and Monetary Authorities

The Permanent Income Hypothesis (PIH) suggests that consumers base spending on expected long-term income, implying fiscal policies shifting temporary income yield limited consumption changes, guiding authorities to prioritize sustainable growth incentives. Consumption smoothing indicates households adjust savings to maintain stable consumption amid income fluctuations, prompting monetary policies to stabilize interest rates and reduce income volatility. Fiscal authorities must consider the PIH when designing stimulus, while monetary policy should focus on credit access and liquidity to support consumption stability.

Criticisms and Limitations of Both Theories

The Permanent Income Hypothesis (PIH) faces criticism for assuming perfect foresight and rational expectations, which overlook behavioral biases and liquidity constraints affecting consumer decisions. Consumption smoothing models are limited by their reliance on complete markets and the availability of credit, making them less applicable in real-world scenarios where income shocks and borrowing restrictions occur. Both theories often neglect heterogeneity among consumers and fail to address the impact of uncertainty and habit formation on consumption patterns.

Conclusion: Integrating Insights for Economic Modeling

Integrating the Permanent Income Hypothesis and consumption smoothing enhances economic modeling by providing a comprehensive framework that captures both long-term income expectations and short-term behavioral adjustments. This synergy allows for more accurate predictions of consumer behavior under varying economic conditions, improving policy formulation aimed at stabilizing consumption patterns. Emphasizing this integration supports robust models that reflect realistic spending responses to income volatility and uncertainty.

Permanent income hypothesis Infographic

libterm.com

libterm.com