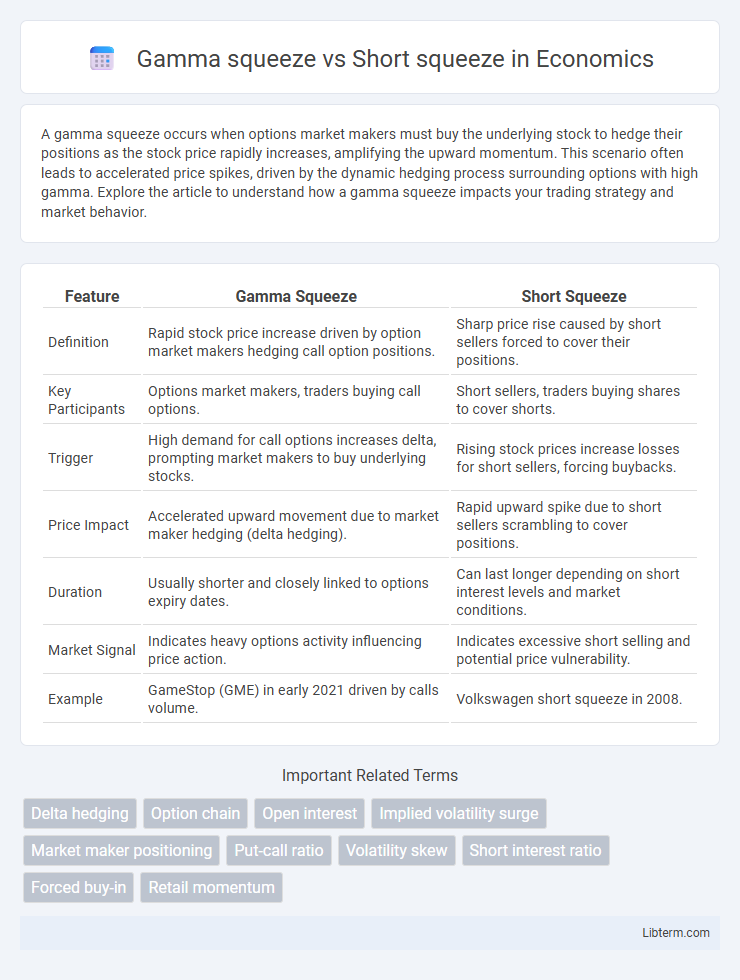

A gamma squeeze occurs when options market makers must buy the underlying stock to hedge their positions as the stock price rapidly increases, amplifying the upward momentum. This scenario often leads to accelerated price spikes, driven by the dynamic hedging process surrounding options with high gamma. Explore the article to understand how a gamma squeeze impacts your trading strategy and market behavior.

Table of Comparison

| Feature | Gamma Squeeze | Short Squeeze |

|---|---|---|

| Definition | Rapid stock price increase driven by option market makers hedging call option positions. | Sharp price rise caused by short sellers forced to cover their positions. |

| Key Participants | Options market makers, traders buying call options. | Short sellers, traders buying shares to cover shorts. |

| Trigger | High demand for call options increases delta, prompting market makers to buy underlying stocks. | Rising stock prices increase losses for short sellers, forcing buybacks. |

| Price Impact | Accelerated upward movement due to market maker hedging (delta hedging). | Rapid upward spike due to short sellers scrambling to cover positions. |

| Duration | Usually shorter and closely linked to options expiry dates. | Can last longer depending on short interest levels and market conditions. |

| Market Signal | Indicates heavy options activity influencing price action. | Indicates excessive short selling and potential price vulnerability. |

| Example | GameStop (GME) in early 2021 driven by calls volume. | Volkswagen short squeeze in 2008. |

Introduction to Gamma Squeeze and Short Squeeze

Gamma squeeze occurs when market makers hedge their options positions by buying the underlying stock as the option's delta increases, causing a rapid price spike. Short squeeze happens when short sellers rush to cover their positions due to rising prices, leading to increased demand and further price surges. Both mechanisms create intense buying pressure but originate from different trading dynamics involving options and short selling.

