Operation Twist involves the Federal Reserve simultaneously buying long-term government bonds and selling short-term Treasury bills to flatten the yield curve and stimulate economic growth. This monetary policy aims to lower long-term interest rates, encouraging borrowing and investment while keeping short-term rates steady. Discover how Operation Twist impacts your financial decisions and the broader economy in the rest of this article.

Table of Comparison

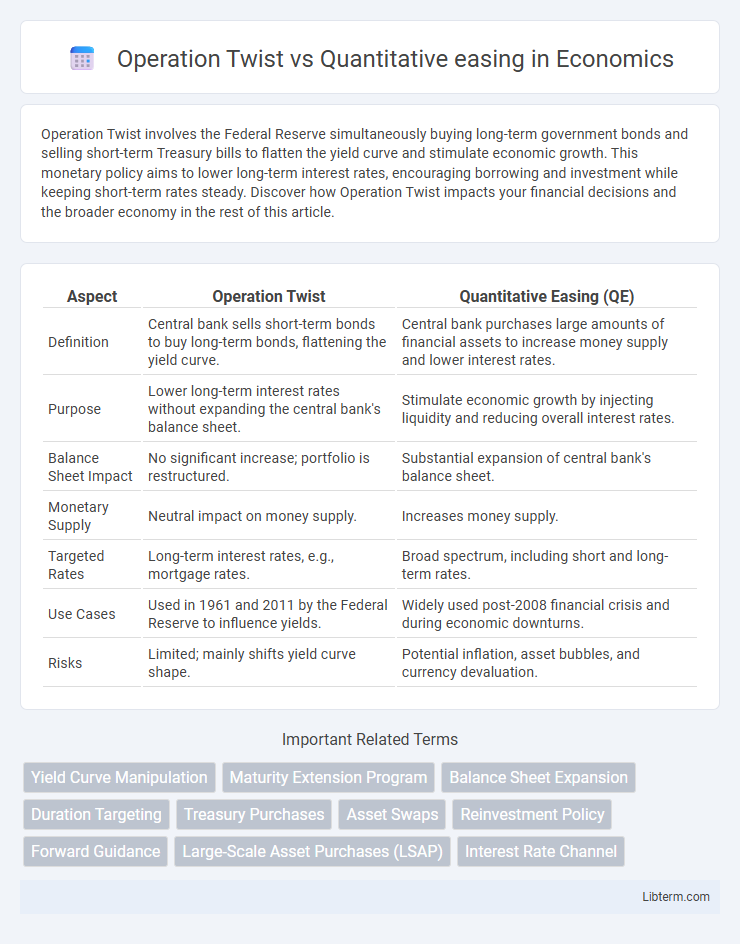

| Aspect | Operation Twist | Quantitative Easing (QE) |

|---|---|---|

| Definition | Central bank sells short-term bonds to buy long-term bonds, flattening the yield curve. | Central bank purchases large amounts of financial assets to increase money supply and lower interest rates. |

| Purpose | Lower long-term interest rates without expanding the central bank's balance sheet. | Stimulate economic growth by injecting liquidity and reducing overall interest rates. |

| Balance Sheet Impact | No significant increase; portfolio is restructured. | Substantial expansion of central bank's balance sheet. |

| Monetary Supply | Neutral impact on money supply. | Increases money supply. |

| Targeted Rates | Long-term interest rates, e.g., mortgage rates. | Broad spectrum, including short and long-term rates. |

| Use Cases | Used in 1961 and 2011 by the Federal Reserve to influence yields. | Widely used post-2008 financial crisis and during economic downturns. |

| Risks | Limited; mainly shifts yield curve shape. | Potential inflation, asset bubbles, and currency devaluation. |

Introduction to Operation Twist and Quantitative Easing

Operation Twist is a Federal Reserve policy aimed at flattening the yield curve by selling short-term Treasury securities and purchasing long-term ones to stimulate economic growth without expanding the central bank's balance sheet. Quantitative easing involves large-scale asset purchases, primarily long-term government bonds and mortgage-backed securities, to inject liquidity into the financial system and lower interest rates during economic downturns. Both strategies target lowering long-term borrowing costs, but Operation Twist adjusts the maturity composition of assets while quantitative easing expands overall monetary base.

Historical Background: Why Each Policy Emerged

Operation Twist originated in the 1960s to flatten the yield curve by selling short-term Treasury securities and purchasing long-term ones, aiming to stimulate economic activity without expanding the Federal Reserve's balance sheet. Quantitative easing (QE) emerged during the 2008 financial crisis as a response to near-zero interest rates, involving large-scale asset purchases to inject liquidity directly into the economy and lower long-term interest rates. Both policies were designed to support economic recovery but differed fundamentally in approach, with Operation Twist focusing on maturity extension and QE on balance sheet expansion.

