Financial market segmentation divides investors based on specific characteristics such as risk tolerance, investment goals, and market preferences to tailor products and services effectively. Understanding these segments enhances your ability to target and meet the needs of diverse client groups, improving overall portfolio performance and customer satisfaction. Discover how financial market segmentation can transform your investment strategy by exploring the full article.

Table of Comparison

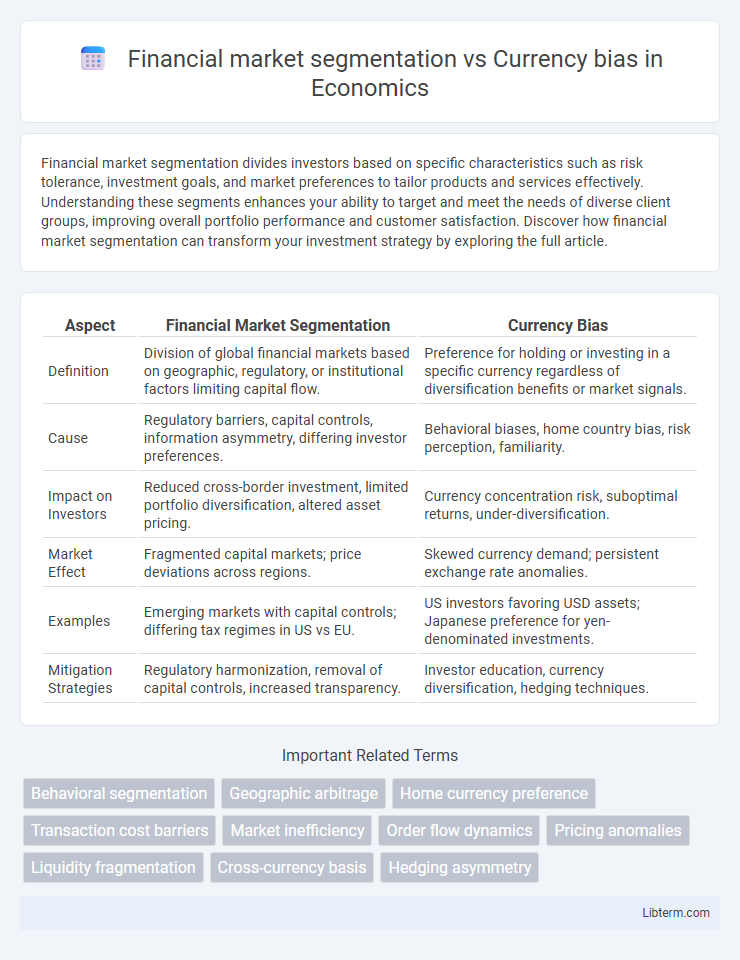

| Aspect | Financial Market Segmentation | Currency Bias |

|---|---|---|

| Definition | Division of global financial markets based on geographic, regulatory, or institutional factors limiting capital flow. | Preference for holding or investing in a specific currency regardless of diversification benefits or market signals. |

| Cause | Regulatory barriers, capital controls, information asymmetry, differing investor preferences. | Behavioral biases, home country bias, risk perception, familiarity. |

| Impact on Investors | Reduced cross-border investment, limited portfolio diversification, altered asset pricing. | Currency concentration risk, suboptimal returns, under-diversification. |

| Market Effect | Fragmented capital markets; price deviations across regions. | Skewed currency demand; persistent exchange rate anomalies. |

| Examples | Emerging markets with capital controls; differing tax regimes in US vs EU. | US investors favoring USD assets; Japanese preference for yen-denominated investments. |

| Mitigation Strategies | Regulatory harmonization, removal of capital controls, increased transparency. | Investor education, currency diversification, hedging techniques. |

Understanding Financial Market Segmentation

Financial market segmentation refers to the division of markets based on investor preferences, regulatory environments, and market accessibility, leading to differentiated asset pricing and investment flows. This segmentation affects currency bias by shaping investor demand for domestic versus foreign currencies, influencing exchange rate dynamics. Understanding financial market segmentation is crucial for analyzing how capital controls, transaction costs, and investor behavior contribute to persistent disparities between local and global market segments.

