Total equity represents the residual interest in the assets of a company after deducting liabilities, reflecting the owners' stake in the business. It is a crucial metric for assessing a company's financial health and value to shareholders. Discover how understanding total equity can empower your financial decisions by reading the full article.

Table of Comparison

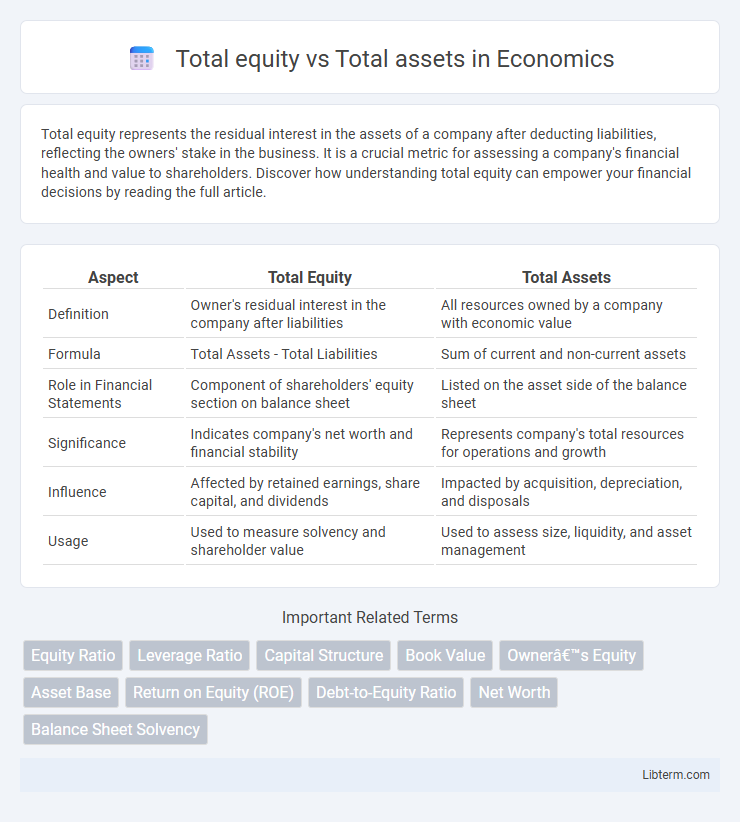

| Aspect | Total Equity | Total Assets |

|---|---|---|

| Definition | Owner's residual interest in the company after liabilities | All resources owned by a company with economic value |

| Formula | Total Assets - Total Liabilities | Sum of current and non-current assets |

| Role in Financial Statements | Component of shareholders' equity section on balance sheet | Listed on the asset side of the balance sheet |

| Significance | Indicates company's net worth and financial stability | Represents company's total resources for operations and growth |

| Influence | Affected by retained earnings, share capital, and dividends | Impacted by acquisition, depreciation, and disposals |

| Usage | Used to measure solvency and shareholder value | Used to assess size, liquidity, and asset management |

Definition of Total Equity

Total equity represents the residual interest in the assets of a company after deducting liabilities, essentially reflecting shareholders' ownership value. It includes common stock, retained earnings, and additional paid-in capital, serving as a key indicator of financial health and net worth. While total assets encompass all resources owned by the company, total equity specifically quantifies the value attributable to shareholders.

Definition of Total Assets

Total assets represent the entire value of everything a company owns, including current assets like cash, inventories, and accounts receivable, as well as fixed assets such as property, equipment, and intangible assets. This figure reflects the total resources available for generating revenue and sustaining operations. Unlike total equity, which indicates the shareholders' residual interest, total assets encompass both equity and liabilities.

Key Differences Between Total Equity and Total Assets

Total equity represents the owners' residual interest in a company's assets after deducting liabilities, reflecting shareholder stake and net worth. Total assets encompass all resources owned by the company, including current and fixed assets, vital for operational capacity and financial strength. The key difference lies in total equity being a subset of total assets, where equity equals total assets minus total liabilities, illustrating the company's solvency and financial leverage.

Importance of Total Equity in Financial Analysis

Total equity represents the owners' residual interest in a company's assets after deducting liabilities, serving as a critical indicator of financial health and solvency. Analyzing total equity helps investors assess the firm's net worth and long-term stability, offering insights into its capital structure and risk profile. Unlike total assets, which show the company's resources, total equity reflects the true value attributable to shareholders, making it essential for evaluating investment potential and financial resilience.

Significance of Total Assets for Businesses

Total assets represent the entire value of everything a company owns, including cash, inventory, property, and equipment, serving as a critical indicator of the company's operational capacity and financial strength. In business analysis, total assets offer insight into the scale and potential revenue-generating power that drives growth and competitive advantage. While total equity reflects ownership value after liabilities, total assets provide a comprehensive view of the resources available to support business activities and strategic investments.

Relationship Between Total Equity and Total Assets

Total equity represents the shareholders' ownership value in a company, while total assets reflect the overall resources controlled by the company. The relationship between total equity and total assets is expressed through the accounting equation: Total Assets = Total Liabilities + Total Equity, highlighting that equity is the residual interest after liabilities are deducted from assets. A higher proportion of total equity to total assets indicates stronger financial stability and lower leverage risk.

Impact on Balance Sheet Structure

Total equity represents the owners' residual interest in a company after liabilities are deducted from total assets, directly influencing the balance sheet's equity section. Total assets indicate the total resources controlled by the company, shaping the balance sheet's asset side and reflecting the firm's investment in operational and non-operational assets. A higher ratio of total equity to total assets strengthens the balance sheet structure by indicating greater financial stability and lower reliance on debt financing.

How Total Equity and Total Assets Affect Company Valuation

Total equity represents the residual interest in the assets of a company after deducting liabilities, directly reflecting shareholders' ownership value, while total assets indicate the overall resources controlled by the company. A higher total equity relative to total assets signifies strong financial stability and lower leverage, positively influencing company valuation by reducing perceived risk. Conversely, total assets demonstrate the scale of a company's operations and growth potential, which investors assess alongside equity to determine the firm's market value and investment attractiveness.

Common Misconceptions: Equity vs Assets

Total equity represents the residual interest shareholders have in a company after liabilities are deducted from total assets, often misunderstood as being equivalent to total assets. Common misconceptions arise when individuals confuse equity with assets, overlooking that total assets include both liabilities and equity contributions. Clarifying that assets encompass all resources owned, while equity specifically reflects ownership value, is essential for accurate financial analysis.

Practical Examples: Analyzing Equity and Assets in Real Companies

Total equity represents the net value owned by shareholders after liabilities are deducted from total assets, providing insight into a company's financial health. For example, Apple Inc.'s 2023 balance sheet shows total assets of approximately $400 billion and total equity of $160 billion, indicating significant leverage and investment by shareholders. Comparing this to Tesla, which had total assets around $60 billion and total equity near $22 billion in 2023, illustrates how asset-heavy companies use equity differently based on industry standards and growth strategies.

Total equity Infographic

libterm.com

libterm.com