Core Mechanisms: How Operation Twist Works

Operation Twist involves the Federal Reserve selling short-term Treasury securities and purchasing long-term Treasury bonds to flatten the yield curve, aiming to lower long-term interest rates and stimulate investment without expanding the central bank's balance sheet. This contrasts with Quantitative Easing (QE), where the Fed buys a broad range of government securities to increase the money supply and directly expand its balance sheet. Operation Twist's core mechanism specifically targets interest rate differentials across maturities, influencing borrowing costs while maintaining overall liquidity levels in the financial system.

Core Mechanisms: How Quantitative Easing Works

Quantitative Easing (QE) involves the central bank purchasing long-term securities to inject liquidity directly into the economy, lowering long-term interest rates and encouraging lending and investment. This expansion of the central bank's balance sheet increases the money supply, aiming to stimulate economic growth during periods of low inflation or recession. Unlike Operation Twist, which reallocates the maturity composition of government bonds without expanding the balance sheet, QE actively increases monetary base and stimulates asset prices.

Key Objectives: Operation Twist vs Quantitative Easing

Operation Twist aims to lower long-term interest rates by selling short-term Treasury securities and buying long-term ones, thereby flattening the yield curve to stimulate borrowing and investment. Quantitative easing focuses on increasing the money supply and lowering overall interest rates by purchasing large amounts of government bonds and other financial assets to boost economic activity. Both strategies target economic stimulation but differ in mechanism; Operation Twist adjusts the maturity composition of debt without expanding the Federal Reserve's balance sheet, while quantitative easing directly increases it.

Economic Impact Comparison

Operation Twist primarily influences long-term interest rates by selling short-term Treasury securities and purchasing long-term bonds, aiming to flatten the yield curve and stimulate investment without expanding the Federal Reserve's balance sheet. Quantitative easing (QE) involves large-scale asset purchases, significantly increasing the Fed's balance sheet to inject liquidity, lower overall interest rates, and support asset prices, thereby promoting economic growth and easing credit conditions. While Operation Twist modestly impacts borrowing costs and encourages investment, QE has a broader economic impact by directly increasing money supply, boosting consumption, and lowering unemployment during downturns.

Market Reactions and Investor Sentiment

Operation Twist involves the Treasury selling short-term bonds and buying long-term bonds to flatten the yield curve, which typically stabilizes bond markets and reassures investors by lowering long-term interest rates without expanding the monetary base. Quantitative easing (QE) directly increases the money supply as the central bank purchases large-scale long-term securities, often boosting investor risk appetite and equity markets but raising concerns about inflation. Market reactions to Operation Twist generally show modest bond market calmness and cautious investor optimism, while QE triggers more pronounced rally in asset prices alongside increased scrutiny over potential asset bubbles.

Advantages and Limitations of Each Policy

Operation Twist targets long-term interest rates by selling short-term Treasury securities and buying long-term bonds, effectively flattening the yield curve to stimulate investment while minimizing balance sheet expansion. Its advantage lies in a focused impact on the cost of long-term borrowing without significantly increasing central bank asset holdings, but it offers limited effectiveness when long-term rates are already low or during severe liquidity crises. Quantitative easing (QE) involves large-scale asset purchases to inject liquidity, lower a broad range of interest rates, and support financial markets, proving powerful in deep recessions, yet it risks inflation, asset bubbles, and central bank balance sheet bloat.

Case Studies: Real-World Examples

Operation Twist, implemented by the Federal Reserve in the early 1960s and again in 2011, aimed to lower long-term interest rates by selling short-term Treasuries and buying long-term securities, effectively flattening the yield curve without expanding the central bank's balance sheet. In contrast, Quantitative Easing (QE), notably during the 2008 financial crisis and post-2020, involved large-scale asset purchases to inject liquidity, expand the Fed's balance sheet, and stimulate economic growth. Case studies from the 2011 Operation Twist show moderate success in reducing long-term borrowing costs, while QE episodes demonstrated stronger impacts on market liquidity, asset prices, and credit conditions but also raised concerns about future inflation and asset bubbles.

Conclusion: Which Policy Suits Current Economic Needs?

Operation Twist targets long-term interest rate reduction by selling short-term bonds and buying long-term securities, effectively flattening the yield curve without expanding the central bank's balance sheet. Quantitative easing (QE) involves large-scale asset purchases to inject liquidity and lower both short- and long-term interest rates, often stimulating growth during severe downturns. Given current moderate inflation and a recovering economy, Operation Twist may better suit needs by supporting growth without excessive balance sheet expansion or overheating risks.

Operation Twist Infographic

libterm.com

libterm.com