Asset substitution occurs when company managers invest in riskier projects after issuing debt, potentially harming creditors by shifting value from safer to riskier assets. This behavior increases the overall risk profile of the firm and can lead to conflicts of interest between shareholders and debt holders. Explore the rest of the article to understand how asset substitution impacts financial decision-making and creditor protections.

Table of Comparison

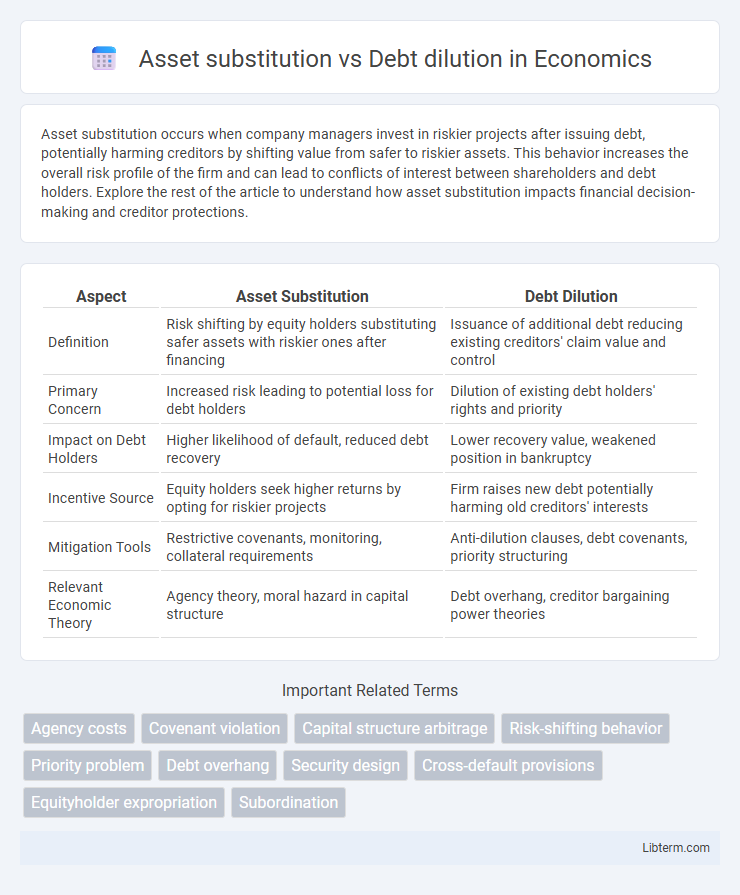

| Aspect | Asset Substitution | Debt Dilution |

|---|---|---|

| Definition | Risk shifting by equity holders substituting safer assets with riskier ones after financing | Issuance of additional debt reducing existing creditors' claim value and control |

| Primary Concern | Increased risk leading to potential loss for debt holders | Dilution of existing debt holders' rights and priority |

| Impact on Debt Holders | Higher likelihood of default, reduced debt recovery | Lower recovery value, weakened position in bankruptcy |

| Incentive Source | Equity holders seek higher returns by opting for riskier projects | Firm raises new debt potentially harming old creditors' interests |

| Mitigation Tools | Restrictive covenants, monitoring, collateral requirements | Anti-dilution clauses, debt covenants, priority structuring |

| Relevant Economic Theory | Agency theory, moral hazard in capital structure | Debt overhang, creditor bargaining power theories |

Introduction to Asset Substitution and Debt Dilution

Asset substitution occurs when a firm with existing debt invests in riskier projects, potentially transferring wealth from debt holders to equity holders by increasing the probability of default. Debt dilution involves the issuance of new debt that reduces the value of existing debt claims, effectively diminishing current debt holders' control and priority. Both concepts reflect agency problems arising from conflicts of interest between equity and debt investors in corporate finance.

Defining Asset Substitution: Key Concepts

Asset substitution occurs when a firm's management opts for riskier projects after issuing debt, potentially diminishing the value of existing debt holders' claims. This shift in investment strategy increases the likelihood of default, adversely affecting creditor returns. Asset substitution contrasts with debt dilution, where issuing new debt decreases existing debt's value by increasing claims on the firm's assets.

