Bertrand equilibrium describes a market condition in which firms compete on price, leading to prices equal to marginal costs in perfectly competitive markets. This concept assumes that all companies produce homogeneous goods and consumers always buy from the lowest-priced seller, resulting in zero economic profits. Explore the rest of the article to understand how this equilibrium shapes pricing strategies in different industries.

Table of Comparison

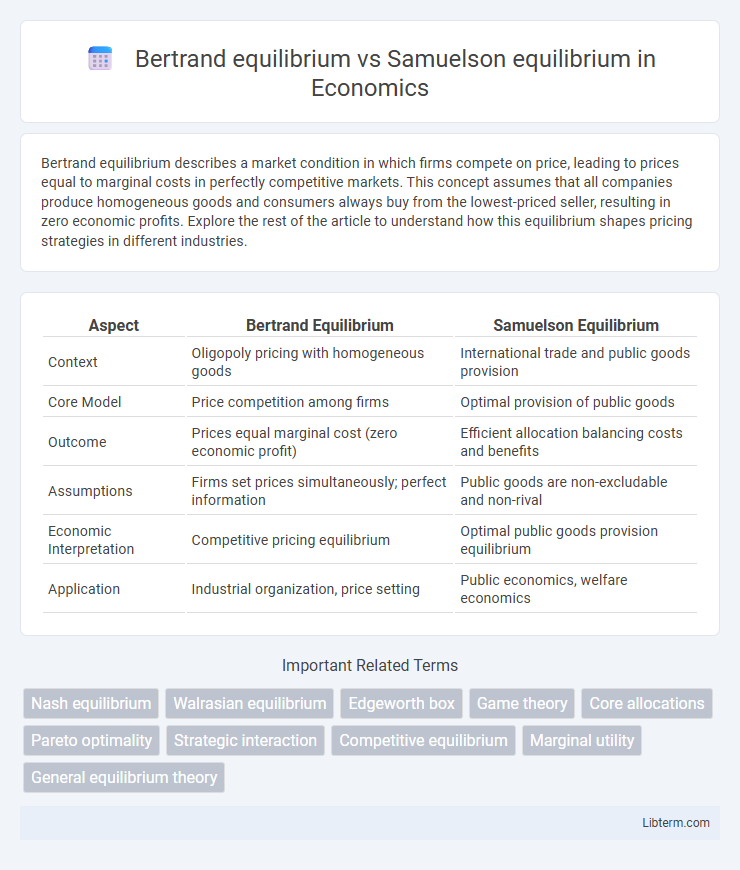

| Aspect | Bertrand Equilibrium | Samuelson Equilibrium |

|---|---|---|

| Context | Oligopoly pricing with homogeneous goods | International trade and public goods provision |

| Core Model | Price competition among firms | Optimal provision of public goods |

| Outcome | Prices equal marginal cost (zero economic profit) | Efficient allocation balancing costs and benefits |

| Assumptions | Firms set prices simultaneously; perfect information | Public goods are non-excludable and non-rival |

| Economic Interpretation | Competitive pricing equilibrium | Optimal public goods provision equilibrium |

| Application | Industrial organization, price setting | Public economics, welfare economics |

Introduction to Bertrand and Samuelson Equilibria

Bertrand equilibrium describes a market state where firms compete by setting prices simultaneously, leading to prices that typically equal marginal cost in homogeneous goods markets. Samuelson equilibrium extends this concept within dynamic economic models, emphasizing intertemporal optimization and the role of expectations in price settings. Both equilibria analyze strategic interactions but differ in temporal framework and assumptions about firms' decision processes.

Historical Context: Bertrand vs Samuelson

The Bertrand equilibrium, introduced by Joseph Bertrand in 1883, models price competition between firms producing homogeneous goods with the assumption of instantaneous price adjustments leading to prices equal to marginal cost. The Samuelson equilibrium, stemming from Paul Samuelson's work in the mid-20th century, extends equilibrium analysis into multi-market and dynamic contexts, incorporating expectations and intertemporal optimization. The historical progression from Bertrand's static, single-period framework to Samuelson's dynamic, multi-period equilibrium reflects the evolution of economic theory towards more complex and realistic market representations.