Defining Gamma Squeeze

A gamma squeeze occurs when options market makers hedge their positions by buying underlying stocks as the price rises, causing a rapid increase in demand and price. It is driven primarily by changes in the options' delta, with market makers adjusting their hedges to remain delta-neutral. Unlike a short squeeze, which involves forced buying from short sellers covering positions, a gamma squeeze is fueled by the dynamic hedging activity linked to options trading.

Understanding Short Squeeze

A short squeeze occurs when heavily shorted stocks experience a rapid price increase, forcing short sellers to cover their positions by buying shares, which drives the price even higher. Unlike a gamma squeeze, which involves options market makers hedging their delta exposure and accelerating price movements, a short squeeze is primarily driven by the demand from short sellers scrambling to limit losses. Understanding short squeezes requires analyzing short interest ratios, stock float, and trading volume to identify potential pressure points where forced buying could trigger sharp price spikes.

Key Differences Between Gamma and Short Squeeze

A gamma squeeze occurs when option market makers buy the underlying stock to hedge their positions as the option's delta increases, causing a rapid price spike, while a short squeeze happens when short sellers are forced to buy shares to cover their positions, driving the price up. Gamma squeezes are closely linked to significant activity in call options and tend to amplify price movements in underlying stocks, whereas short squeezes directly relate to the pressure on short sellers as stock prices rise unexpectedly. The key difference lies in the driving mechanism: gamma squeeze is driven by option hedging dynamics, and short squeeze stems from forced short covering.

How Gamma Squeezes Occur in the Market

Gamma squeezes occur when market makers hedge their options positions by dynamically buying underlying shares as the option's delta changes, increasing demand and driving the stock price higher. This process intensifies as the stock price nears the strike price of heavily traded call options, causing rapid price acceleration due to feedback loops between delta hedging and price movement. In contrast to short squeezes, which result from forced buying by short sellers covering positions, gamma squeezes stem primarily from options market mechanics and hedging activities.

The Mechanics Behind Short Squeezes

Short squeezes occur when heavily shorted stocks experience a rapid price increase, forcing short sellers to buy shares to cover their positions, thereby driving prices even higher. This cascade effect intensifies as borrowing shares becomes costly and limited, exacerbating the upward momentum. Trading volumes surge during these squeezes, reflecting panic-driven demand from shorts exiting their positions.

Historical Examples of Gamma Squeeze Events

Historical examples of gamma squeezes prominently include the GameStop surge in January 2021, where a surge in call option buying forced market makers to buy shares to hedge, drastically pushing up the stock price. Another notable event occurred with AMC Entertainment during the same period, demonstrating how aggressive option activity led to substantial price accelerations distinct from traditional short squeezes. Unlike classic short squeezes that involve forced buying due to short sellers covering positions, gamma squeezes hinge on dynamic hedging of options, causing intense market volatility driven by option market mechanics.

Notable Short Squeeze Case Studies

Notable short squeeze case studies include the 2021 GameStop (GME) event, where retail investors triggered a surge in stock prices by buying shares and call options, creating a gamma squeeze that amplified short sellers' losses. The Volkswagen short squeeze in 2008 demonstrated how a sudden scarcity of shares led to a rapid price increase, forcing short sellers to cover positions at steep losses. Both cases highlight mechanisms where rapid buying pressure forces shorts to close, but gamma squeezes are specifically driven by option market makers hedging, intensifying price volatility.

Risks and Rewards for Traders

Gamma squeezes expose traders to rapid price swings due to heavy options market activity, potentially amplifying gains or losses within short timeframes. Short squeezes result from forced buybacks by short sellers facing rising prices, often causing sharp upward movement but carrying significant risk if timing and market sentiment shift unexpectedly. Both scenarios involve high volatility and demand precise risk management to capitalize on rewards while mitigating substantial losses.

Strategies to Navigate Squeeze Scenarios

Navigating gamma and short squeeze scenarios requires understanding the distinct dynamics of options vs. stock positions; traders often use delta hedging to mitigate risk during gamma squeezes by adjusting option positions as the underlying asset's price changes. In short squeeze situations, monitoring short interest ratios and utilizing stop-loss orders can prevent significant losses from rapid price surges driven by forced short covering. Employing real-time market data and volatility indicators helps traders identify early signals of squeezes, enabling timely position adjustments and risk management.

Gamma squeeze Infographic

libterm.com

libterm.com