A margin call occurs when your account value falls below the broker's required minimum margin, prompting you to deposit additional funds or sell assets to cover losses. Understanding margin calls is essential to managing the risks involved with leveraged trading and protecting your investments from forced liquidation. Read on to learn how to effectively respond to margin calls and safeguard your portfolio.

Table of Comparison

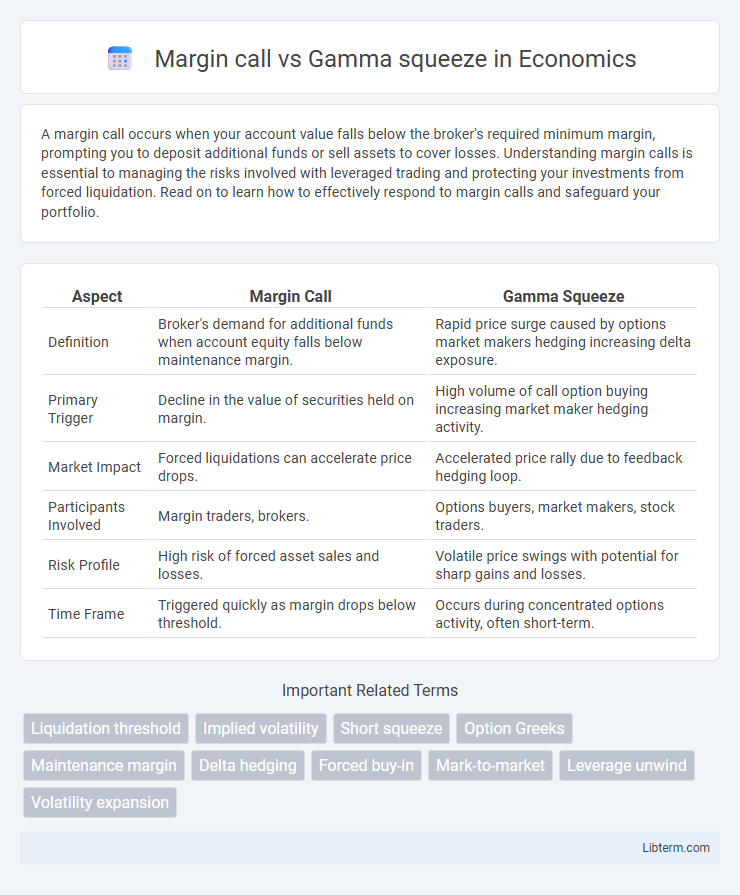

| Aspect | Margin Call | Gamma Squeeze |

|---|---|---|

| Definition | Broker's demand for additional funds when account equity falls below maintenance margin. | Rapid price surge caused by options market makers hedging increasing delta exposure. |

| Primary Trigger | Decline in the value of securities held on margin. | High volume of call option buying increasing market maker hedging activity. |

| Market Impact | Forced liquidations can accelerate price drops. | Accelerated price rally due to feedback hedging loop. |

| Participants Involved | Margin traders, brokers. | Options buyers, market makers, stock traders. |

| Risk Profile | High risk of forced asset sales and losses. | Volatile price swings with potential for sharp gains and losses. |

| Time Frame | Triggered quickly as margin drops below threshold. | Occurs during concentrated options activity, often short-term. |

Introduction to Margin Call and Gamma Squeeze

A margin call occurs when an investor's account value falls below the broker's required maintenance margin, forcing the sale of securities to cover the shortfall. A gamma squeeze involves a rapid increase in an underlying asset's price due to option market makers hedging their positions by buying shares, driven by rising gamma exposure. Both phenomena can trigger sharp price movements but originate from different market mechanics--margin calls stem from borrowing constraints, while gamma squeezes are linked to options trading dynamics.

