Arbitrage Pricing Theory (APT) offers a multifactor approach to asset pricing, emphasizing the relationship between expected returns and various macroeconomic factors. Unlike the Capital Asset Pricing Model (CAPM), APT considers multiple sources of systematic risk, providing a more flexible and comprehensive framework for evaluating your investment choices. Explore the rest of the article to understand how APT can enhance your financial decision-making strategies.

Table of Comparison

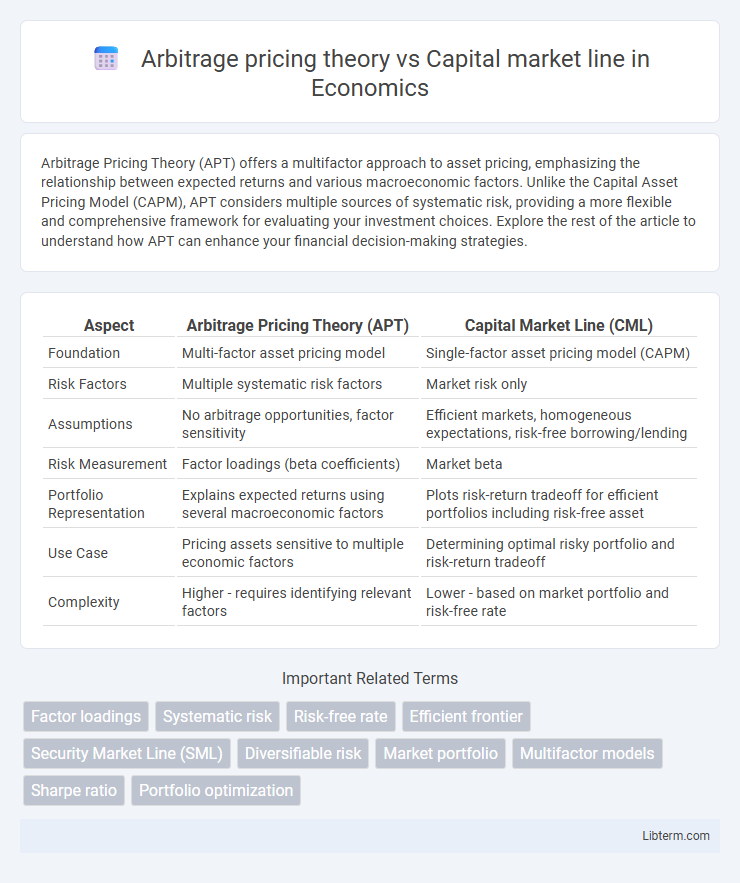

| Aspect | Arbitrage Pricing Theory (APT) | Capital Market Line (CML) |

|---|---|---|

| Foundation | Multi-factor asset pricing model | Single-factor asset pricing model (CAPM) |

| Risk Factors | Multiple systematic risk factors | Market risk only |

| Assumptions | No arbitrage opportunities, factor sensitivity | Efficient markets, homogeneous expectations, risk-free borrowing/lending |

| Risk Measurement | Factor loadings (beta coefficients) | Market beta |

| Portfolio Representation | Explains expected returns using several macroeconomic factors | Plots risk-return tradeoff for efficient portfolios including risk-free asset |

| Use Case | Pricing assets sensitive to multiple economic factors | Determining optimal risky portfolio and risk-return tradeoff |

| Complexity | Higher - requires identifying relevant factors | Lower - based on market portfolio and risk-free rate |

Introduction to Arbitrage Pricing Theory (APT)

Arbitrage Pricing Theory (APT) provides a multi-factor approach to asset pricing by explaining returns through various macroeconomic factors, contrasting with the Capital Market Line's (CML) reliance on market risk and expected return. APT assumes no arbitrage opportunities exist, allowing investors to exploit pricing inefficiencies across multiple risk sources, unlike the single-factor model inherent in CML derived from the Capital Asset Pricing Model (CAPM). This flexibility in APT yields a more comprehensive framework for asset valuation in complex financial markets.

Understanding the Capital Market Line (CML)

The Capital Market Line (CML) represents the risk-return trade-off of efficient portfolios combining the risk-free asset and the market portfolio, illustrating the highest expected return for a given level of risk measured by standard deviation. Unlike the Arbitrage Pricing Theory which uses multiple factors to explain asset returns, the CML is derived from the Capital Asset Pricing Model (CAPM) and assumes a single market factor. The CML is fundamental in portfolio theory for optimizing asset allocation and assessing the performance of diversified portfolios relative to the market equilibrium.

