A perfect market is characterized by numerous buyers and sellers, homogeneous products, and complete information, ensuring no single participant can influence prices. This market structure promotes maximum efficiency and optimal resource allocation, where prices reflect all available information. Explore the rest of the article to understand how perfect markets function and impact economic decisions.

Table of Comparison

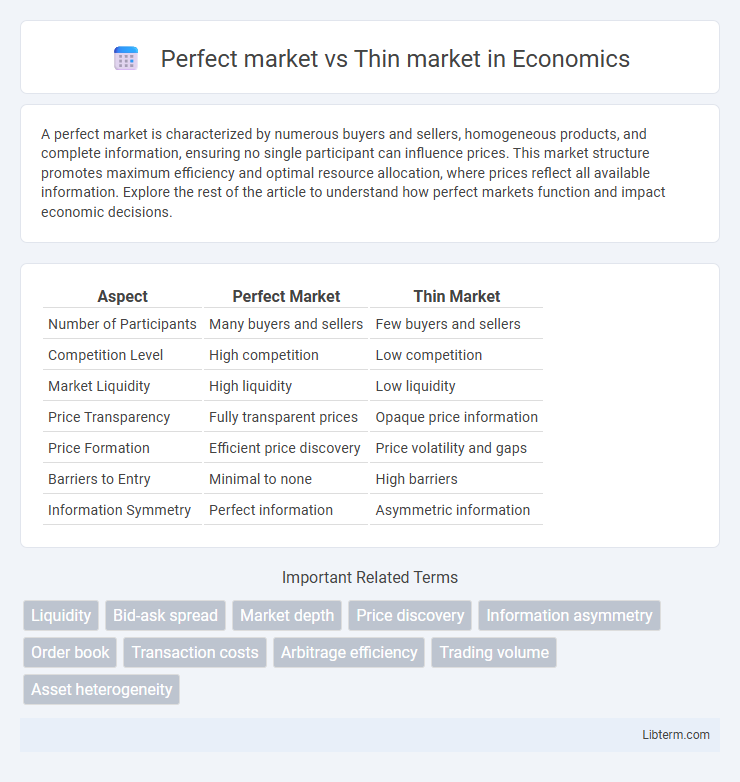

| Aspect | Perfect Market | Thin Market |

|---|---|---|

| Number of Participants | Many buyers and sellers | Few buyers and sellers |

| Competition Level | High competition | Low competition |

| Market Liquidity | High liquidity | Low liquidity |

| Price Transparency | Fully transparent prices | Opaque price information |

| Price Formation | Efficient price discovery | Price volatility and gaps |

| Barriers to Entry | Minimal to none | High barriers |

| Information Symmetry | Perfect information | Asymmetric information |

Introduction to Perfect and Thin Markets

Perfect markets feature numerous buyers and sellers with homogeneous products, ensuring full transparency and ease of entry and exit, which results in efficient price discovery. Thin markets are characterized by limited participants and low trading volumes, often causing price volatility and reduced liquidity. The contrast highlights how market structure directly impacts the efficiency and stability of trading environments.

Defining Perfect Market: Key Characteristics

A perfect market is characterized by numerous buyers and sellers, homogeneous products, perfect information, and free entry and exit, ensuring no single participant can influence prices. Price transparency and market equilibrium are maintained through these conditions, facilitating efficient resource allocation. Contrastingly, a thin market has few participants and limited transactions, leading to price volatility and reduced liquidity.

Understanding Thin Market: Core Attributes

A thin market is characterized by low trading volume and limited liquidity, resulting in wider bid-ask spreads and higher price volatility compared to a perfect market where numerous buyers and sellers create efficient price discovery. Core attributes of thin markets include infrequent transactions, a small number of market participants, and greater susceptibility to price manipulation or distortions. This limited activity often leads to challenges in accurately assessing an asset's true value and increases transaction costs for traders.

Major Differences Between Perfect and Thin Markets

Perfect markets exhibit numerous buyers and sellers with homogeneous products, ensuring high liquidity and negligible transaction costs, while thin markets have few participants, leading to lower liquidity and higher price volatility. In perfect markets, information is symmetric and freely available, facilitating efficient price discovery, whereas thin markets suffer from information asymmetry and less transparent pricing. Price flexibility in perfect markets contrasts with the rigid, often erratic pricing structure in thin markets due to limited trading activity.

Price Formation in Perfect vs Thin Markets

Price formation in perfect markets occurs through numerous buyers and sellers, ensuring prices reflect all available information and lead to efficient market equilibrium. In thin markets, limited participants and lower transaction volumes cause prices to be less responsive to new information, often resulting in higher price volatility and potential deviations from true value. Consequently, price signals in thin markets are less reliable, reducing market liquidity and efficiency compared to perfect markets.

Liquidity and Market Depth Comparison

Perfect markets exhibit high liquidity and substantial market depth, allowing for swift transactions with minimal price impact and narrow bid-ask spreads. Thin markets suffer from low liquidity and shallow market depth, resulting in greater price volatility, wider spreads, and difficulty executing large orders without significant market disruption. The concentration of buyers and sellers in perfect markets contrasts sharply with the sparse participation seen in thin markets, directly influencing market efficiency and stability.

Information Availability: Transparency Levels

Perfect markets feature high transparency levels, ensuring complete and accurate information availability to all participants, enabling efficient pricing and optimal resource allocation. Thin markets suffer from limited information dissemination and lower transparency, causing price inefficiencies and increased transaction costs due to asymmetry among buyers and sellers. Enhanced transparency in thin markets can reduce uncertainties and improve market participation and liquidity.

Impact on Traders and Investors

Perfect markets offer traders and investors high liquidity, minimal transaction costs, and efficient price discovery, enabling rapid execution of trades and accurate reflection of asset values. Thin markets, characterized by low trading volume and limited participant activity, lead to higher volatility, wider bid-ask spreads, and increased risk of price manipulation, complicating order execution and investment decision-making. The contrasting liquidity conditions directly affect market efficiency, risk exposure, and the overall profitability of trading strategies.

Examples of Perfect and Thin Markets

In a perfect market, examples include the agricultural commodity market where numerous buyers and sellers trade identical products like wheat or corn, ensuring high liquidity and price transparency. Thin markets, such as art auctions or rare collectible coins, involve limited buyers and sellers, resulting in low transaction volume and higher price volatility. The differences in market depth significantly impact price discovery and market efficiency.

Conclusion: Choosing Between Market Types

Selecting between a perfect market and a thin market depends on the trade-off between liquidity and price efficiency; perfect markets offer high liquidity and stable prices due to numerous buyers and sellers, while thin markets exhibit lower liquidity with greater price volatility from limited participants. Investors prioritizing quick transactions and narrow bid-ask spreads benefit more from perfect markets, whereas niche asset traders might accept thin markets despite higher risk for unique investment opportunities. Understanding market depth and participant behavior is essential for aligning investment strategies with the appropriate market type.

Perfect market Infographic

libterm.com

libterm.com