Understanding Debt Dilution: Core Principles

Debt dilution occurs when a company issues new debt that diminishes the value of existing debt holders' claims, often by increasing the total debt burden or altering debt seniority. This process can erode bondholder wealth through increased default risk or reduced recovery rates in bankruptcy scenarios. Understanding debt dilution requires analyzing covenant protections and monitoring shifts in debt structure that impact existing creditors' priority and security.

Comparative Analysis: Asset Substitution vs Debt Dilution

Asset substitution involves risky projects that benefit equity holders at the expense of debt holders by increasing the firm's risk profile after debt issuance, while debt dilution occurs when issuing new debt reduces the value of existing debt by increasing overall leverage. Both affect creditors but differ in timing and impact: asset substitution is a post-debt behavior that shifts risk, whereas debt dilution is a pre-emptive capital structure decision altering claim seniority and value. Understanding these mechanisms helps in structuring debt covenants and mitigating creditor risks in corporate finance strategies.

Causes and Motivations Behind Asset Substitution

Asset substitution occurs when a firm's equity holders replace safe assets with riskier projects after debt issuance, aiming to increase potential returns at the expense of creditors, driven by equity holders' incentive to maximize residual value. This behavior is motivated by the limited liability feature of equity, which allows shareholders to benefit from upside gains while losses beyond their investment are borne by debt holders. In contrast, debt dilution involves issuing additional debt that reduces the value of existing debt, but asset substitution specifically arises from shifts in the firm's risk strategy post-debt issuance.

Mechanisms and Triggers of Debt Dilution

Debt dilution occurs when a company issues new debt, reducing the value of existing debt by increasing the total claim against assets, often triggered by declining creditworthiness or deteriorating asset quality. Mechanisms of debt dilution include issuance of junior or subordinated debt, convertible bonds, and refinancing at unfavorable terms that disadvantage prior creditors. This contrasts asset substitution where firms take on riskier projects post-debt issuance, while debt dilution is primarily activated by financial distress signals or covenant violations prompting renegotiation of debt terms.

Impact on Creditors and Bondholders

Asset substitution increases risk for creditors and bondholders by encouraging equity holders to invest in high-risk projects, potentially reducing the value of existing debt claims. Debt dilution diminishes the value of existing creditors' claims by increasing the total debt outstanding, which lowers the priority and recovery rate in case of default. Both practices worsen creditors' bargaining power and increase the cost of debt financing.

Effects on Shareholder Value and Corporate Governance

Asset substitution often reduces shareholder value by encouraging riskier investments that benefit debt holders at the expense of equity investors, thereby distorting corporate governance incentives. Debt dilution, on the other hand, can erode shareholder wealth through the issuance of new debt that dilutes existing equity claims and weakens governance oversight by increasing creditor influence. Both mechanisms challenge effective corporate governance by misaligning management priorities and undermining shareholder control in favor of creditors.

Legal and Regulatory Safeguards

Legal and regulatory safeguards addressing asset substitution and debt dilution focus on protecting creditor rights through covenants and disclosure requirements that limit risky asset transfers and excessive debt issuance. Bankruptcy laws and securities regulations enforce transparency and impose penalties for breaches, enhancing creditors' ability to monitor and challenge harmful financial maneuvers. These safeguards help maintain market integrity by reducing informational asymmetries and preventing value transfers from debt holders to equity holders.

Strategies for Mitigating Asset Substitution and Debt Dilution Risks

Strategies for mitigating asset substitution and debt dilution risks include implementing covenants that restrict risky investment behaviors and limit additional debt issuance, thereby protecting creditor interests. Monitoring financial ratios and enforcing stricter collateral requirements help maintain asset quality and ensure borrowers do not dilute existing debt value. Effective risk management also involves transparent reporting and aligning incentives between equity holders and creditors to discourage harmful asset substitution and debt dilution.

Asset substitution Infographic

libterm.com

libterm.com