Defining Margin Call: Key Concepts

Margin call occurs when an investor's account equity falls below the broker's required maintenance margin, prompting a demand to deposit additional funds or liquidate positions. This mechanism protects lenders by ensuring investors maintain sufficient collateral against borrowed funds used for leveraged trading. In contrast, a gamma squeeze involves sharp price increases driven by option market makers hedging their positions, highlighting different risk dynamics in financial markets.

Understanding Gamma Squeeze: An Overview

Gamma squeeze occurs when traders buying options force market makers to hedge by purchasing the underlying asset, driving prices sharply higher. This feedback loop intensifies price movements, distinct from a margin call where brokers liquidate positions to cover losses. Understanding gamma squeeze helps investors anticipate rapid asset price spikes fueled by option market dynamics.

Mechanisms Behind Margin Calls

Margin calls occur when an investor's account equity falls below the broker's required maintenance margin, forcing the liquidation of assets to cover losses and restore the minimum balance. This mechanism involves real-time portfolio valuation, where declining asset prices trigger collateral shortfalls and automatic sell orders to prevent further risk exposure. In contrast, gamma squeezes stem from options market dynamics, where rapid hedging by market makers against changes in the underlying asset's price significantly drives stock prices upward.

How Gamma Squeeze Unfolds

A gamma squeeze unfolds as options market makers hedge their positions by buying the underlying stock to manage the risk from increased option demand, which pushes the stock price higher. This dynamic amplifies price movements as more call options are purchased, triggering further hedging and stock buying. The feedback loop creates rapid price spikes distinct from a margin call, where forced selling occurs due to leveraged investors liquidating positions.

Margin Call vs Gamma Squeeze: Core Differences

Margin call occurs when investors must deposit additional funds to cover losses on leveraged trades, leading to forced liquidation of positions. Gamma squeeze arises when rapid buying of short-dated call options forces market makers to buy the underlying stock to hedge, driving prices higher. The core difference lies in margin call being a risk management mechanism triggering liquidation, while gamma squeeze is a price-driving feedback loop caused by options market dynamics.

Risk Factors Associated with Each Event

Margin calls pose significant risk due to forced liquidation of positions, which can amplify market volatility and lead to substantial losses for traders unable to meet collateral requirements. Gamma squeezes increase risk by causing rapid price movements driven by options market makers hedging their delta exposure, potentially resulting in extreme short-term volatility and liquidity shortages. Both events exacerbate systemic risk, with margin calls triggering deleveraging spirals and gamma squeezes inducing price distortions beyond fundamental asset values.

Impact on Traders and Market Dynamics

Margin calls force traders to liquidate positions rapidly, often amplifying market volatility and triggering sharp price declines as forced selling cascades. Gamma squeezes occur when options market makers hedge by buying underlying assets, causing accelerated price increases and heightened trading volumes that can create short-term market distortions. Both scenarios impact market dynamics by increasing liquidity demand, but margin calls generally exacerbate downward pressure while gamma squeezes drive sudden upward momentum.

Historical Examples of Margin Calls and Gamma Squeezes

The 2008 financial crisis featured a notable margin call event when Lehman Brothers' collapse triggered widespread forced liquidations across the market. In contrast, the January 2021 GameStop surge epitomized a gamma squeeze, where retail investors' heavy call option purchases drove rapid upward price volatility, forcing short sellers to cover positions. Historical data reveal margin calls often precipitate abrupt market downturns, while gamma squeezes can cause sharp, short-lived price spikes driven by complex options market dynamics.

Strategies to Navigate Margin Calls and Gamma Squeezes

Navigating margin calls requires maintaining sufficient equity in your account and understanding your broker's margin requirements to avoid forced liquidation. Managing gamma squeezes involves monitoring option open interest and implied volatility to anticipate sharp price movements and mitigate risk through strategic position adjustments or hedging. Combining risk management tools with real-time market analysis helps traders withstand margin calls and capitalize on gamma squeeze opportunities effectively.

Margin call Infographic

libterm.com

libterm.com