Tax revenue is the total income generated by governments through the collection of taxes from individuals and businesses, serving as the primary source of funding for public services and infrastructure. Efficient management and strategic allocation of tax revenue are crucial for economic stability and growth. Explore the rest of the article to understand how tax revenue impacts your community and the economy at large.

Table of Comparison

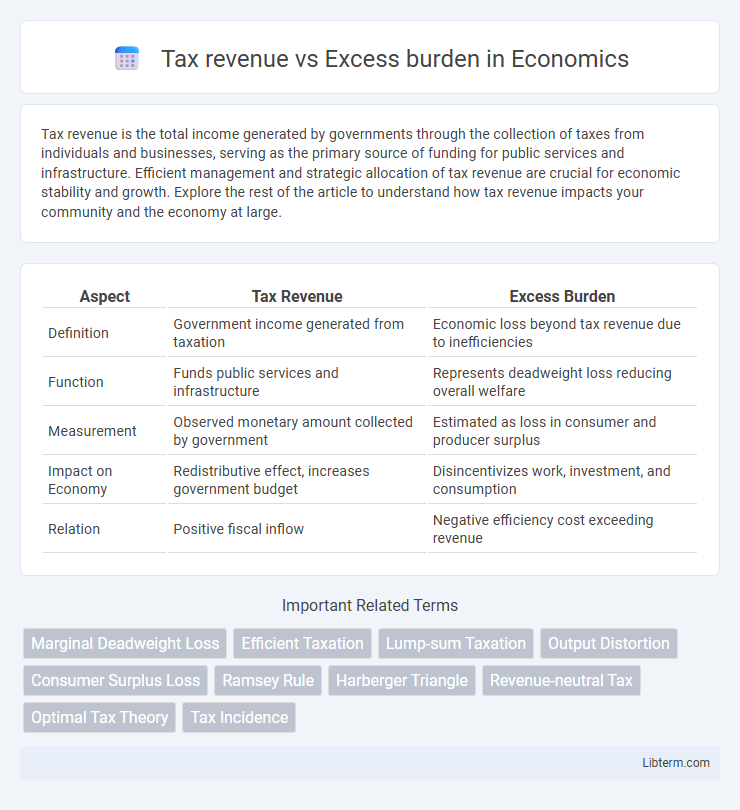

| Aspect | Tax Revenue | Excess Burden |

|---|---|---|

| Definition | Government income generated from taxation | Economic loss beyond tax revenue due to inefficiencies |

| Function | Funds public services and infrastructure | Represents deadweight loss reducing overall welfare |

| Measurement | Observed monetary amount collected by government | Estimated as loss in consumer and producer surplus |

| Impact on Economy | Redistributive effect, increases government budget | Disincentivizes work, investment, and consumption |

| Relation | Positive fiscal inflow | Negative efficiency cost exceeding revenue |

Introduction to Tax Revenue and Excess Burden

Tax revenue represents the total income collected by governments through various forms of taxation, crucial for funding public goods and services. Excess burden, or deadweight loss, measures the economic inefficiency created when taxes distort consumer and producer behavior, leading to a loss of total welfare beyond the revenue raised. Understanding the balance between tax revenue and excess burden is essential for designing efficient tax systems that minimize economic distortions while maximizing public resources.

Understanding Tax Revenue: Definition and Importance

Tax revenue represents the total income collected by governments from various taxes imposed on individuals and businesses, serving as the primary source of funding for public services and infrastructure. Understanding tax revenue is crucial for analyzing government fiscal capacity and economic policy effectiveness. Evaluating tax revenue helps balance the benefits of funding essential services against the economic distortions measured by the excess burden, or deadweight loss, caused by taxation.

What is Excess Burden in Taxation?

Excess burden in taxation refers to the economic loss beyond the actual tax revenue collected due to distortions in consumer and producer behavior caused by taxes. This welfare loss arises because taxes alter market decisions, leading to reduced trade, inefficient resource allocation, and deadweight loss. Understanding excess burden is crucial for designing tax policies that minimize negative impacts on economic efficiency while maximizing government revenue.

The Relationship Between Tax Revenue and Excess Burden

The relationship between tax revenue and excess burden highlights the trade-off between government income and economic efficiency loss. As tax rates increase to raise more revenue, the excess burden--or deadweight loss--grows disproportionately, reducing overall welfare. Optimal taxation seeks to maximize revenue while minimizing excess burden to balance fiscal needs with economic productivity.

Measuring Excess Burden: Methods and Metrics

Measuring excess burden involves estimating the economic loss beyond actual tax revenue using metrics like deadweight loss, which reflects inefficiencies caused by taxation. Economists employ methods such as the Harberger triangle analysis and elasticity-based approaches to quantify changes in consumer and producer surplus resulting from tax-induced distortions. Accurate measurement relies on data about tax rates, labor supply elasticity, and market responsiveness to capture the real cost of taxation relative to tax revenue collected.

Factors Influencing Excess Burden in Tax Systems

Factors influencing excess burden in tax systems include the elasticity of labor and capital supply, which determines how significantly taxpayers alter their behavior in response to tax rates. The structure of the tax system, such as progressive versus proportional taxes, affects the distortion of economic decisions and the resulting efficiency loss. Market characteristics, including competition levels and the availability of substitutes, also play a crucial role in shaping the excess burden caused by taxation.

Comparing Tax Structures: Minimizing Excess Burden

Comparing tax structures reveals that minimizing excess burden depends on the tax's design, with lump-sum taxes generating no excess burden while income and sales taxes cause distortions by altering labor supply and consumption choices. Efficient tax systems prioritize broad bases and low rates to reduce deadweight loss, thereby enhancing economic productivity and minimizing welfare loss. Empirical data show that shifting from high distortionary taxes to value-added or property taxes can substantially lower excess burden without sacrificing revenue.

Policy Implications: Balancing Revenue and Efficiency

Tax revenue generation must be carefully balanced against the excess burden or economic inefficiency caused by taxation, as high tax rates can distort labor supply, investment decisions, and consumption patterns. Policymakers should design tax systems that optimize revenue while minimizing excess burden by broadening tax bases and lowering marginal rates, thereby reducing economic distortions and enhancing overall welfare. Implementing efficient tax instruments such as value-added taxes or consumption taxes can help maintain sufficient public revenue without significantly impairing economic productivity.

Real-World Examples: Tax Revenue vs Excess Burden

Tax revenue generated from cigarette excise taxes in countries like Australia and the UK demonstrates significant government funds used for public health, yet these taxes also create an excess burden by discouraging consumption and shifting consumer behavior. In contrast, value-added taxes (VAT) in European Union nations efficiently raise substantial tax revenue with relatively lower excess burden due to broad tax bases and less distortion in consumer choices. Comparing carbon taxes implemented in Sweden reveals how high tax revenue supports green initiatives, but excessive burden may arise from increased production costs and economic adjustments in energy-intensive sectors.

Conclusion: Optimizing Tax Policy for Growth and Fairness

Balancing tax revenue with the excess burden is crucial for designing tax policies that promote economic growth and fairness. Efficient tax systems minimize distortions, ensuring increased public funds without significantly hindering productivity or investment incentives. Optimizing tax policy requires integrating data on tax elasticities, income distribution, and economic behavior to achieve equitable revenue generation with minimal excess burden.

Tax revenue Infographic

libterm.com

libterm.com