Key Assumptions of APT and CML

Arbitrage Pricing Theory (APT) assumes that multiple macroeconomic factors influence asset returns and that markets are arbitrage-free, allowing for no riskless profit opportunities, while the Capital Market Line (CML) is based on the Capital Asset Pricing Model (CAPM) assumptions of a single market portfolio and investors holding efficient portfolios with homogeneous expectations. APT does not require the market portfolio to be mean-variance efficient, contrasting with the CML's reliance on the efficient frontier and a risk-free asset for constructing portfolios. Both models assume investors are rational and risk-averse, but APT emphasizes factor sensitivities without specifying the source of systemic risk, whereas CML depends on market equilibrium and perfect capital markets.

Risk Factors: Multi-Factor vs. Single Index

Arbitrage Pricing Theory (APT) employs a multi-factor model to explain asset returns, incorporating various macroeconomic risk factors such as inflation, interest rates, and market indices. In contrast, the Capital Market Line (CML) is based on the Capital Asset Pricing Model (CAPM), which uses a single index--the market portfolio--to capture systematic risk. This multi-factor approach in APT allows for a more granular analysis of diverse sources of risk, whereas CML simplifies risk measurement to a single market-related factor.

Portfolio Construction Approaches

Arbitrage Pricing Theory (APT) constructs portfolios by identifying multiple macroeconomic factors influencing asset returns, emphasizing a multi-factor model for risk diversification. The Capital Market Line (CML) is derived from the Capital Asset Pricing Model (CAPM), focusing on the trade-off between risk and return by combining a risk-free asset with a market portfolio to optimize portfolio selection. Portfolio construction under APT aims for exposure to several systematic risks, while CML-based portfolios rely on efficient market portfolios and linear risk-return optimization.

Explaining Expected Returns: APT vs. CML

Arbitrage Pricing Theory (APT) explains expected returns through multiple macroeconomic factors, capturing diverse sources of systematic risk with asset-specific sensitivity coefficients. The Capital Market Line (CML), derived from the Capital Asset Pricing Model (CAPM), represents expected returns based solely on market portfolio risk measured by standard deviation, assuming a single-factor market equilibrium. APT's multifactor approach provides a more flexible and empirically testable framework for pricing assets, while CML emphasizes the trade-off between risk and return in a market portfolio context.

Diversification and Systematic Risk

Arbitrage Pricing Theory (APT) emphasizes diversification by allowing multiple macroeconomic factors to explain asset returns, reducing unsystematic risk through exposure to various systematic risk sources. In contrast, the Capital Market Line (CML) represents the risk-return trade-off for efficient portfolios, focusing on systematic risk measured by beta, assuming investors hold fully diversified market portfolios. Both frameworks highlight diversification to minimize unsystematic risk, but APT's multifactor approach captures a broader set of systematic risks compared to the single-factor model underlying the CML.

Empirical Evidence and Practical Applications

Arbitrage Pricing Theory (APT) demonstrates empirical support through its ability to capture multiple risk factors influencing asset returns, offering greater flexibility compared to the Capital Market Line (CML), which relies on the single-factor market portfolio assumption. Studies reveal APT's strength in explaining cross-sectional variations in asset returns, especially in multifactor models including macroeconomic variables, while the CML effectively guides portfolio optimization under the Capital Asset Pricing Model (CAPM) framework. Practical applications of APT include risk management and multifactor asset pricing strategies, whereas the CML is primarily used for portfolio selection emphasizing efficient frontier and market risk, highlighting their complementary roles in financial modeling.

Strengths and Limitations of Each Model

Arbitrage Pricing Theory (APT) offers a multifactor approach that captures diverse economic risks influencing asset returns, providing flexibility beyond the single-factor Capital Asset Pricing Model (CAPM) underlying the Capital Market Line (CML). The CML excels in illustrating the optimal portfolio mix of risk-free assets and the market portfolio, emphasizing efficient frontier concepts and clear risk-return trade-offs. However, APT's reliance on factor identification and estimation challenges limits its practical application, whereas CML assumes market efficiency and homogeneity of investor expectations, which may oversimplify real-world dynamics.

Conclusion: Choosing Between APT and CML

Arbitrage Pricing Theory (APT) offers a multifactor approach considering multiple macroeconomic variables, providing flexibility and capturing more diverse risk factors than the single-factor Capital Market Line (CML) based on the Capital Asset Pricing Model (CAPM). Investors seeking detailed risk analysis prefer APT for its ability to incorporate multiple sources of systematic risk, while those valuing simplicity and market equilibrium assumptions might choose the CML for its straightforward risk-return trade-off. Selection between APT and CML ultimately depends on the complexity of risk factors an investor aims to model and the desired balance between theoretical rigor and practical application.

Arbitrage pricing theory Infographic

libterm.com

libterm.com