Net national income measures the total income earned by a country's residents after accounting for depreciation on assets. It reflects the actual earning power and economic well-being of your nation's population over a specific period. Explore the full article to understand how this indicator impacts economic policies and personal finances.

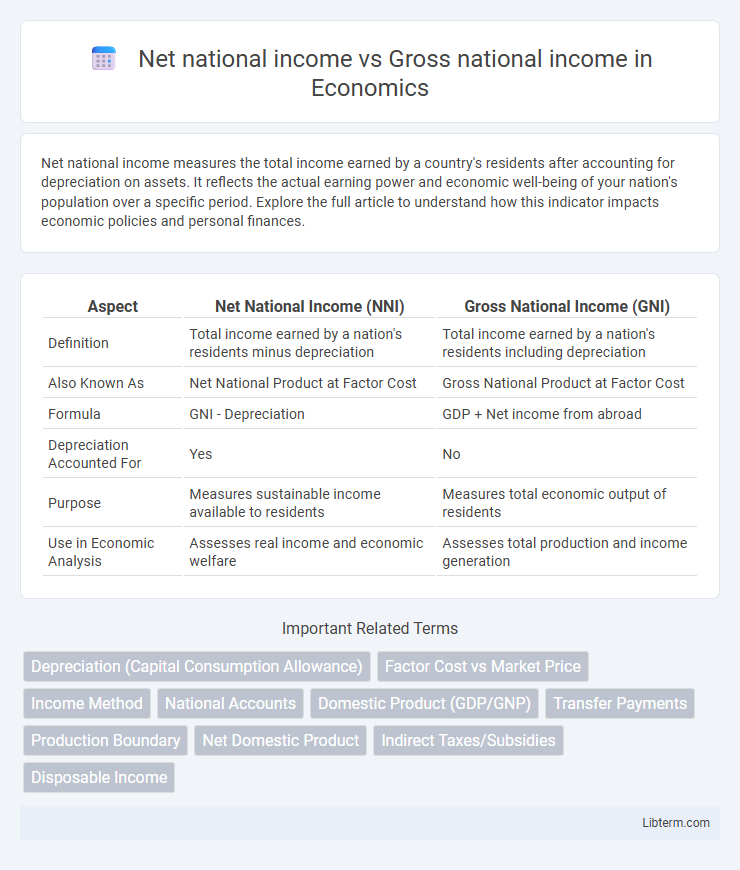

Table of Comparison

| Aspect | Net National Income (NNI) | Gross National Income (GNI) |

|---|---|---|

| Definition | Total income earned by a nation's residents minus depreciation | Total income earned by a nation's residents including depreciation |

| Also Known As | Net National Product at Factor Cost | Gross National Product at Factor Cost |

| Formula | GNI - Depreciation | GDP + Net income from abroad |

| Depreciation Accounted For | Yes | No |

| Purpose | Measures sustainable income available to residents | Measures total economic output of residents |

| Use in Economic Analysis | Assesses real income and economic welfare | Assesses total production and income generation |

Introduction to National Income Concepts

Net National Income (NNI) represents the total income earned by a nation's residents after accounting for depreciation on capital assets, offering a clear measure of sustainable economic welfare. Gross National Income (GNI) includes the total domestic and foreign income earned by residents before subtracting depreciation, reflecting overall economic output. Understanding the distinction between NNI and GNI is essential for accurately assessing a country's economic health and long-term growth potential.

Definition of Gross National Income (GNI)

Gross National Income (GNI) measures the total income earned by a country's residents and businesses, including any income earned abroad, before deducting depreciation. Net National Income (NNI) is derived by subtracting depreciation from GNI, reflecting the net production value available to the economy. Understanding GNI is crucial for assessing economic performance as it encapsulates both domestic production and international income flows.

Definition of Net National Income (NNI)

Net National Income (NNI) represents the total market value of all final goods and services produced by a country's residents within a specific period, minus depreciation on capital goods. It reflects the actual income earned by the nation's factors of production, providing a more accurate measure of economic well-being than Gross National Income (GNI), which includes total income without accounting for capital consumption. NNI is a crucial indicator for assessing sustainable economic growth and the long-term capacity for investment and consumption.

Key Differences Between GNI and NNI

Gross National Income (GNI) represents the total income earned by a country's residents and businesses, including net income from abroad, while Net National Income (NNI) deducts depreciation or capital consumption from GNI to reflect the actual income available for consumption and investment. GNI emphasizes the overall economic income generated, whereas NNI provides a more accurate measure of sustainable economic well-being by accounting for the wear and tear on capital assets. Understanding the distinction between GNI and NNI is crucial for assessing economic performance and long-term growth potential.

Calculation Methods for GNI and NNI

Gross National Income (GNI) is calculated by summing the Gross Domestic Product (GDP) and net primary income received from abroad, including wages, rents, profits, and dividends. Net National Income (NNI) is derived by subtracting depreciation (capital consumption allowance) from GNI, reflecting the actual income available for consumption and savings. The key difference lies in NNI accounting for asset depreciation, providing a more accurate measure of sustainable national income than GNI.

Components Included in GNI and NNI

Gross National Income (GNI) includes the total domestic and foreign output claimed by residents, incorporating gross domestic product (GDP) plus net income earned from abroad such as wages, rents, interest, and profits. Net National Income (NNI) is derived by subtracting depreciation (capital consumption allowance) from GNI, reflecting the actual income available to the nation for consumption and investment after accounting for asset wear and tear. Components of GNI emphasize both domestic production and cross-border income flows, while NNI adjusts these figures by the loss in capital value to present a more accurate measure of sustainable income.

Importance of Measuring National Income

Measuring Net National Income (NNI) and Gross National Income (GNI) is crucial for evaluating a country's economic health and living standards, as these indicators reflect the total income earned by a nation's residents. GNI includes total domestic and foreign income, while NNI adjusts for depreciation, providing a more accurate measure of sustainable income. Policymakers rely on these metrics to design fiscal policies, allocate resources efficiently, and assess economic growth over time.

Economic Implications of Using GNI vs NNI

Gross National Income (GNI) includes total income earned by a nation's residents, while Net National Income (NNI) subtracts depreciation from GNI, reflecting the actual income available for consumption and investment. Using GNI may overestimate economic welfare by ignoring capital consumption, whereas NNI provides a more accurate measure of sustainable income, influencing fiscal policies and long-term economic planning. Policymakers relying on NNI can better assess the true economic well-being and sustainability of national resources compared to those using GNI.

Limitations of GNI and NNI Metrics

Gross National Income (GNI) and Net National Income (NNI) both measure economic performance but have limitations in capturing true welfare or environmental costs. GNI does not account for depreciation of capital assets, leading to overestimation of sustainable income levels, while NNI adjusts for this depreciation but still neglects non-market activities and externalities like pollution. Both metrics fail to address income distribution inequalities and informal economies, limiting their effectiveness in comprehensive economic analysis.

Conclusion: Choosing the Right National Income Indicator

Net National Income (NNI) provides a more precise measure of a country's economic welfare by accounting for depreciation of capital, unlike Gross National Income (GNI), which reflects total income before subtracting depreciation. Policymakers and analysts prioritizing sustainable economic growth and accurate welfare assessment should prefer NNI for informed decision-making. GNI remains useful for understanding overall income generation, but NNI's adjustment for consumption of fixed capital offers a clearer picture of long-term economic health.

Net national income Infographic

libterm.com

libterm.com