Core Assumptions of Bertrand Equilibrium

Bertrand equilibrium assumes firms compete by setting prices simultaneously in a market with homogeneous products and identical marginal costs, leading to a price equal to marginal cost in equilibrium. The core assumption of price competition contrasts with Samuelson equilibrium, which relies on quantity competition and demand functions in oligopolistic markets. In Bertrand models, consumers buy from the lowest-priced firm, making price the primary strategic variable influencing market outcomes.

Key Principles of Samuelson Equilibrium

Samuelson equilibrium emphasizes the efficient allocation of resources through the intersection of individual preferences and production possibilities, ensuring Pareto optimality under public goods and externalities. Unlike Bertrand equilibrium, which centers on price competition between firms producing homogenous goods, Samuelson's framework addresses public goods' non-excludability and non-rivalry characteristics. The core principle involves balancing marginal rates of substitution with marginal rates of transformation to achieve social optimality in resource distribution.

Mathematical Formulation: Bertrand Equilibrium

Bertrand equilibrium is characterized by firms setting prices simultaneously in a duopoly, leading to a Nash equilibrium where each firm's price is the best response to the other's. Mathematically, if firms 1 and 2 choose prices p1 and p2, the equilibrium occurs at (p1*, p2*) such that p1* = argmax p1(p1, p2*) and p2* = argmax p2(p2, p1*), where pi denotes firm i's profit function. This model assumes price competition with homogeneous products and marginal cost c, resulting in equilibrium prices that equal marginal cost under perfect competition conditions.

Analytical Framework: Samuelson Equilibrium

Samuelson equilibrium is grounded in an analytical framework that models economic markets using rational expectations and continuous-time stochastic processes, emphasizing dynamic optimization and general equilibrium conditions. This framework integrates agents' intertemporal budget constraints and utility maximization under uncertainty, leading to equilibrium prices that reflect all available information and anticipate future market states. Unlike the static pricing models in Bertrand equilibrium, the Samuelson equilibrium captures the endogenous evolution of prices through agents' forward-looking behavior and market-clearing conditions.

Applications in Modern Economic Theory

Bertrand equilibrium models price competition among firms producing homogeneous goods, emphasizing strategic pricing behavior prevalent in oligopolistic markets and digital platforms. Samuelson equilibrium, rooted in public goods and welfare economics, addresses efficient resource allocation and optimal provision of public goods in economies with externalities. Both equilibria provide critical frameworks for analyzing market outcomes, influencing regulatory policies and the design of competitive strategies in modern economic theory.

Comparative Analysis: Strengths and Limitations

Bertrand equilibrium excels in modeling price competition where firms set prices simultaneously, highlighting the impact of marginal costs on market pricing but often assumes homogeneous products and neglects capacity constraints. Samuelson equilibrium, rooted in general equilibrium theory, incorporates broader economic interactions and resource allocations, providing a comprehensive framework for welfare analysis yet may suffer from computational complexity and less direct applicability to oligopolistic pricing scenarios. Comparing both, Bertrand equilibrium offers clearer insights into price-setting behavior in competitive markets, whereas Samuelson equilibrium affords a deeper understanding of equilibrium states in an economy-wide context.

Real-World Examples and Case Studies

Bertrand equilibrium occurs in markets where firms compete on price, often resulting in prices driven down to marginal cost as seen in the airline industry, where carriers engage in aggressive fare competition on popular routes. Samuelson equilibrium, based on market equilibrium theory in public goods and externalities, is exemplified by environmental policy case studies where optimal provision of public goods like clean air balances individual utility and social welfare. Comparing the two, real-world telecom pricing illustrates Bertrand competition, while Samuelson equilibrium informs efficient allocation of public resources in urban planning scenarios.

Conclusion: Implications for Economic Policy

Bertrand equilibrium, characterized by firms competing on price leading to marginal cost pricing, implies that policies promoting price transparency and competition can enhance consumer welfare and market efficiency. Samuelson equilibrium, reflecting public goods provision under symmetric information with efficient resource allocation, suggests policymakers should focus on optimal taxation and subsidies to correct market failures in public goods. Understanding the distinctions between these equilibria aids in designing targeted economic policies that balance competitive markets and public good provision.

Bertrand equilibrium Infographic

libterm.com

libterm.com