Defining Currency Bias in Financial Markets

Currency bias in financial markets refers to the tendency of investors and institutions to prefer domestic or familiar currencies over foreign ones, influencing investment decisions and market behavior. This bias impacts portfolio diversification, risk assessment, and asset allocation by skewing exposure toward certain currencies despite global opportunities. Understanding currency bias helps distinguish it from financial market segmentation, which divides markets based on geographic, regulatory, or economic factors rather than investor preferences for currency.

Key Drivers Behind Market Segmentation

Financial market segmentation is primarily driven by geographic, regulatory, and investor behavior differences, which influence asset allocation, liquidity preferences, and risk tolerance across regions. Currency bias occurs when investors prefer domestic currency assets due to perceived familiarity, lower information costs, and hedging inefficiencies in foreign exchange markets. These key drivers shape portfolio diversification strategies and impede capital flows by reinforcing home-country biases and segmented investment patterns.

Causes and Consequences of Currency Bias

Currency bias in financial markets arises from investors' preference for domestic currency assets due to familiarity, reduced perceived risk, and hedging costs, leading to suboptimal international diversification. This bias causes distorted portfolio allocations, higher exposure to domestic economic shocks, and inefficiencies in capital flow distribution across global markets. Understanding financial market segmentation helps reveal how regulatory, informational, and transactional barriers reinforce currency bias and limit cross-border investment integration.

Impact of Segmentation on Global Investments

Financial market segmentation creates barriers that limit capital flow across countries, restricting investors' access to a diverse range of assets and reducing global portfolio diversification benefits. Currency bias further compounds this effect by influencing investor preferences towards domestic currencies, leading to suboptimal allocation and higher exposure to exchange rate risks. The combined impact of market segmentation and currency bias results in inefficiencies, increased costs, and constrained global investment opportunities, hindering optimal wealth accumulation and risk management.

How Currency Bias Shapes Investor Behavior

Currency bias influences investor behavior by creating a preference for domestic currencies, often leading to under-diversification in global portfolios. Financial market segmentation, driven by regulatory, informational, and transactional barriers, reinforces this bias by limiting access to foreign investments and increasing perceived risks. This interplay results in portfolio allocations skewed towards familiar currencies, reducing potential returns and increasing vulnerability to domestic economic fluctuations.

Comparative Analysis: Segmentation vs. Currency Bias

Financial market segmentation divides investors based on geographic, economic, and regulatory factors, influencing diversification and investment opportunities. Currency bias reflects investors' preference for domestic currency assets, often limiting exposure to foreign exchange fluctuations and broader market gains. Comparative analysis shows segmentation emphasizes structural market differences, while currency bias highlights behavioral tendencies impacting portfolio composition and risk management.

Strategies to Mitigate Market Segmentation

Market segmentation in financial markets restricts capital flow by creating barriers between domestic and international investors, often exacerbated by currency bias favoring home currency assets. Strategies to mitigate market segmentation include enhancing cross-border financial regulations, promoting currency convertibility, and developing integrated financial infrastructures that facilitate seamless investment across currencies. Implementing macroprudential policies and encouraging multinational fund vehicles also reduce currency bias and broaden access to global capital markets.

Approaches to Overcome Currency Bias

Financial market segmentation limits investors' access to diverse assets due to regulatory barriers and informational asymmetries, while currency bias arises from preferences for domestic currency-denominated assets. Approaches to overcome currency bias include employing currency hedging techniques, diversifying portfolios internationally, and utilizing exchange-traded funds (ETFs) that provide currency exposure adjustments. Institutional investors increasingly adopt algorithmic strategies and global macro funds to mitigate currency fluctuations and enhance risk-adjusted returns.

Future Implications for Investors and Policymakers

Financial market segmentation restricts capital flow due to regulatory barriers and market frictions, leading to inefficiencies that affect global investment diversification. Currency bias, driven by investors' preference for domestic currency assets, intensifies the home bias effect and influences exchange rate stability. These dynamics pose future challenges for investors in risk assessment and for policymakers in designing integrated markets and mitigating currency risks to promote efficient capital allocation.

Financial market segmentation Infographic

libterm.com

libterm.com